For as long as I can remember, I’ve been hearing about a War on Cash. The war, as illustrated by India’s recent demonetization, is not on cash itself but on the illegal use of cash and, by association, the fraudulent creation of cash. Both fraudulent notes and coins along with large cash denominated amounts transferring between criminals, spurs the governments of the world to try to get rid of cash. Not only that, but cash is dirty. Literally. Most cash has some form of cocaine and other drugs residue, along with faeces and other unhygienic materials. That was part of what prompted the Canadian and now UK governments to introduce plastic money. Plastic money is not only more secure from fraud, but can literally be washed to get rid of bad deposits. Now that’s what I call money laundering.

Anyways, one of the first governments to really crack down on cash was Sweden. Interestingly, the Swedish government has been the first to talk of an eKrona digital currency, and that is in part because they were the first to introduced paper money back in 1661.

I remember a speech given by the Deputy Governor of Sweden’s central bank Sveriges Riksbank seven years ago, where he was talking about the war on cash and how they could get payments to move to cards but cash was still preferred for amounts under SEK100 (USD$10):

“Despite the fact that card payments predominate in terms of both the number and value of payments, the Swedish public still prefers cash to cards for purchases of less than SEK 100. Our survey shows that as many as 22 per cent choose cash for purchases between SEK 100 and SEK 500. For amounts under SEK 100, cash is preferred by 63 per cent. There are no fully–comparable figures from any of the surveys carried out in 2006, but in 2006 the "average consumer" did not choose to pay by card until the purchase sum exceeded SEK 123.”

Sweden demonstrates the conundrum in many European economies: how to get rid of cash for small payments? Merchants often have signs up saying cards only accepted for payments above €20, and many now have signs saying cheques not accepted.

Things have changed in the last seven years though, thanks to mobile and contactless payments. In fact, Sweden continues to lead the race to try to be a fully cashless society in this context.

According to the Riksbank, in 2015 cash transactions made up barely 2% of the value of all payments made in Sweden – a figure some see dropping to 0.5% by 2020. In shops, cash is now used for barely 20% of transactions, half the number five years ago, and way below the global average of 75%.

And astonishingly, about 900 of Sweden’s 1,600 bank branches no longer keep cash on hand or take cash deposits – and many, especially in rural areas, no longer have ATMs. Circulation of Swedish krona has fallen from around 106 billion in 2009 to 80 billion last year.

This is why the world's oldest central bank, has now announced that it's exploring the concept of a digital currency (the eKrona) to accompany its Swedish kroner notes, which could ultimately save tourists a trip to the currency exchange desk.

It is surprising therefore that Sweden comes sixth in the Global Digital Money Index.

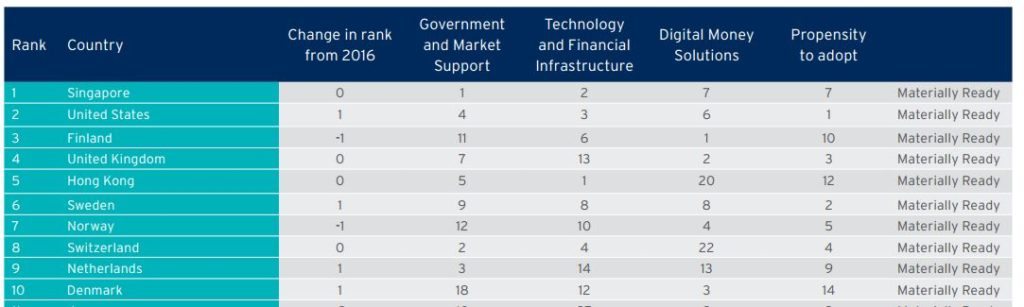

The Index is produced by Citi and Imperial College London, and ranks ninety countries for their readiness to be cashless and move entirely to digital money.

The Index ranks every country by four factors: government and market support; technology and financial infrastructure; digital money solutions; and propensity to adopt. Although Sweden is almost #1 on the last factor, it falls below others on the remaining three. Surprising really.

In fact, I disagree with the report, as it has Singapore at #1, but USA and UK at numbers 2 and 4 makes no sense to me. USA is way behind everyone when it comes to digital money – they still send me cheques and I still find many places where cash is preferred. As for the UK, sure we can be cashless in London, but get out of the Cities and try and pay for your pack of chewing gum with a contactless card and you’ll get a bemused look.

Maybe I’m misreading the report – it doesn’t explain why these countries are ranked this way - although it does provide a great case study on the Indian economy, demonetization and the Aadhaar scheme, which I can recommend you read.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...