I regularly talk about BBVA (Spain) and DBS (Singapore) as banks that are doing the right things for digital transformation. They both started early, have a leadership team who are committed and have been driving down this road with results. Results in terms of awards and recognition within the technology community, but what about in the investment community? Maybe not, as I recently noticed a headline in The Economist

BBVA, a Spanish bank, reinvents itself as a digital business

But it was the subtitle that really caught my attention:

It wants to be as nimble as a fintech start-up; shareholders are having to be patient

The point of the article was that for all of the banks’ changes, it has underperformed in the market compared to its peers. A few paragraphs to explain the background before my take on it …

BBVA “began overhauling its computing systems in around 2007, a six-year task Mr González says he would rather have undertaken sooner. Now the bank is focusing on what customers see above the glass of their smartphones and on the internal processes below it. ‘At the end of the day, we won’t be a bank any more,’ he says, but a ‘digital house’.

“In Spain digital sales (e.g., loans, mortgage or insurance policies arranged online) made up 26.3% of the total, by volume, in the first eight months of 2017, up from 17.1% in 2016 and just 8.8% in 2015. The number using the app as their main link to services has risen by 40% in the past 12 months.”

But the bank’s “indicators of digital progress lack long-term financial targets. The stock market is not impressed. Over the past five years, little distinguishes BBVA’s share price from those of Santander and CaixaBank, which rank first and third in Spain.”

BBVA share price is in blue, compared with Santander in orange and CaixaBank in brown

Interesting. As the poster child of European banks converting to digital BBVA, formerly known as Banco Bilbao Vizcaya Argentaria, should be showing impressive results after a decade of change.

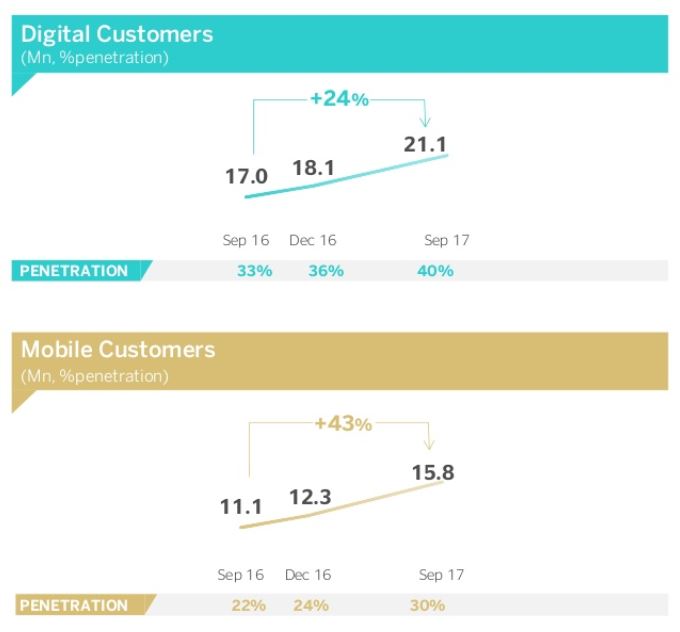

I spent a little while looking at BBVA’s financial results and activities. In 2016, digital customers in Spain were up 20% to 18.4 million (21.1 million Q3 2017), with a significant rise in mobile customer, up 38% to 12.4 million in 2016, rising to 15.8 million by Q3 2017. That’s why digital sales are doubling year-on-year, as noted above.

The bank has €690 billion of assets under management, and net income was up 15% in 2016. Market cap is €56 billion today. The efficiency ratio is 49.6% in Q3 2017, down over 2% from the year before (51.8%), and Return on Equity (ROE) ratio is 8.5%, up 1.3% over the year before.

It’s performing pretty well. Nevertheless, when reading investment analysts views, they rarely mention BBVA’s digital transformation. Instead, they focus upon their performance, unsurprisingly, and that is not delivering.

BBVA is one of the European banks that is more attractive to U.S. investors due to its geographically diversified business, namely its vast exposure to emerging markets. This feature has enabled the bank to achieve relatively good returns over the past years despite the challenges it had to face, namely the global financial crisis and the Spanish real estate collapse. This justifies why historically it has traded at a premium to the European banking sector …

However, given the many issues it faces, namely margin pressure in Spain, exposure to oil, a relatively weak outlook in emerging markets and a weak capitalization, BBVA is a value trap and investors should avoid its stock until macroeconomic conditions improve and the bank reaches a capitalization level more in line with its peer group.

Most other investment sites say the same.

What this shows for me is that digital transformation is all well and good, but it is not delivering a discernible differentiation yet.

For example, comparing DBS – the South East Asian digital banking poster child – results with their competitors OCBC and UOB in Singapore, you see a similar trend:

DBS share price is in blue, compared with OCBC in orange and UOB in brown

With analyst commentary similarly focusing on the DBS financials and not the digital change programme:

Upside

- Ability to reprice loans at higher interest rates and lower costs of funding, from large pool of CASA deposits.

- Higher non-interest income from wealth-management and Manulife bancassurance businesses.

- Sharp and sustained rebound in commodity prices.

- Asset quality better than expected with no major credit slippages and proactive loan restructuring.

- Higher demand for domestic mortgages from easing of cooling measures.

- Translation benefits from appreciation of USD/HKD.

Downside

- Highest asset-quality risks from exposure to North and South Asia and O&G sector.

- Sharp decline in the value of securities and shocks in fixed-income portfolio.

- Job losses in Singapore become pervasive, hurting mortgage portfolio.

- Lack of liquidity of a funding currency.

- Emergence of dominant financial competitor in Singapore.

- Capital-raising by peers.

This means that, all in all, yes, digital transformation is important but in the overall scheme of things, particularly shareholder returns and investments, it’s irrelevant today. Tomorrow? Maybe The Economist sums it up best:

Francisco Gonzalez, BBVA’s Chairman, “is 72 and the bank’s rules say he must go at 75. If he is right, the tech giants [GAFA] may by then be parked on BBVA’s lawn. At least it will be expecting them.”

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...