I was reflecting on a friend of mine who runs a FinTech start-up. Their company was on a funding round, and struggling. They struggled so much that they ended up having to lay off a load of staff, cut budgets and defer income. In fact, they reached the point where they would only survive another week or two if the funding round didn’t drop. Then it did. Everything is well and good. But it gives you an insight into how hard starting a new firm is, FinTech or Tech or any really. This was brought home to me by a Medium blog from August last year, about a young lady who joined a Silicon Valley start-up as their Head of Marketing only to find it was all a veneer sham set up by a narcissistic founder who had no idea how to run a piss up in a brewery, let alone a tech start-up. How many of those are there in FinTech? Well, we’ve seen one and I wonder how many more are out there. Here will be a few, and these will be weeded out this year, as the squeeze in funding hits.

Looking at the different geographies, America is fairly resilient as Silicon Valley has a vibrant network of investment support. Sure, it’s not what it was, but it’s still bullish when established players like SoFi can get half a billion dollars from Silver Lake Partners. That’s $1.89 billion of funding for a firm valued at just $4.3 billion. Interesting, particularly when you look at what’s been happening with Lending Club and others.

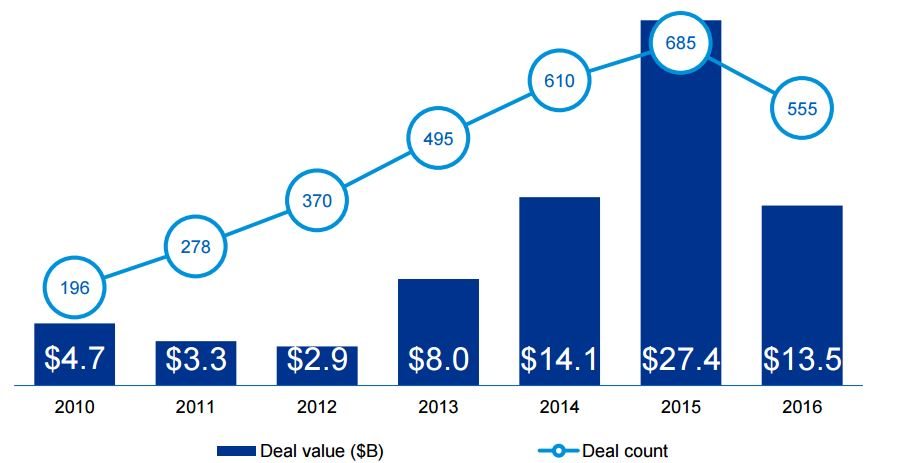

America is still big on FinTech.

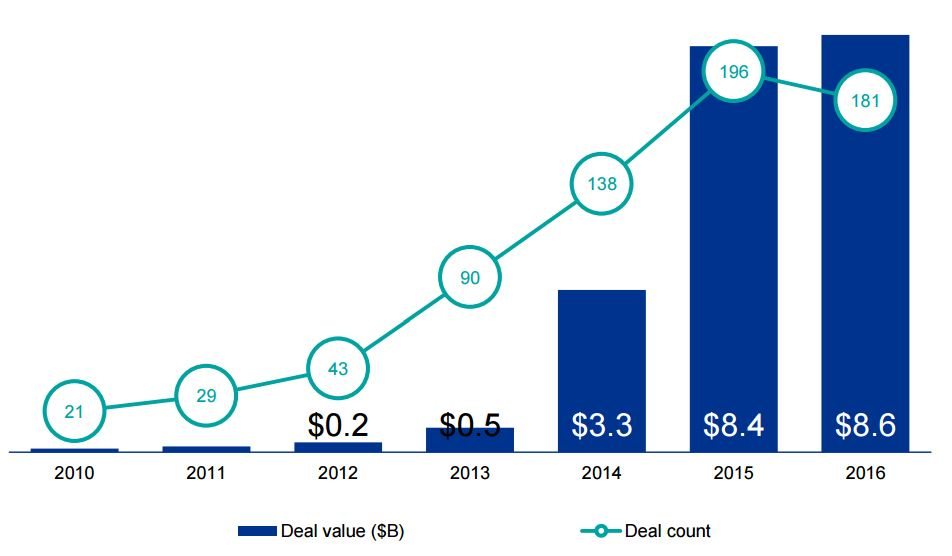

Asia is big on FinTech. Asia’s just woken up to what FinTech can do to be honest, and are about two to three years behind most European and American FinTech communities, so it’s now wonder Asia is big on FinTech. 2016 was a record year for Asian FinTech investments, and 2017 will probably continue that bullish behaviour.

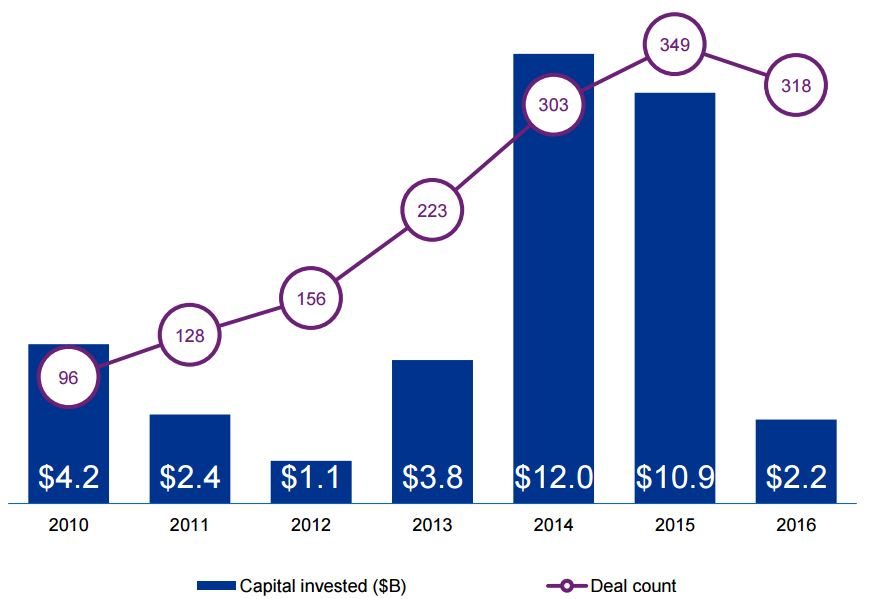

Then you come to Europe. Hmmm. Post-Brexit, cynical, divided Europe. We’ve already seen that Brexit had a chilling effect on London investments. Investment in UK FinTech start-ups dropped by a third after June’s Brexit decision, according to Innovate Finance, from $1.2 billion in 2015 to $783 million last year. But it’s worse than that, according to KPMG, who reckon that UK FinTech investments were down 85% from $4.6 billion in 2015 to $654 million in 2016.

That doesn’t mean London has lost its place. London continues to be seen as one of the truly global financial centres which, along with a vibrant tech start-up sector, has helped create a strong environment for fintech firms to start up and scale. That still sets it apart from Europe, where FinTech investment dropped 80% from $10.9 billion in 2015 to $2.2 billion in 2016.

What this means is that the funding desert in European FinTech will lead to several explosions on the 2017 horizon. Looking at the European FinTech50 for example, how many of these firms need funding? Will they find it? If they don’t, will their failures fuel further fear? Will European FinTech become a FinFail?

I don’t’ think so, but I do think we are going to see some stinking great heaps of poop hit the FinTech fan if the funding gates dry up.

All graphics taken from KPMG’s Pulse of FinTech Report, Q4 2016

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...