Just over a year ago, it was predicted that the skies would fall, the earth would open and fire and brimstone would rain down all over Britain if we voted to leave Europe.

Our people ignored all the dire warnings – what do experts know? – and a year later, not a great deal has changed. The skies are still above us, the earth below and there has been no fire or brimstone. But that’s because we haven’t started leaving yet. Sure, Article 50 has been triggered, and there was a general election that removed any mandate for a hard Brexit, so we’re now heading towards some sort of fudge.

The government seemingly doesn’t know what is going to happen – the free movement of people may end in March 2019 or March 2022, who knows? – and their negotiating team appear to be well prepared for tough discussions.

Yes, we are well prepared. We came along with a pen.

OK, so this is all the high level stuff. What does it mean for banking?

In the run-up to the EU referendum, a PwC report estimated that between 70,000 and 100,000 financial services jobs could be lost from London if the UK voted for Brexit. In another report by Oliver Wyman in October 2016, estimated that as few as 4,000 financial services jobs could be lost from London. What’s the truth?

Well, we’re seeing the American banks migrating to Dublin:

- Citi preparing to move 900 staff to Dublin from London

- JP Morgan appears to make good on Brexit threat with new Dublin office

- Bank of America chooses Dublin as EU base after Brexit

Although Wells Fargo ignored these noises and has pushed ahead with a £300 million investement in a new London office.

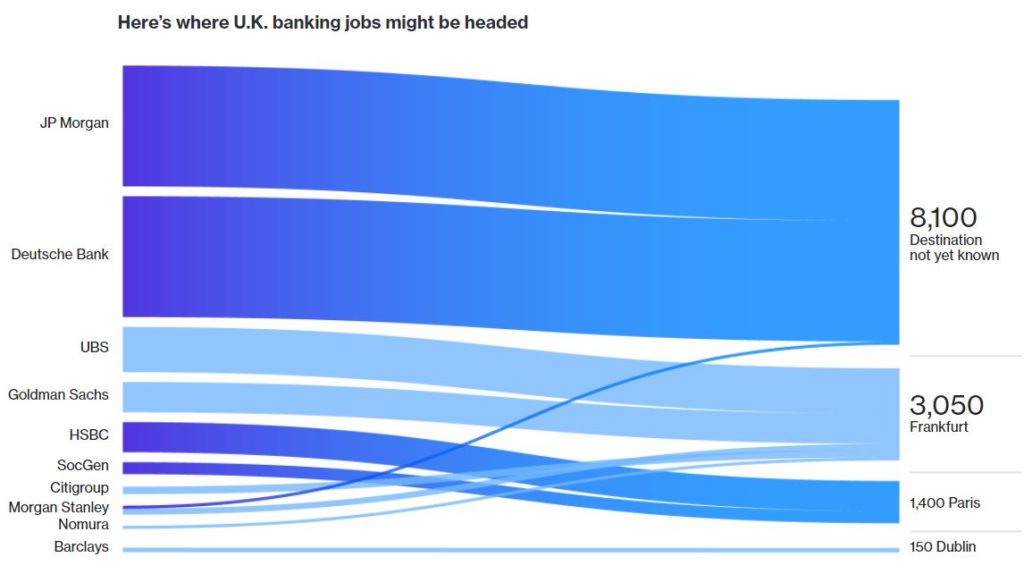

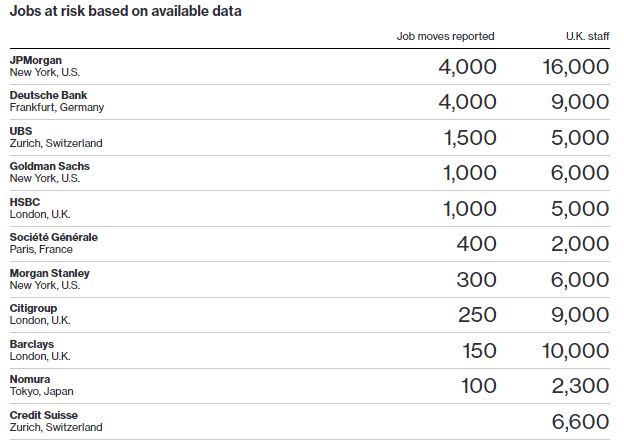

HSBC is moving 1,000 people to Paris (at a cost of $300 million) whilst Deutsche Bank are moving 4,000 people from London back to Germany, alongside Morgan Stanley, Standard Chartered and Nomura. There is some fallout. So far, over 12,000 jobs have been announced as moving out of London to Europe.

Source: Bloomberg

According to Bloomberg’s tracking of announcements, significant moves have been made by JP Morgan and Deutsche Bank but, in the scheme of things, the other banks still have their major base in London.

This does not mean it’s good news. Oliver Wyman, the same research firm that gave a best case of losing 4,000 jobs last October, is now predicting 40,000 jobs will go. From CNBC:

“As many as 40,000 sales and trading and investment banking roles could move from the City of London to other European finance hubs as banks scramble to maintain access to the European single market once Britain leaves the bloc in 2019, according to estimates from consultancy Oliver Wyman …

“The wholesale banking industry, which includes sales, trading and investment banking, accounts for 80,000 jobs in the U.K., according to Oliver Wyman estimates. The consultancy separately estimates that the wider financial services industry, including insurers and retail banks, will lose 31,000 to 35,000 jobs over the medium term.

“The impact of such job losses would be striking, not just for the industry but the U.K. economy as a whole. The financial services industry is one of the largest contributors to U.K. gross domestic product (GDP), accounting for 22 percent of London's GDP alone.”

Oliver Wyman further predict that Brexit will raise UK banks’ costs 4% and capital needs 30%.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...