I recently was hauled up over saying that Western Union (WU) was being disrupted by FinTech. The words that a reader took issue with are:

The high fees of Western Union and other remittance providers were fairly punishing … until FinTech came along

Western Union is being disrupted, to an extent, but this person was making the point that if it were not for WU, the impoverished would have struggled even more than they do today to send money. True.

Equally, they point out that FinTech has yet to disrupt anything in the financial inclusion area. I disagree with that.

Meantime, the core issue with WU is their exclusivity clauses that have been used for decades to successfully lock markets to one provider, who can then increase their mark-up fees as there is no alternative. That’s been a tradition of WU, and has been a strong debate among governments, with the latest move of the European Union to investigate whether WU colluded to drive rivals out of the money-transfer market.

That’s why much media dislikes the WU model and hopes that FinTech firms like TransferWise and ABRA will disrupt that model. However, as rightly pointed out on the Save on Send blog, WU have at least been serving the financially excluded well for the past years, and continue to do so. In fact, they've written a brilliant piece about the company and its past, present and future, and allowed me to reprint here so here’s what they have to say:

Western Union: permanent leader of international money transfer?

“… long, sorry decline has left the 140-year-old company a shell of its former self. Today, it is fighting for its very survival. Western Union fell victim to technological advances…” – Associated Press, 1991

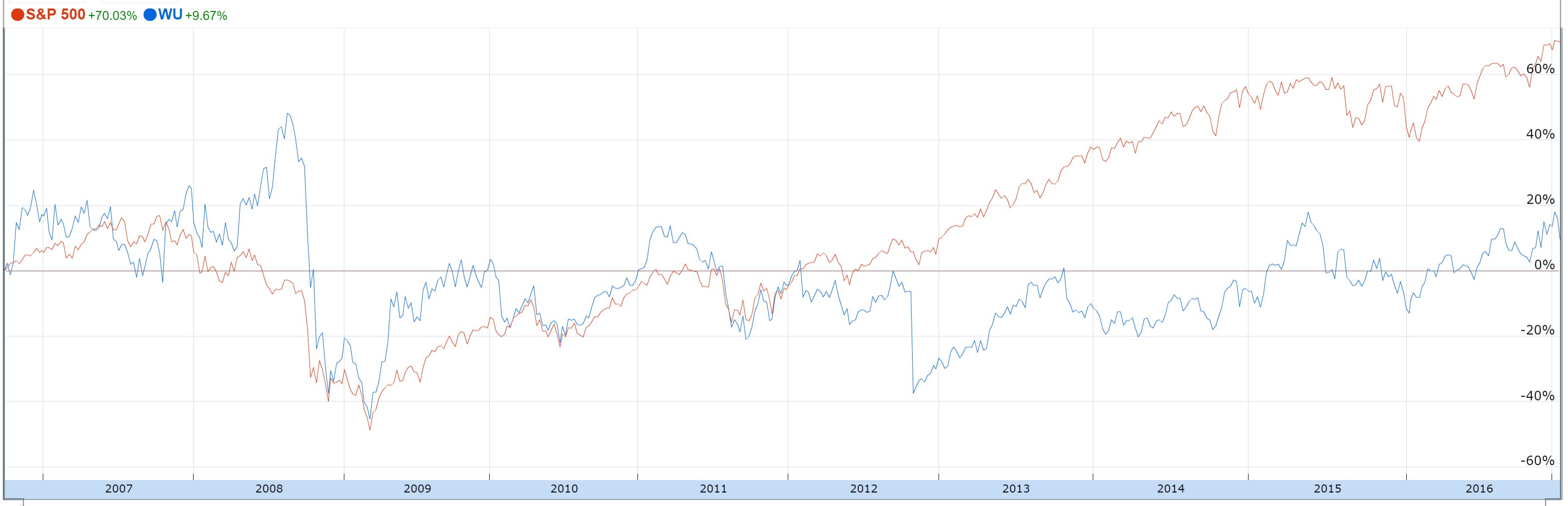

Reading current reporting about Western Union’s role in international remittances could make us think that the company has been a successful monopoly of this space forever, but, now, with the arrival of some disruptive innovation (“P2P”, “Bitcoin-blockchain”, “Social”, “Mobile”…), there is a real danger of its imminent demise. In reality, Western Union’s subsidiary, Western Union Financial Services Inc., began providing international money transfers in mid 80s when deregulation allowed a previously domestic service to expand internationally. By mid 90s, Western Union’s coverage included major remittance destinations like China. In those first ten years of its money transfer business, Western Union’s parent (renamed into New Valley in 1991) had plenty of upheavals going near or into a bankruptcy. After changing hands few times, the money transfer subsidiary was resurrected as an independent entity in 2006. Western Union’s stock performance has been highly volatile ever since with 20% decline in price since IPO, dwarfed by the overall market:

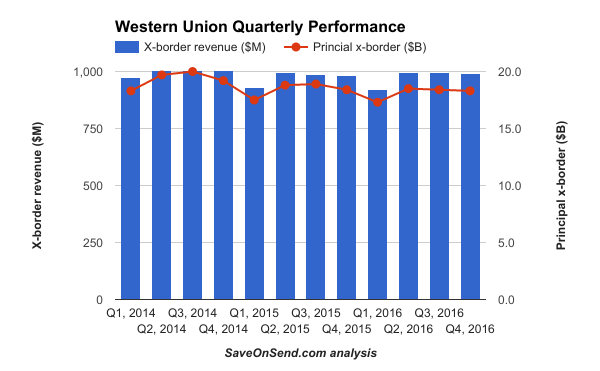

After faster initial growth, for the last three years Western Union’s business metrics have been flat. Reinvention requires a change in culture which won’t happen with existing management. Hence, with global growth in remittances slowing down, don’t expect a different picture in years to come:

Same management incompetence was demonstrated in FTC’s lawsuit which Western Union settled in January 2017.

“Even though Western Union’s internal reports have identified agent locations where 5% to over 75% of the transactions constituted confirmed and potential fraud, and/or suspicious activities, Western Union has allowed many of these agents and subagents to continue operating, with only temporary suspensions, if any…”

But Western Union is still valued at $10+ billion. Do you remember how experts were confidently predicting the demise of Western Union after PayPal acquired Xoom (for more on that fun story read this SaveOnSend article)? Well, since its IPO, PayPal’s stock has performed exactly as… Western Union’s:

But a “slow decline” story doesn’t seem to be interesting enough for absolute majority of publications. Instead, we continue being subjected to sensational reporting about Western Union’s being on the way to oblivion due to, again, some innovation du jour – this time, instead of “fax machine” or “Internet” from 20-30 years ago, it is Facebook or Bitcoin or FinTech startups.

The reasons for such sloppy reporting across Tech media, Wall Street Journal, New York Times, and other publications are laziness and overconfidence plus host of cognitive biases. For example, it could be due to a powerful “projection bias” which makes us assume that everybody is similar to us or want to be similar to us. So if a reporter is eager to try sending money with mobile, Bitcoin, Facebook, then frequent senders of remittances shall be also very interested in such transfer method.

1. Western Union’s Market Share

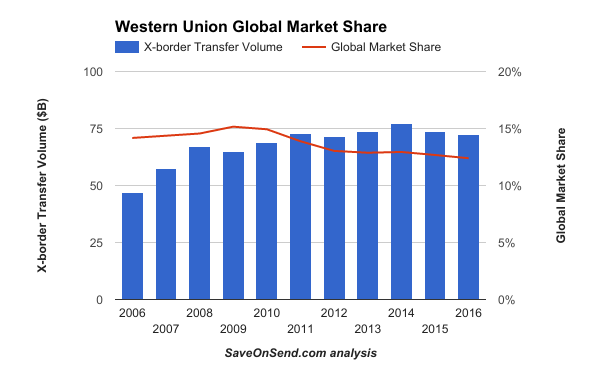

As with most facts about international consumer remittances, Western Union’s market share presents a complex picture – over the last decade, it has declined slightly while the company cross-border transfer volume has been growing till 2014:

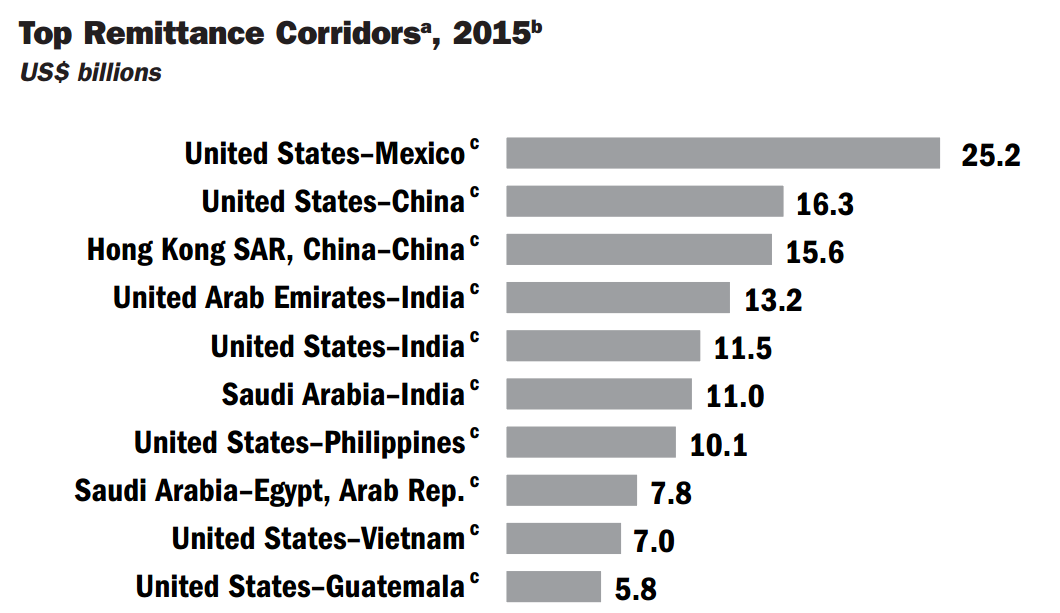

The market share decline is due to a much faster increase in global transfer volumes over the same period. To make matters more complicated, the data on global transfer volumes is very hard to obtain. For directionally accurate information, The World Bank provides uniquely valuable resources; alternatively, for in-depth analysis of specific corridors one could hire an industry expert like Faisal Khan.

The remainder of the remittances market is highly fragmented, with dozens if not hundreds of providers of various sizes competing in each large corridor. Obviously, Western Union’s market share is also not evenly distributed across global corridors. There are top corridors where its share is less than 10%, and there are very small corridors where it is approaching 50%. But, as we wouldn’t call a single gas station in a small town a “monopoly,” it seems odd to criticize Western Union for providing services in places where nobody else wants to compete.

2. Western Union’s track record of innovation

Many ardent fans of Bitcoin and FinTech startups love a story about Western Union’s rejection of “talking telegraph” in 1876, but seem to forget that Western Union had maintained a telegraph monopoly for the next 100 years launching many innovations in the process.

While PayPal was first with email transfers in 1999, in its more recent money transfer history, Western Union went first online in 2000, started singing up mobile partnerships in 2007, launched a smartphone application in 2011 when TransferWise and Remitly were just starting and before Azimo was founded. While TransferWise is known for innovative use of data for driving referral traffic and Remitly has positioned itself as a “mobile” innovator, Western Union has been leveraging the latest technologies in a more comprehensive way. Whether its extensive use of “big data”, exploring partnership with Ripple Labs, or investing in blockchain, the popular narrative about Western Union as backward and ignorant is not supported by facts.

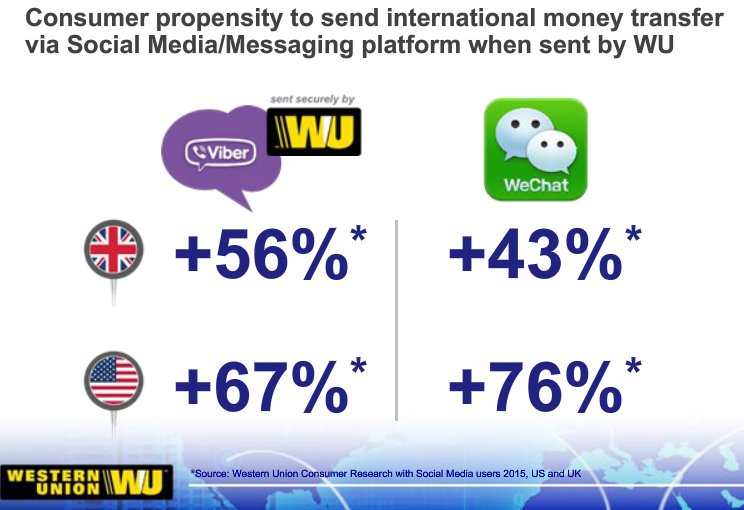

Western Union was also the first to launch partnerships with WeChat and Viber. Why would such innovative providers partner with Western Union? Technically, because Western Union could execute such complex integration better than anybody, but primary reasons is that consumers trust Western Union much more when it comes to money transfers:

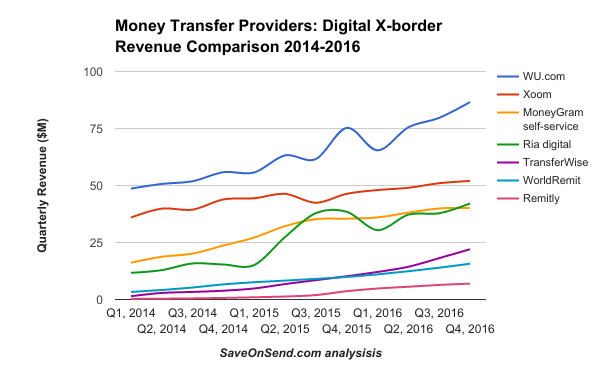

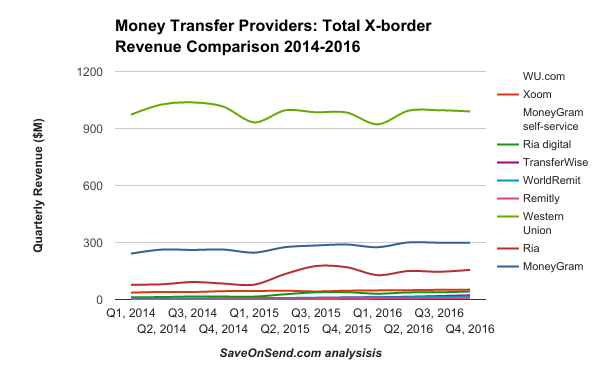

Western Union was already larger than Xoom prior to establishing a dedicated online-mobile unit, Digital Ventures, in San Francisco in 2011. Since then, the company has been growing its digital business 20-30% annually, maintaining safe distance from Xoom, Ria and MoneyGram and with no other provider close in sight:

It is also important to keep in mind that 80% of new WU.com customers are net new, i.e., they haven’t used Western Union in any capacity before. It means that there is relatively little cannibalization, around 2%, from Western Union’s offline to digital channels – instead, the company is managing to attract entirely new customer segments. There is a myth fueled by Fintech PR that younger consumers prefer new providers. Looking at actual demographics segmentation of customer base for incumbents across financial services, one would find that so-called “millennials” have a similar preference for trusted brands (aka “incumbents”) as other generations:

Western Union has accomplished a similarly strong growth in the online engagement across key social sites, coming up with an innovative idea to develop dedicated Facebook pages for Filipino, Indian, and Latino customers. As a result, its engagement metrics are 10x higher than of its main online competitors.

Western Union Celebrating 5MM Facebook “likes” – June 2015

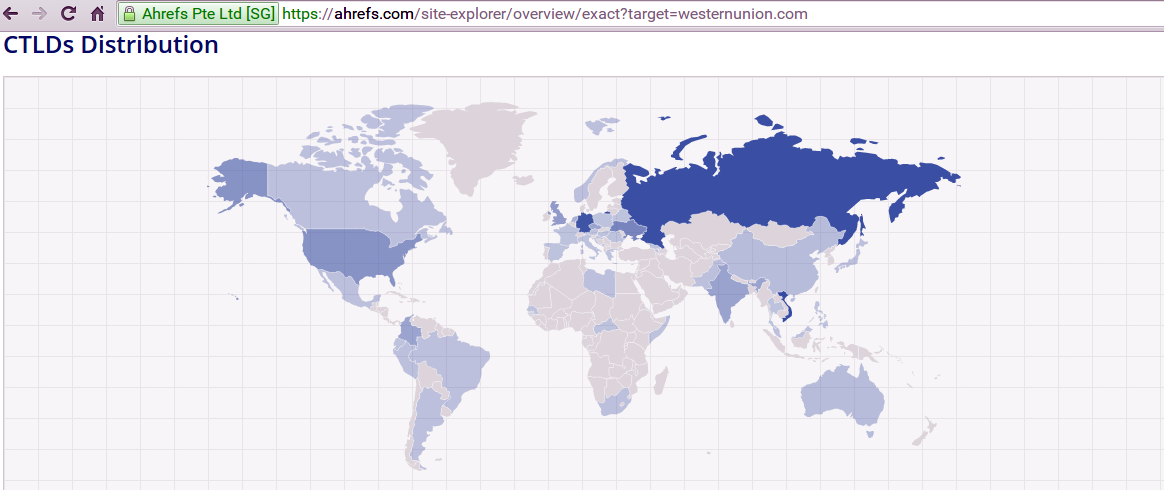

However, at SaveOnSend, we are skeptical of any online engagement metrics. In case of Western Union, like with many other remittance providers, users from Russia seem to be significantly more proactive than the ones from the US which is somewhat unexpected:

Western Union’s on-going digital transformation is not just focused on a customer engagement. Over 2016-2017, the company is spending $120 million on “WU Way,” an efficiency program, mostly on severance (40% of all costs) and consultants (25% of all costs) with an objective to digitize its operations, consolidate 55 off-shore IT locations, and lay-off material portion of staff, hoping to realize $20-25 million in annual savings.

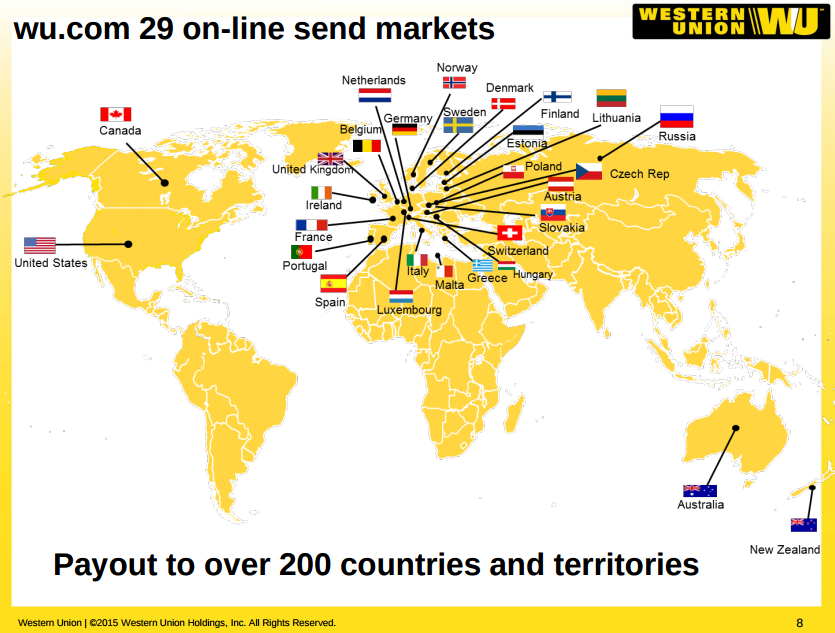

Hence, Western Union’s performance in digital is hard to interpret. Despite solid growth, it fell far short from its own expectations in 2012 to reach $500+MM in Digital revenue by 2015. Western Union’s USA website is still only available in English and Spanish, and its outbound digital services are available in less than 20% of countries (37 as of February 2017):

After on-boarding 20 countries by 2010, and 23 in 2011, Western Union added only 2 countries to its digital footprint in 2012-2014, but then added 9 in 2015. It is now covering 90+% of the world outbound send countries by transfer volume, and remaining ones are either too small or are constrained by government regulations that prohibit online remittances. When UAE, among top-10 countries in outbound remittance volumes, decides to allow digital money transfers, there is little doubt that Western Union’s effort in securing its digital market share there would be immediate and massive. 70+% of Western Union customers have bank accounts, but only 9% of consumer revenue comes from digital channels, and it is not because the company doesn’t have the right digital offering. The usage of digital channel varies dramatically by corridor or, to be more precise, by ethnicity. As we discuss later, there are many fundamental differences among Indians, Filipinos, Chinese, Mexicans and other major migrant groups living in USA. One such difference is a ratio of disclosed income. For Indians, who happened to be mostly in white-collar jobs, that ratio is very high. But many other nationalities get paid in cash and avoid taxes (think of your typical babysitter, a gardener, or a cab driver). Using digital channels is not a consideration for those groups because while saving few dollars they have a much more significant concern about being reported to IRS.

Such prioritization across corridors also makes sense in the offline word. Western Union’s agent network went from 200K agents in 2006 to 485K in 2011. By 2017, that number only increased to 550,000. Why such slowdown in adding new agents? Because around 30% of those agents are already not seeing any remittances according to 2016 annual filing:

“As of December 31, 2016 , more than 70% of our locations had experienced money transfer activity in the previous 12 months”

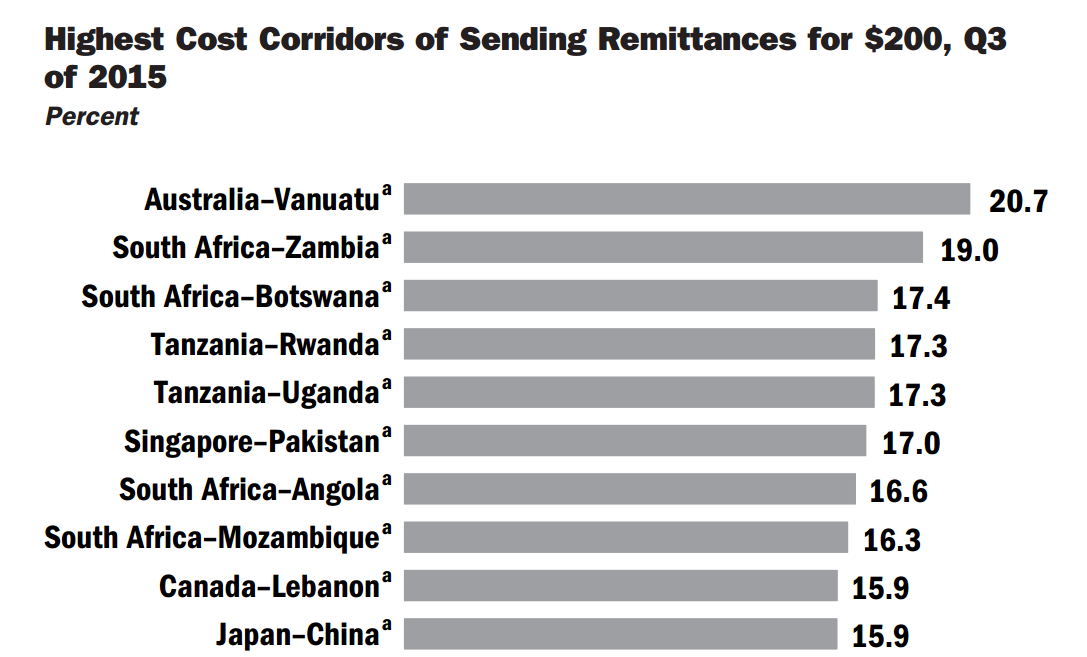

Western Union is not unique in its business-savvy prioritization of where to offer its services. For all their posturing about helping “poor” and “unbanked,” FinTech remittance startups continue setting up offices in the world’s wealthiest cities targeting well-off and tech-savvy senders while conveniently accusing Western Union of being a high-price monopoly. See the world’s most expensive corridors here and then check which startups are offering services for those:

Source: Open Knowledge

Talk is cheap, but VCs could be very impatient, and selecting a smaller corridor with a small percentage of tech-savvy users is just not lucrative enough. Here is how Remitly’s founder explained his motivation when launching the startup in 2011 (read full story here):

Words like “kid”, “education”, and “Africa” must be a part of any pitch deck, and, apparently, the only practical way to send money from USA to Kenya in 2011 was to start another company. So which destination did Remitly start with? It must have been Kenya? Nope, too small volume – $0.5B per year, plus that kid didn’t seem to care for school anyway. Maybe it was Nigeria? At least it is in Africa and among Top-5 global destinations. Nope, still not big and tech-savvy enough… so Remitly started with Philippines and 3 years and $20MM+ in funding later continued with India, then with China and in 2016 with Latin America. Remitly also expanded into its outbound business beyond the US into Canada, but… Africa just has to wait.

Why is this anecdote relevant to our question about Western Union’s leadership position? It is representative of a mindset common for remittance startups. Rather than challenging Western Union’s market share where it doesn’t have an online presence, they are going after the same “top” corridors where Western Union’s Digital Ventures is already well-established:

Source: Open Knowledge

Instead of Lagos and Sao Paulo, they open regional offices in Denver and New York, coming to Western Union’s home turf where it has proven to take “full-measure” when warranted.

3. Western Union’s competitive zeal

Western Union strategy is both complex and assertive. While overall commanding 15-20% pricing premium for its brand, Western Union applies substantially different margins across corridors. It is frequently adjusting fees across transfer amounts and send-receive methods. While such practice is consumer-unfriendly, it shows that Western Union takes a considerable effort in order to maximize profits.

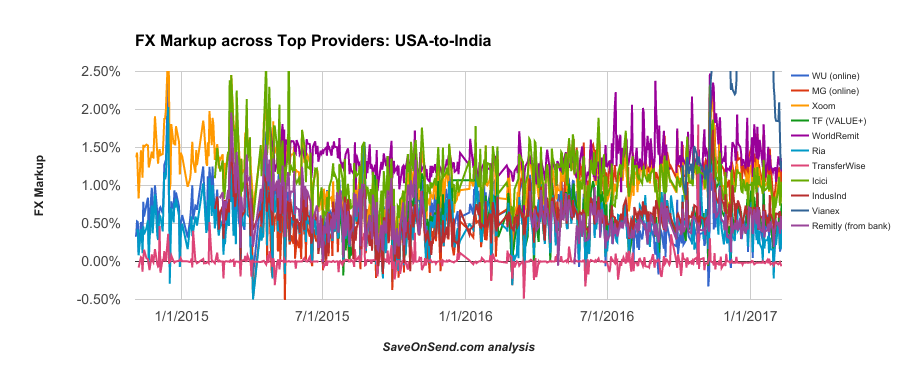

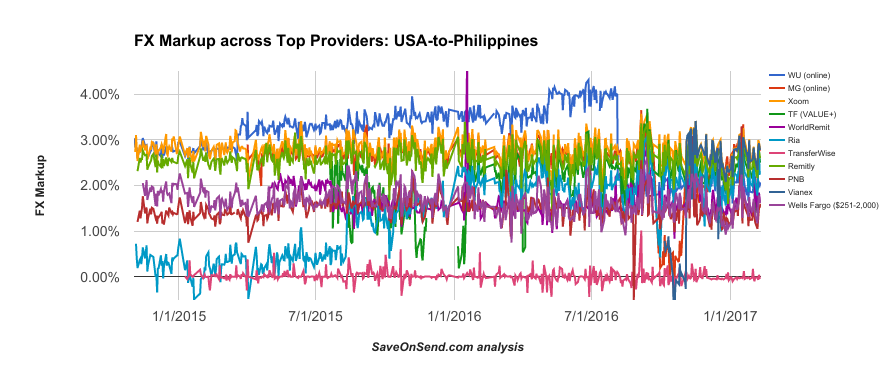

For example, Western Union’s FX markup for sending money from USA to India is one of the lowest, for USA to Philippines, till recently, it was one of the highest:

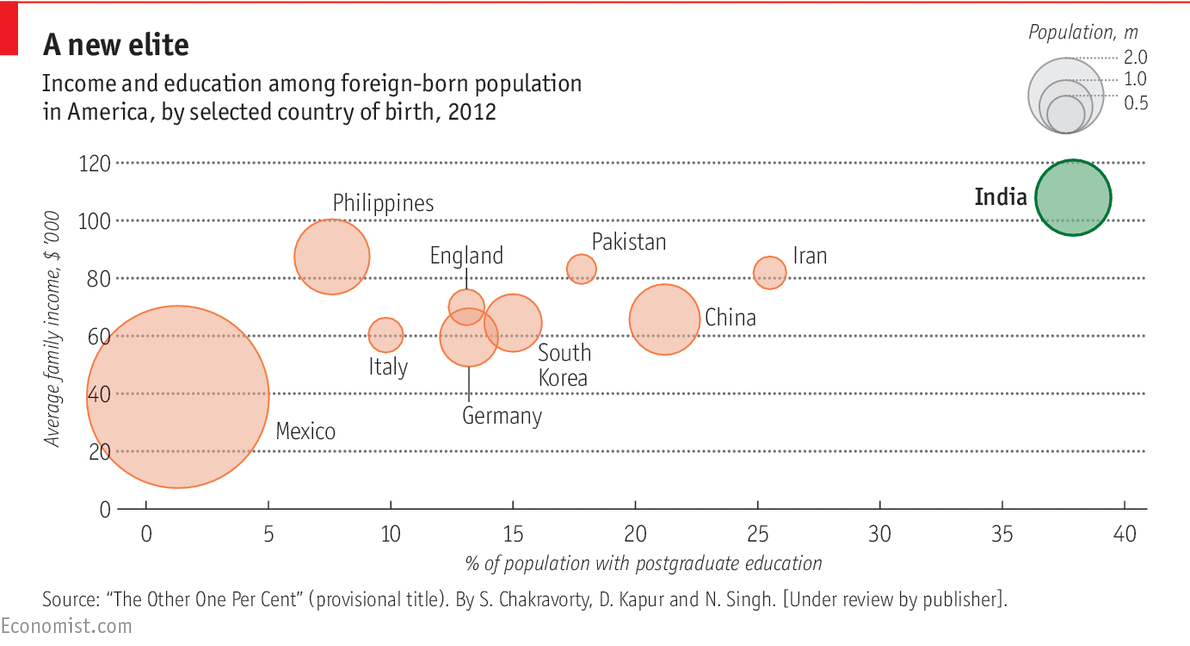

What could explain such difference in tactics for two corridors that are quite similar in size and located in the same region on a global scale? Let’s review how Indian and Filipino migrant groups living in USA are comparing in income and education:

Because Indians are so far ahead of other main migrant groups in education, they are quite unique in their engagement when it comes to remittances. More than 80% of money transfers by this group in USA are conducted online. From a cultural standpoint, Indians are significantly more likely to compare prices using sites like SaveOnSend, and are more likely to switch providers:

For other migrant groups, the average use of digital for money transfer is less than 10%, for Filipino senders from USA being slightly higher. Other migrant groups also seem to conduct less price comparison and seem to be less prone to switching providers. As a logical consequence, Western Union has to be and is far more competitive in the USA-to-India corridor. In a related example, after noticing TransferWise activity in UK, Western Union reduced margins and offered specials to ensure its market share. With Chinese customers, the issue has more to do with a culture of secrecy and mistrust of formal channels. So Western Union at times would be offering literally free transfers for some send-receive methods in order to gain a foothold in this segment.

Yes, some money transfer providers might be more aggressive or even apply misleading tactics like in the case of TransferWise, but to assume that startups’ innovative capabilities are beyond Western Union’s reach is ill-informed at best. Read this amusing article by The Guardian hailing WorldRemit’s mobile payments to Africa… 8 years after Western Union began piloting same services. Also, listen to Faisal Khan‘s response when a co-founder of a brand-new startup comments on being more agile than Western Union (25:40-29:30 segment in this Around The Coin podcast).

“Experts” who forecast Western Union’s imminent demise also don’t seem to realize that the company could simply acquire smaller providers in order to preserve its market share. Western Union has proven to be an ardent supporter of such strategy with myriad of acquisition throughout the years like Vigo in 2005 or Finint in 2011.

4. Western Union’s Financial Health

However, having a sizable leadership in remittances volume and in the digital segment or establishing an adaptable strategy might not be enough for the long-term market leadership if the underlying business model is not sound. Western Union, with its previous “near-death” experiences, knows this better than anybody else. Why don’t investors seem to take seriously the commonly accepted narrative in publications on remittances about Western Union’s imminent disruption? Because that narrative contradicts facts. Investors could have “bullish” or “bearish” mood swings, but only actual results, revenues and profits, really matter to them in the long-term. Take another look at the chart of Western Union’ stock prices since IPO at the beginning of this article. You might notice two massive sell-offs around financial crisis in 2008 and when Western Union warned about precipitous reductions in margins in 2012. But then results came in, and, quarter after quarter, Western Union hasn’t been doing as bad as was initially expected:

Stricter government regulations that are meant to mitigate terrorism and money laundering are driving banks to reconsider costs-vs-benefits of servicing smaller money transfer providers. As the result, there have been a wave of shutdowns since 2013 and it is likely to continue (read Faisal Khan’s post on this topic). Naturally, displaced customers would then seek the most established replacement, avoiding another small player or startup, with Western Union being the obvious choice.

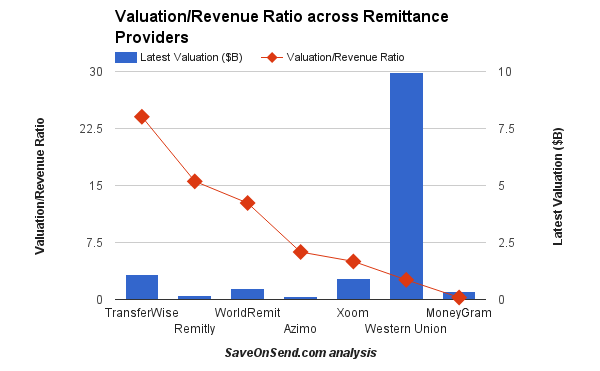

So maybe Western Union’s revenues will keep stagnating or even start declining, but to expect a significant drop would seem unreasonable. Besides, while having by far the largest digital presence, Western Union’s valuation multiple remains reasonable:

5. Room for disruption

Influenced by few examples like Google, Apple, and Amazon, we seem eager to assume a similar possibility of so-called “game changer” for international consumers remittances, something that would address a consumer unmet need in a fundamentally new way (Skype) or even create a new demand (eBay). Fortunately, or unfortunately, depending on one’s perspective, neither one has been the case for Western Union’s dominant role in cross-border consumer remittances:

Besides reasons for Western Union’s market leadership discussed above, a more fundamental reason for the unlikely change is consumers. They will continue sending cash for decades to come with transition from offline (aka, “cash agents”) to online is crawling at 2% per year. What we discovered at SaveOnSend is that an average frequent sender doesn’t seem too eager to save $10/month if it requires switching from a routine he/she has grown to cherish.

Looking at the long line at Starbucks, it would seem odd to consider those consumers as victims of a latte monopoly that takes advantage of its customers with slow and expensive service. Why shall we think differently about consumers who stay in line to Western Union’s cash agent?

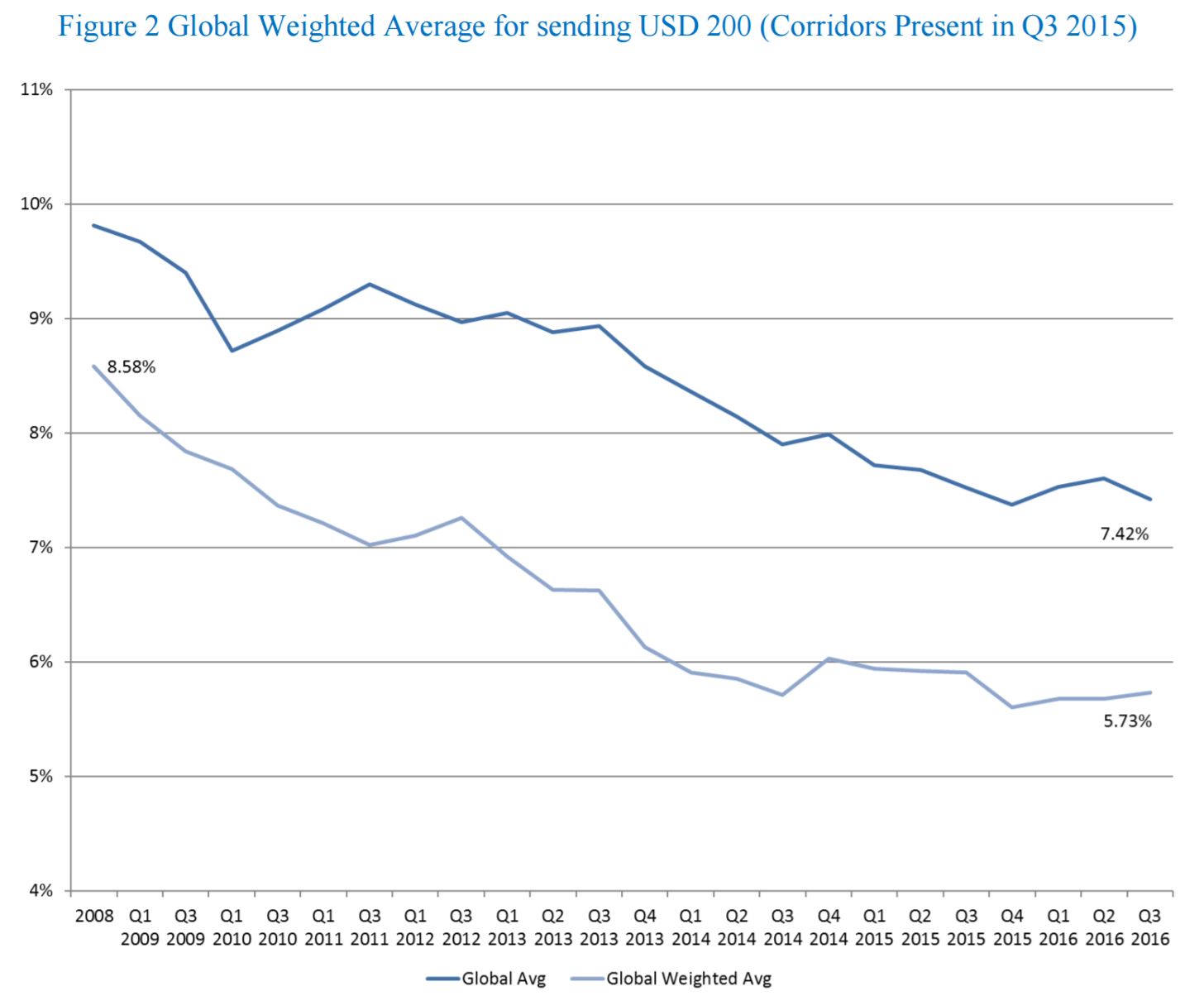

It wasn’t always the case, but these days consumers are generally satisfied with their options for cross-border remittances. There are very few complaints and half of those are about fraud (read report here), while the margins have been falling over the last 3 decades, dropping 30% in the last 7 years alone to less than 6% (global weighted-average):

Source: Remittance Prices

For top global corridors, margins are even lower, especially, when sending money via online-mobile. Western Union’s global weighted-average margin is ~5% (for Ria Money Transfer, 3rd largest global provider, it is ~4%). For in-depth analysis of specific innovations in consumer remittances, read our other posts on P2P and Bitcoin.

6. Western Union’s real contender

Let’s consider if Facebook could be a real contender for a shot to reach Western Union’s market share in the next 10 years. Embracing a tough reality that consumers are generally not looking for an alternative provider, new transfer method, or, especially, for some new type of currency, could Facebook offer a superior use case while investing hundreds of millions of dollars in acquiring and retaining cross-border remittance customers?

While it is unlikely to offer enough on both dimensions in order to take over Western Union’s leadership spot, there are objective reasons why Facebook might be the best contender:

a) master of localization: top remittance providers still only have its USA site in English and Spanish, while many larger ethnic groups among senders might strongly prefer to engage using their native languages

b) efficient customer acquisition: with margins approaching 0% for online money transfer while cost per customer acquisition is getting close to $50, leveraging its own massive global reach and advertisement-based business model would allow Facebook to drive margins even lower, burning competition in the process

c) sufficient “war chest”: with $10+B on hand Facebook could buy up likes of Ria Money Transfer and TransFast in order to get a quick international foothold and cherry-pick best processes in those companies (e.g., risk management)

d) spillover into “unbanked”: in some top remittance destinations, Facebook’s penetration is high enough to capture a significant portion of “unbanked” – Facebook could leverage this via its existing local partnerships to “cash-out” Facebook accounts.

One likely hurdle for Facebook would be to overcome its “sharing-app” image among consumers, especially, in the 30+ age range (who are the majority of remittance senders). While a larger proportion of millennials and Generation Z is open to using apps like Venmo, even those users of SaveOnSend were against the Facebook registration option out of fears that it might make their remittance comparison information public. There is already some anecdotal evidence that a relatively slow uptake of Facebook domestic transfers for USA has been also driven by privacy concerns.

For now, Facebook is experimenting with its long-rumored acquisition target Azimo. In August 2016, they launched a cumbersome 3-step service virtually assuring Western Union of no imminent threat:

Conclusion

So, based on the above, would Western Union likely remain the leader of international consumer remittances for the next decade? Probably. While its market share might fall to 10% in the next 5 years, there doesn’t seem to be any innovation or a provider who could take over Western Union’s lead in this time frame. The environment is simply too competitive already, consumers are already pretty satisfied, and Western Union has proven its grit time and time again.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...