There are different views of what constitutes a FinTech Unicorn. For example, Techcrunch lists just 20 (+1) FinTech Unicorns today:

- ANT Financial $60B (Feb 2017)

- Lufax $18.5B (Jan 2016)

- Stripe $9.2B (Nov 2016)

- ZhongAn $8B (Jun 2015)

- JD Finance $7.1B (Jan 2016)

- One97 Communications $4.83B (Aug 2016)

- SoFi $4.3B (Feb 2017)

- Credit Karma $3.5B (Jun 2015)

- Adyen $2.3B (Sep 2015)

- Mozido $2.39B (Oct 2014)

- Avant $2B* (Sep 2015)

- Firstp2p $2B (Sep 2016)

- Prosper $1.9B (Apr 2015)

- Lakala $1.6B (Jun 2015)

- Qudian $1.5B (Jul 2016)

- Robinhood (+1) $1.3B (Apr 2017)

- TransferWise $1.1B (May 2016)

- Gusto $1.05B (Dec 2015)

- Kabbage $1B (Mar 2017)

- Funding Circle $1B (Jan 2017)

- Rong360 $1B (Oct 2015)

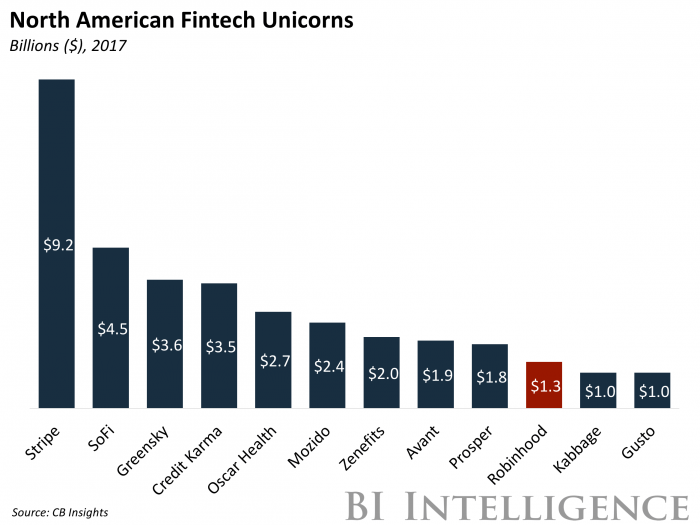

Business Insider adds in a few more, such as Zenefits and Oscar Health:

But their list constitutes just 27 firms. It’s a lot less than the numbers Jim Bruene threw around two years ago: Fintech Unicorn List Q2 2015: An Estimated 46 Have Arrived + 38 On Their Tails, but then Jim catches firms not caught on other lists such as Square, Wonga and Betterment. Some of these are off the list due to IPOs, and others have disappeared thanks to failures such as Powa Technologies.

Now I’ve noticed that more and more articles are appearing that question the business model of these FinTech firms and upstart unicorns.

For example, a view from Business Insider is that the cross-subsidisation of offering cheap entry-level deals is down to using VC cash to fund such offers. They question the business models of N26, Revolut, TransferWise, Funding Circle and more, asking how they’re going to make money. My favourite comment in this report were those of ING’s Head of FinTech Benoit Legrand:

“It’s good to acquire customers but I can tell you when we started ING Direct it was a 10 to 15 years process. Eventually, we accumulated about €1 billion of losses. It’s not €20 million of capital you need if you really want to be serious.”

Banking is an expensive business and hard to break into. This point is reinforced by Chris Myers, CEO of BodeTree, in Forbes, who believes that FinTech is failing.

Two years ago, I wrote about the potential pitfalls facing online lenders; now, I’m convinced that the contagion that plagued that space is beginning to spread to other aspects of the fintech sector.

He thinks it’s failing because there is a fundamental strategic contradiction between tech and finance, as articulated by renowned investor J. Christopher Flowers to the Wall Street Journal: “the tech idea that you must get big fast and dominate a sector” is at odds with the slow-moving nature of finance, and lending in particular.

Investors of all kinds, from traditional venture groups to angel investors, are accustomed to the modern tech growth curve. Most funds, either institutional or private, have a three to five-year investment horizon. This means that investors inject capital into a business with the expectation of realizing a return on that capital within that investment horizon.

The problem is that finance is a very slow-moving sector. Whether you’re selling bank technology, small-business solutions, or acting as a lender, it takes time to break into the market.

Unfortunately, fintech companies (and online lenders in particular) often receive pressure from both existing and potential investors to demonstrate so-called “hockey stick” growth. This, in turn, leads to short-term thinking on behalf of the fintech company, which brings us to the second reason for the industry’s woes.

I also agreed with Chris’s comments about how incredibly resistant to change the industry is.

Incumbents in the finance sector are incredibly powerful and complacent. Most don’t fear fintech companies looking to take their business because, frankly, not a single one poses a real threat at this time. Banking, and Financial Services in general is highly regulated and therefore inherently conservative. It’s the one industry I can think of where a commitment to innovation and decisive action is detrimental to a career.

Whatever the reality, it is evident in Europe and America that the FinTech bubble is stuttering. That is why US investment in FinTech was down 12.7% in 2016 and the UK was down 33.7%.

This doesn’t mean the bubble has burst, but it does mean that funding is drying up for the FinTech unicorns and will surely test their revenue models in 2017.

Source: Visual Capitalist

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...