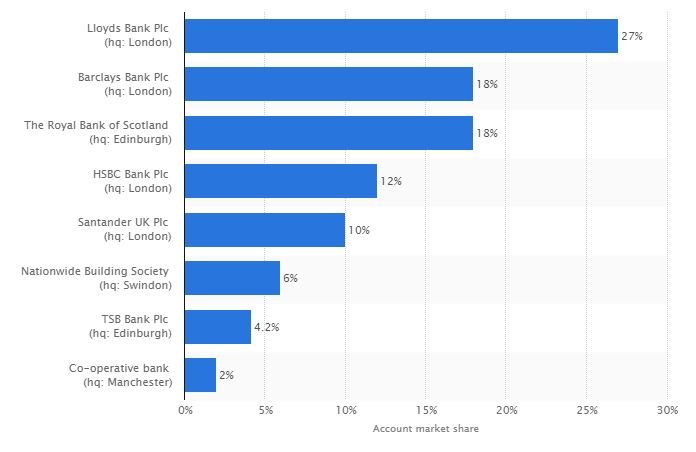

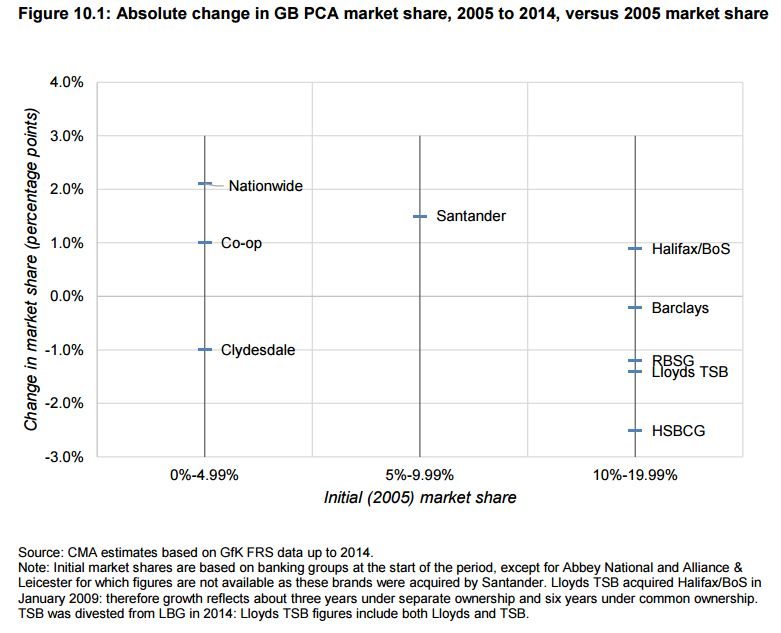

I’m very sceptical about competition in banking because I’ve been waiting for it to happen for too long. Back in the 1990s, I visited Australia that had just had sweeping reforms in banking to promote more competition. Zero affect. America’s biggest banks haven’t seen much change to their market share in the last decade, and UK banks have just been getting bigger. In 2003, the big four banks owned 63% of the deposit account marketplace. That grew to 70% and, excluding the impact of mergers and acquisitions, the four largest banks have lost less than 5% market share since 2005.

Market Share of the UK Banks

Source: Statista

Change in UK Banks Market Share, 2005 to 2014

Source: The Competition and Markets Authority Investigation into Retail Banking

Twenty years ago, we thought banks would be challenged by new entrants … but they weren’t. Sainsbury Bank launched in 1997 on the back of a consumer survey that found most consumers thought banks were ‘greedy’, ‘arrogant’ and ‘complacent’. They may well be but customers are lazy and think banks are just a utility, so they don’t switch.

Sainsbury still has made hardly any impact on the large banks market share and Tesco, who offer the best rates for deposit account banking in the UK, still haven’t got very far. Metro Bank launched in 2010 and have been expanding branches aggressively – it has opened 50 in seven years – but have only got to a million customers after all that investment - that’s smaller than First Direct – and are yet to make a profit.

Now, we have a huge number of new entrants, and I cannot see them challenging the big boys. In fact, if they did, they would get acquired or squeezed out on interest rates, as I shared with Jim Marous on The Financial Brand.

But equally, you wonder why the big banks retain these market shares when they are often name-shamed by angry customers. I remember Bark of America having an absolute PR disaster, when they announced a $5 per month debit card fee after the Durbin amendment to Dodd-Frank capped interchange fees. That was in November 2011 and it cost them 1% market share (BoA is the #1 USA bank and had 12% share of deposits in 2010, falling to under 11% today). I would claim that losing 1/12 of your market share is fairly substantial.

UK consumers aren’t quite as fickle. When I wrote about BoA’s PR disaster, I said that Barclays ousting of their CEO Bob Diamond over LIBOR fixing was the worst gaffe of that year. Did that cost them?

In 2007, Barclays had 15 million retail customers. In 2017, the latest annual report (p28) notes: “Personal Banking provides simple and transparent banking products to around 16 million customers”. Not much change there then.

Why don’t things change much? Because you’ve got to have a major disaster in service to get a lackadaisical customer to bother to do anything.

That’s why I found it quite interesting to get a note on my email today from SumOfUs.org, which is a website that describes itself as “SumOfUs exists to put bad corporations back in their place”. SumOfUs are attacking Barclays Bank’s board meeting this Wednesday over fracking.

The issue began at the end of last year, as shale exploration company Third Energy got council approval to start operations in North Yorkshire. Friends of the Earth helped residents of the village where the work was to start to take the company to the High Courts to get this stopped, but they failed.

Barclays are aware of this attack as a bunch of fracking protesters regularly take action outside their branches:

Barclays has responded to this pressure by issuing the following statement on Star Wars Day (May 4 if you’re not in on this):

“Third Energy is a British business with a history of investment and good corporate citizenship in North Yorkshire, and this is set to continue into the future … we have ensured that Third Energy, as they go through the planning process, has plans that are compatible with Barclays’ Purpose & Values, and that the company is addressing the key concerns that are being raised … Third Energy plans and operates its wells in accordance with the UK’s robust regulatory regime, which is overseen by four different regulatory bodies.”

They say a lot more but SumOfUs, Friends of the Earth and other groups disagree. Here’s what they have to say:

We're headed to Barclays' AGM in 2 days to ramp up our demand that it stops investing in fracking.

The multinational bank owns Third Energy -- the fracking firm poised to tear up the gorgeous Yorkshire village of Kirby Misperton.

Over 50,000 SumOfUs members have already signed the petition calling on Barclays to pull out of the fracking firm. Will you join them before we deliver it to Barclays bosses?

Stop backing fracking Barclays!

Living up close to a shale gas well could mean 24-hour drilling, air, noise and light pollution, a huge increase in HGV trucks through rural areas and possible water contamination.

Research has shown that people living near fracking wells have greater risks of asthma, migraines and premature births. Lives could be plagued just so Barclays can profit.

Anti-fracking campaigners have been on the ground to protect the Ryedale fracking site from Third Energy -- and we can stand with them by calling on Third Energy's backers to pull its investments. Now public support in the UK for fracking has dropped to an all-time low, it’s time for Barclays to stop investing in Third Energy.

Barclays’ annual meeting falls during Global Divestment Week -- where people all around the world will be coming together and calling on institutions everywhere to take a stand and divest from fossil fuels once and for all.

Investing in fossil fuels is not compatible with a safe climate. So we're teaming up with Friends of the Earth to hammer that message home to Barclays by delivering a huge petition. It’s time for Barclays to do the right thing and stop investing in firms like Third Energy.

Barclays: Stop investing in fossil fuel companies like Third Energy!

Just last week, our movement had a huge win. After tireless campaigning from SumOfUs members and our partners, people power forced Australian bank Westpac to rule out bankrolling a proposed mega-mine that would cook the climate and destroy the Great Barrier Reef. Let’s do the same with Barclays' fracking investments, and help end reliance on fossil fuels for good!

Lovely.

Barclays isn’t the only bank to get into trouble over climate change protests – Westpac saw similar action over the Adani Coal Project, as has ANZ, Citizens Bank, BNP Paribas, TD and more.

Anyways, I’m posting this here to share the fact that:

- active protests make a lot of noise;

- it makes not a blind bit of difference to a banks’ market share; and

- it shows that consumers aren’t that bothered about being ethical when co-operative bank, which has championed the fact that it only invests ethically with green policies, can’t find a buyer.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...