I now think I am a good friend of Pablo García Arabéhéty, CGAP's Regional Representative for Latin America and the Caribbean. This is, in part, because he’s contributed one of the key pieces I’m using in my new book Digital Human (due for release next Spring), and partly because we met at the CIAB conference last week, where he presented a case study on OXXO in Mexico. Now, having blogged about FinTech in Brasil yesterday, it would be unfair of me not to give Mexico some focus today so, here goes.

As mentioned yesterday, FinTech in Mexico has exploded in the last year, growing by 50% and anticipated to take 30% of bank business. Now, I could blog about all that, and specifically 12 stand-out start-ups in Mexico, but you can read the links for the FinTech scene in Mexico. Instead, I’d rather cover the details discussed by Pablo who, before he went on stage, said he was going to talk about OXXO in Mexico, a 7-11 style retail store and Mexico’s largest corner shop retail chain.

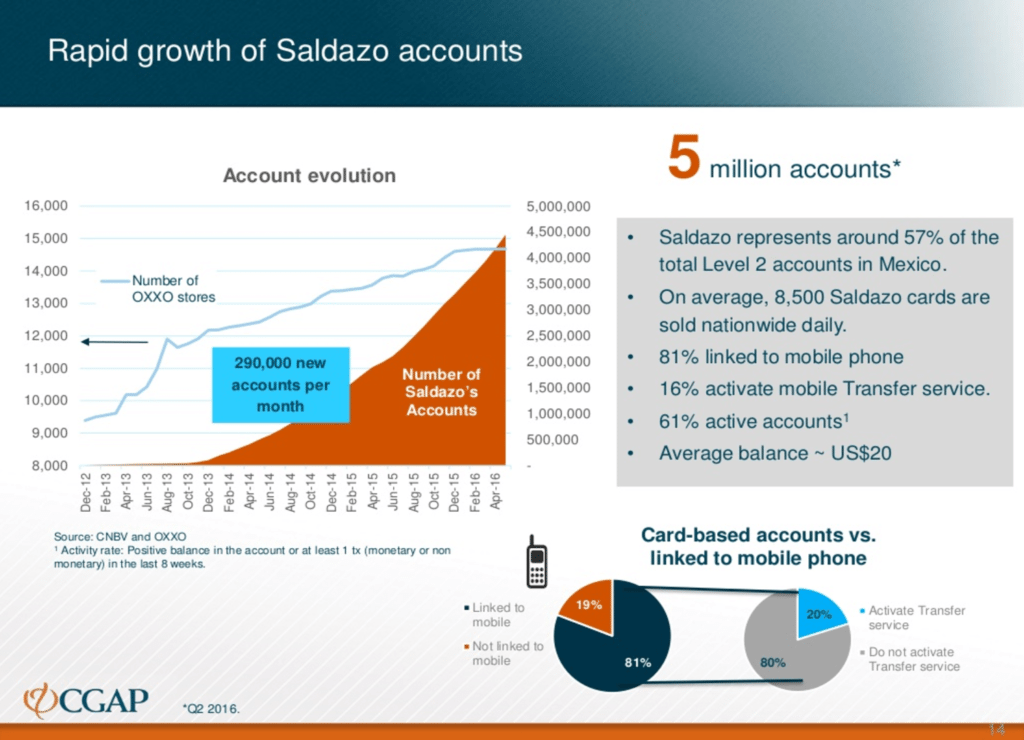

OXXO partnered with Banamex in 2012 to launch Saldazo, a co-branded, simplified account with low know-your-customer (KYC) requirements and no minimum balance (albeit capped). It is issued by Banamex as a VISA card, and then sold and activated by OXXO. Opening an account costs less than US$2, works in less than five minutes and can be opened at any of the more than 14,000 OXXO outlets

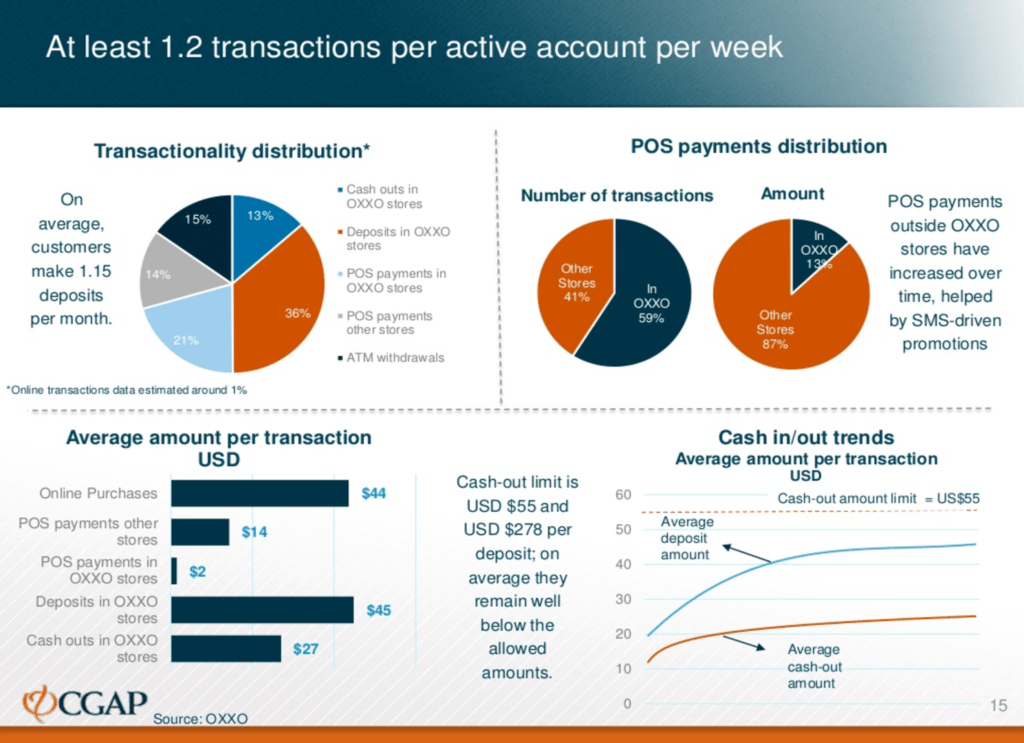

Once you have the card, then it works as a digital wallet and can be linked to Banamex’s mobile app which offers enables mobile payments and money transfers, balance inquiries, withdrawals and airtime purchases without needing to use the card.

It has since been incredibly successful. For example, over five million accounts were opened in just three years and, according to figures from Reuters, they average 8,500 cards being issued daily (although it’s not yet profitable). In fact, it could be a future highlight for Citibank, who own Banamex, as Saldazo is now the first formal banking product for 42% of Mexicans.

The World Bank illustrates the Saldazo story well, focusing upon the experience of Adrian, a private driver who lives in a rural area outside of Mexico City. Adrian popped into OXXO to buy a soft drink and was offered a Saldazo card. Within minutes he received his card, which he now uses to enjoy a range of services including savings, bill pay and sending money. Today, Adrian automatically deposits his paycheck into his account and uses the card to purchase gas and food, pay bills, and transfer money to his wife, whom he encouraged to get a card so that when he is on the road he doesn’t have to worry about her having money available.

Adrian’s story reflects the fact that digital payments are often the first formal financial service that people use, and is a driving force to more financial inclusion everywhere.

You can see the success in Mexico from just these two slides:

And you can see the whole presentation below:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...