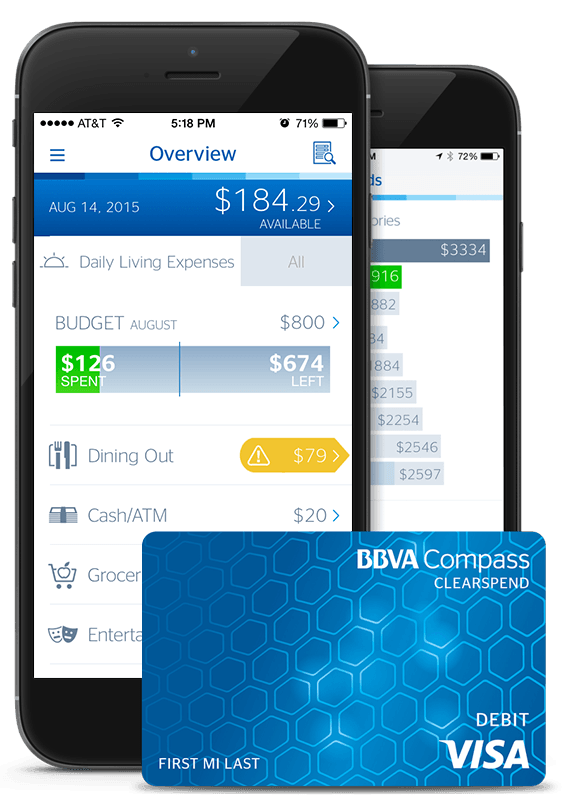

We had a great meeting of the Financial Services Club this week with guest keynote Derek White, Global Head of Customer Solutions for BBVA reporting directly to the CEO, Carlos Torres Vila. Derek is responsible for the drive to transform the customer value proposition, including global product and design, customer experience, launching new products and services and leveraging big data and customer analytics.

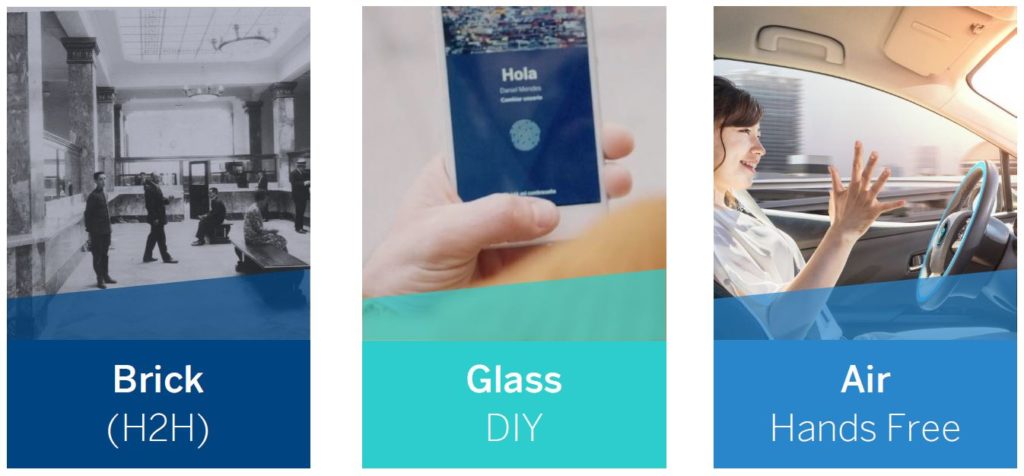

He gave an insightful presentation around how the world is changing, and how banks are moving from the age of brick to glass to air.

The focus of most banks is on the age of glass, with a clear investment in mobile apps. This is not the right focus however, as everything is moving to hands-free frictionless processes that require no tap and pay or touch ID.

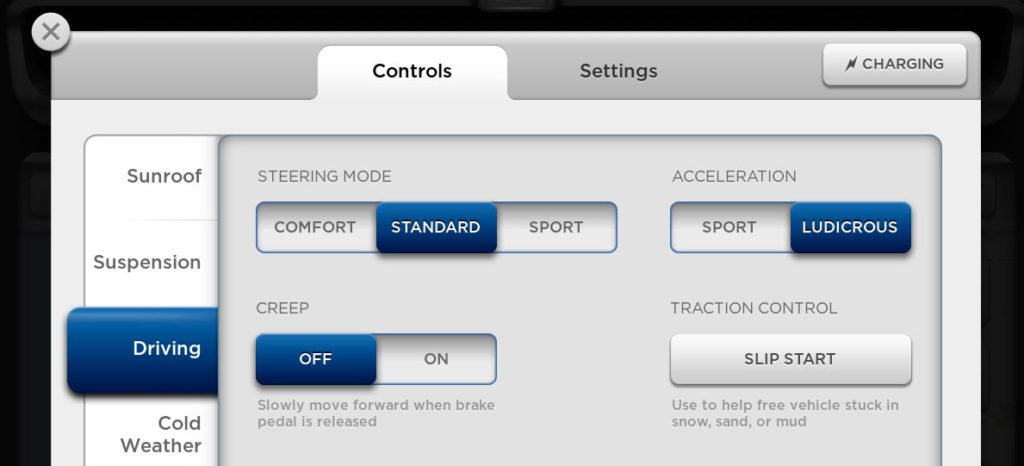

He gave a couple of great examples from the Tesla world, where you have the choice of sports drive, insane drive or ludicrously insane drive.

We even have beds that have artificial intelligence and can adapt ot our sleep patterns and positions throughout the night.

This is the age of smart, wireless activities that require no action on our part. As mentioned a few times, I call it The Semantic Age and, when discussing The Semantic Bank, it is clearly defined as the bank seamlessly integrated into the customer’s everyday lives.

In this context, banks have to be fast and agile, prototyping and deploying developments that make life easier in days, not months or years. To do that, they need a different structure focused upon digital design, engineering, data leverage and digital sales.

And Derek made clear that “these core capabilities need to be inside the organisation at the C-Suite level”, something I regularly underline on this blog.

Derek threw in a few more statistics and comments, including the fact that:

- most bank development cycles average two years as compared with 24 hours for a FinTech;

- the average customer visits a branch for about 90 minutes in total throughout the course of the year, as compared to spending 45 hours per year on their mobile banking app

It was a great night and, for those who missed it, he’s kindly allowed me to share his presentation here.

Thanks Derek.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...