It’s been an interesting few weeks, watching bitcoin’s rollercoaster ride as it rises to valuations over $4,000 and then dives to almost $2,000 before rising again to near $6,000.

This is for an asset that just a year ago you could have purchased for a few hundred dollars. The rise of cryptocurrency valuations is confusing and fuelled by everything from China and Russia trying to ban the asset, to forks that offer you free cash and coins.

It is for these reasons that Jamie Dimon (CEO, JP Morgan) calls bitcoin a fraud …

… and Gottfried Leibbrandt (CEO, SWIFT) gets a big laugh from bankers by talking about bitcoin whilst showing tulips on a slide.

Bankers may laugh at bitcoin but they’re obviously conflicted. On the one hand, Goldman Sachs says that bitcoin is less reliable as an investment than gold, and then considers the launch of a new trading operation focused on bitcoin; whilst Morgan Stanley CEO James Gorman says that bitcoin is “certainly something more than just a fad.”

Maybe that’s because bitcoin was recently peaking at a market cap of almost $100 billion, making it more valuable than the market cap of Goldman Sachs or Morgan Stanley. And you do have to ask why JP Morgan is trading bitcoins on behalf of clients when Jamie Dimon said he would fire anyone at the bank trading in them.

It’s nice therefore to see some rationale in this haven of confusion. Adam Lutwin, CEO and co-founder of Chain, writes on Medium:

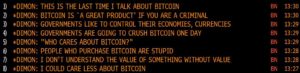

Let me start by stating that I believe:

- The market for cryptocurrencies is overheated and irrationally exuberant

- There are a lot of poseurs creating them, and some scammers, too

- There are a lot of conflicts of interest, self-serving hype, and obfuscation

- Very few people in the media understand what’s going on

- Very few people in finance understand what’s going on

- Very few people in technology understand what’s going on

- Very few people in academia or government understand what’s going on

- Very few people buying cryptocurrencies understand what’s going on

- It’s very possible I don’t understand what’s going on

Also:

- Banks and governments aren’t going away

- Traditional software isn’t going away

It’s a long piece that concludes with:

- Cryptocurrencies (which I prefer to call crypto assets) are a new asset class that enable decentralized applications

- Decentralized applications enable services we already have today, like payments, storage, or computing, but without a central operator of those services

- This software model is useful to people who need censorship resistance which tend to be people that are either off the grid or who want to be off the grid

- Most everyone else is better off using normal applications because they are 10x better on every other dimension, at least for now

Meantime, back in Jamie Dimon's office ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...