For many years, I’ve been using Michael Treacy’s The Discipline of Market Leaders to talk about the business model of banking. The book claims that all companies are comprised of three major components: a manufacturer, a processor and a retailer. The book claims that most companies are only good at one of these things, and few can be good at two let alone three. Apple is probably one of the few that does all three, but even they fail on occasion (note recent iOS updates).

Some time ago, my thinking moved along a little bit, in that I realised that banks talk about front, middle and back office. Front, middle and back office is that same as Treacy’s retailer, processor and manufacturer, but just in a different parlance.

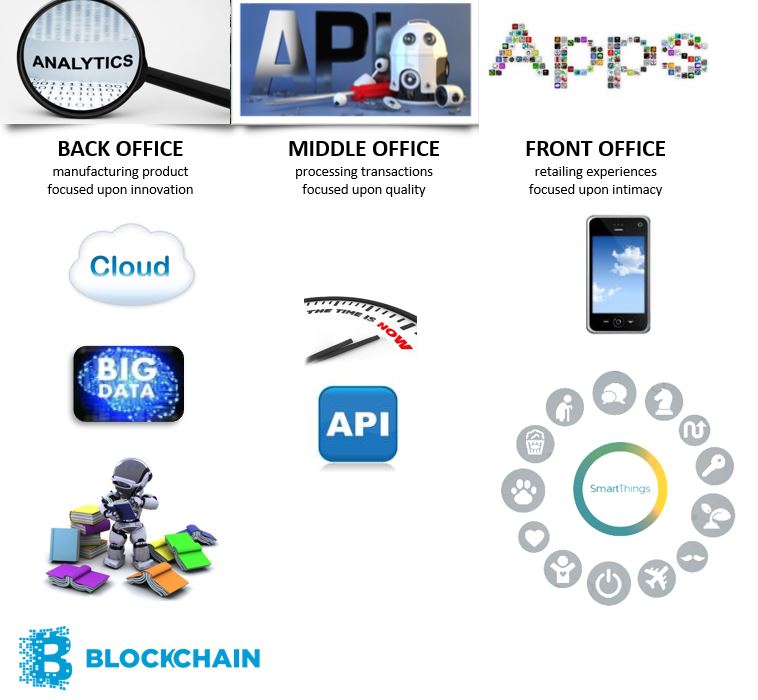

Therefore, for those who know my presentations or read the blog regularly, you will recognise this slide:

And then I use this slide to build a picture of specialists coming into the markets attacking the front office with apps, the middle offices with APIs and the back office with analytics. The apps, APIs and analytics race to rip open banking to open sourced structures is well under way.

This outline business model of a bank, or any firm, is actually useful when considering any project as it turns out. For example, I have been a proponent of business transformation for many years. The method of transforming is to map out the key customer interactions and build the business based around that customer-centricity. This structured view of the customer-focused organisation would then be built around the key principles of people, process and product. Again, I realised recently that the focal point of building a business by defining the people, process and product structures also fits back into the retail, processing and manufacturing view of a company. A company, and a bank in particular, is built based upon people, processes and products in the front, middle and back office.

Then again, this process moves on and a recent conference presentation had a slide in the middle that talked about products, platforms and experiences. Again, it’s just another wording of the same back, middle and front office. The back office is all about product and service innovations; the middle office is all about the platform infrastructure that connects the back and front office for processing transactions and interactions; and the front office is all about customer intimacy and the user experience.

No matter how you word it, this is how it works.

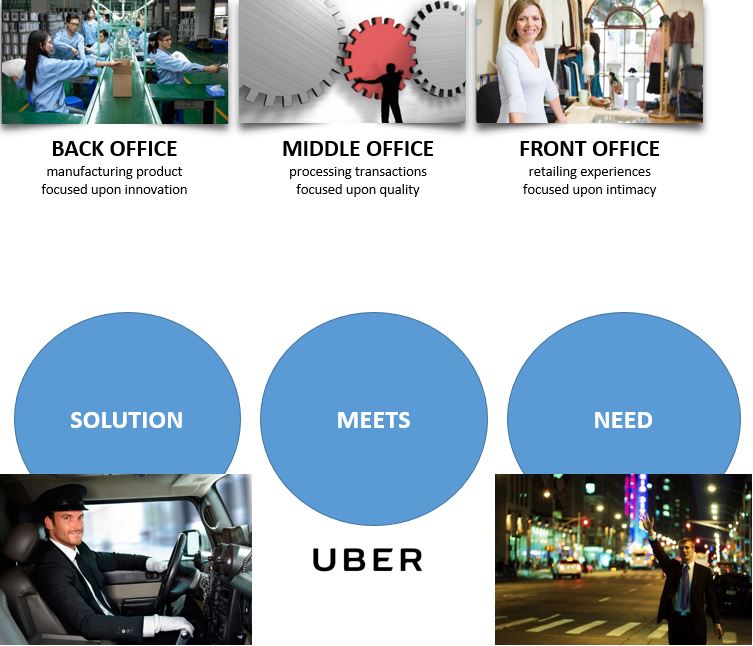

Now, I talk about marketplaces and platforms. The marketplace is all about someone who has a problem being connected to someone who has a solution. The platform is the structure that allows that connection to take place. As I write this, I’m again struck by the way in which we can think of problem meets solution through a platform that matches someone who has a need being matched with someone who can meet that need.

Uber provides car drivers for those who need rides; Airbnb matches people who need beds with people who have them; and so on and so forth.

The critical aspect of this dialogue is that the middle office is now where the action is, as it moves from physical to digital. Digital platforms providing open sourced infrastructure to connect those who need something with those who have something is the whole way in which P2P works. eBay, Zopa, Prosper, Uber and more are all about connecting front and back office – needs and solutions – in real-time. That is the platform revolution we are experiencing and it is seriously changing the game.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...