I had an interesting experience in Lebanon recently, where the accepted currency is the Lebanese pound or the US dollar. In fact, the US dollar is preferred as, since the civil war in the country, the Lebanese pound has been tied to the US dollar at 1500 Lebanese pounds per dollar. Everywhere around the country are signs in US dollars and the ATMs dispense US dollars.

I’ve seen this in many countries. In several Middle Eastern countries, they pay me in US dollars cash. It may be surprising, but is often the case. In fact, the unofficial currency of Afghanistan, Bolivia, Cambodia, Costa Rica, Guatemala, Lebanon, Myanmar, Panama, Paraguay, Peru, Philippines, Uruguay and North Korea is the US dollar. Equally, the official currency of Ecuador, East Timor, El Salvador, Marshall Islands, Micronesia, Palau, Turks and Caicos, the British Virgin Islands and Zimbabwe is the US dollar.

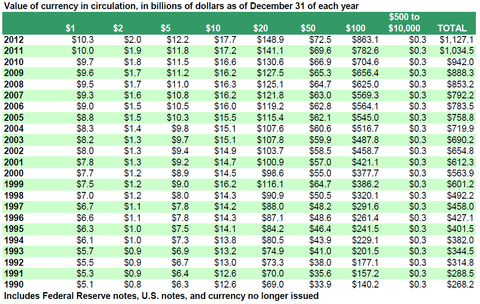

It is notable that the countries most reliant on the US dollar tend to be those that have had some form of monetary crisis in the past. For example, in Lebanon, prior to adopting ties to the US dollar, the currency suffered a hyperinflationary period that meant the Lebanese pound pretty much became worthless. The same is true in many of the other countries listed above. Meantime, with so many countries using the US dollar as their currency, is it surprising that of the $1.4 trillion of dollars in circulation, 75% are $100 bills that are most likely to be used outside the USA?

When a South African businessman buys supplies from China, he pays in US dollars. When central banks hold foreign reserves, they favour US dollars. All over the world, when things start to get crazy, people start putting $100 bills under the mattress. In fact, as of 2011, roughly two-thirds of all $100 bills were held outside the US according to Ruth Judson, an economist at the Federal Reserve. That would be around $600 billion in cash outside America in $100 bills alone.

Bruce Bartlett, a former advisor to Ronald Reagan and George W. Bush, summarises what this means for American policy quite well:

One consequence of the rising share of United States currency held abroad is that it may distort analyses of the relationship between the money supply and economic activity. Many economists believe that inflation results largely, if not exclusively, from an increase in the money supply, much of which consists of currency, the rest being bank deposits, travellers checks and other forms of money.

But if much of the money supply circulates abroad, then any analysis correlating the money supply to domestic economic activity may be distorted and provide false conclusions.

Incidentally, exports of cash appear in the Commerce Department’s data on international transactions (Line 67). It is recorded as an increase in foreign-owned assets in the United States, but is better thought of as an almost costless way of financing a good chunk of our current account deficit. It’s like borrowing money from foreigners that most likely will never have to be paid back, at zero interest.

Nice, and for the up-to-date stats, checkout the Federal Reserve's latest updates.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...