I saw a really interesting presentation in Kigali at the Dot Finance Africa FinTech Summit from Yasaman Hadjibashi, Chief Creation Officer with Barclays Africa (soon to be something else).

She began with a discussion of the make-up of Africa:

- By 2050, it is expected that the population will double from 1.2 billion today to 2.4 billion people

- The average African is just 19.5 years old

- 2 out of 3 adult Africans have no access to banking

- 6% have formal credit access and 16% formal savings access

In Sub-Saharan Africa:

- 1 in 4 adults cannot read

- 182 million adults are unable to read and write (23% of population)

- 48 million youths (ages 15-24) are illiterate (22%)

- 30 million primary aged children are not in school (22%)

These populations are being served by mobile:

- 3 out of 4 Africans have a mobile phone

- 45% have a mobile money account

Airtel, Tigo and MTN are all winning with services from Tap and Go contactless payments to mobile loans and savings, as discussed on Thursday.

What I find interesting is that banks are ignoring the opportunity to get into mobile ecosystem and, in doing so, they are messing up. These mobile network operators (MNOs) will upscale over time to offer full bank services. They will either do that in partnership with banks or at the banks’ expense. This means that banks must open up and offer APIs that MNOs can plug-and-play into their network services. It’s the only way a bank can remain relevant as 80% of Africa’s population move into the mobile money enabled world.

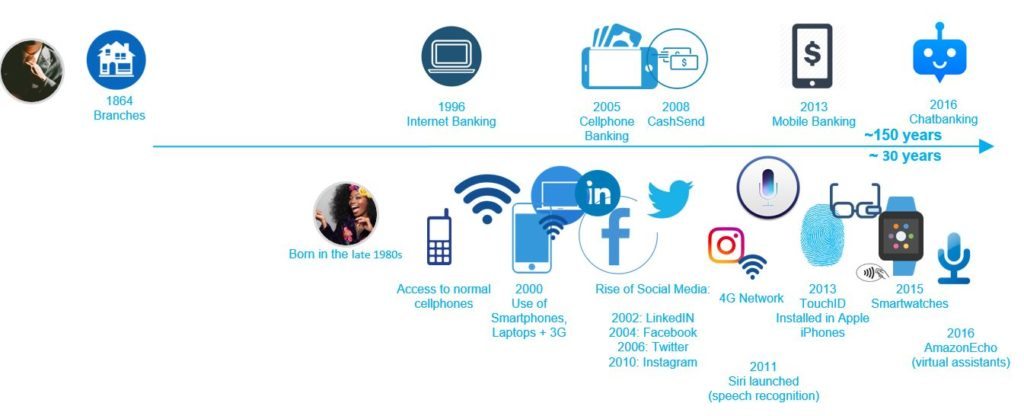

Barclays might be one of these, although Yasaman didn’t explicitly say this. Nevertheless, she did put up this chart which shows the modern African lifestyle:

It’s a nice chart and shows how rapidly life is changing. To be part of this Barclays have one of their incubation Accelerators called Rise, based in Cape Town (the others are in New York, London, Manchester, Vilnius, Tel Aviv and Mumbai). There they are focused upon a number of co-creation projects including:

- Open Banking with Howler and The Sun Exchange

- Payments with Fomo Travel, FlexPay and ByteMoney

- Big Data with Spatial Edge

- Blockchain with Avenews-GT

- AI & Machine Learning with Abe.Ai and Kapitalwise

- InsurTech with eCOIDA

Hopefully that will develop into more interesting projects, with Yasaman concluding around some case studies of what they are doing in co-creation projects in Africa.

The first is to address lending by using a new lending model designed for millennials. Half of Africans under the age of 30 are declined credit because they have no credit history. In response to this, Barclays Africa are working with HelloSoda (“We unlock the valuable information contained inside social and unstructured data”) and SocialLender (“microcredit based on social reputation”) to offer loans based upon your Facebook and other social profiles.

In most African countries where people have access to the internet (27.7% of the population right now). Where they have access, 1 in 3 Africans (9.3% of the total population) actively use Facebook, so this makes sense in that people with no financial history can at least get a loans possibility through having a social history.

The second case study is Barclays partnering with Asoriba in Ghana.

Start-up company Asoriba has developed a mobile app that allows churches to manage, engage and connect as a kind of Facebook for church members and leaders. Think about it as a Customer Relationship Management (CRM) tool for church leaders to manage the church easily and effectively. Through the app they can get content from services, information about events, and donate and pay tithes and offerings. Christians normally give a tenth of their monthly income to the church, and that’s the piece where Barclays and Asoriba have been working together in Ghana and now in South Africa.

All in all, the insights gained from Yasaman’s presentation provided a great kick off to the Dot Finance event, and I really enjoyed it\

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...