I wrote about the fact that digital transformation does not create greater shareholder value … yet … and then DBS announce that they are the first bank in the world to demonstrate the link between digitization and shareholder value creation on November 17. Interesting, as I blogged about this on November 16, inspired by an article in The Economist.

First, DBS CEO Piyush Gupta talked through their digital strategy and journey. His presentation about their digitalisation begins on Slide 12 in this PDF, and it is recent, just since 2014. The strategy begins with 5 core capabilities:

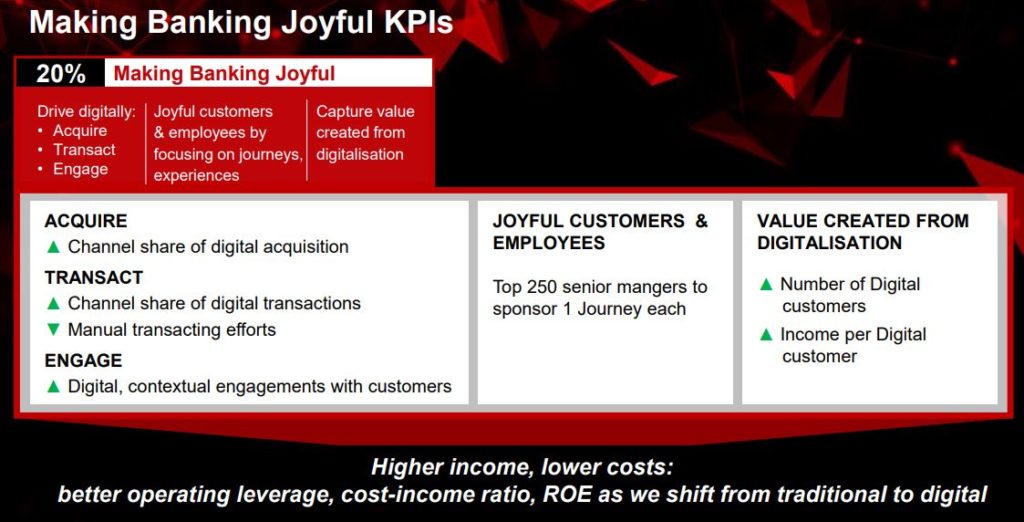

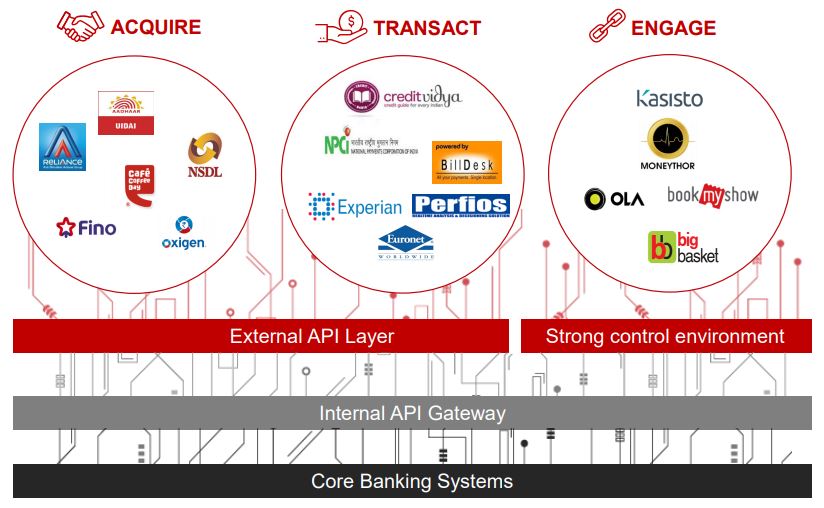

ACQUIRE • Increase customer acquisition through wider distribution • Lower acquisition cost

TRANSACT • Eliminate paper • Create instant fulfilment • Decrease cost

ENGAGE • Drive ‘sticky’ customer behaviours • Cross-sell through contextual marketing • Increase income per customer

ECOSYSTEMS: Pipes to Platforms

DATA: Be insights driven

But then the bank recognise that capabilities aren’t enough, it has to change the culture, and so a vision was put into play making banking joyful. In order to do this, the bank recognise they had to put digital to the core of the company and act like a 22,000 person start-up. This was delivered by focusing upon customer journeys and, in those customer journeys, to make the bank invisible. In other words, take all the friction out of every customer interaction and experience with finance.

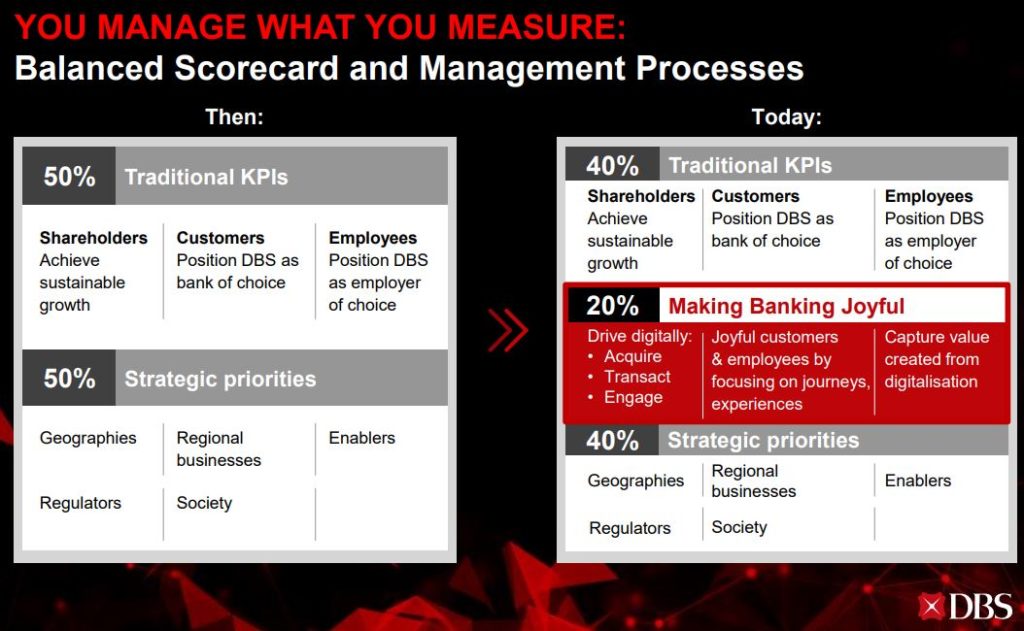

This meant moving from legacy systems to open APIs in a microservice architecture living in the cloud; moving from a waterfall management team to agile; and moving from projects to platforms. You can read the slides for more but, for me, DBS did something upfront that many other banks are yet to implement. They recognise that to change the culture and the focus of 22,000 meant changing the measures and rewards to reflect digital.

Changing the culture is the most critical part of any digital transformation, and those who treat digital as a project to delegate will never get there. The fact that DBS built digital into the corporate fabric was evidenced by the Euromoney award given to DBS in 2016, when they were chosen as the World’s Best Digital Bank. In presenting the award Clive Horwood, the editor of Euromoney, said:

“It is demonstrably the case that digital innovation pervades every part of DBS, from consumer to corporate, SMEs to transaction banking and even the DBS Foundation.”

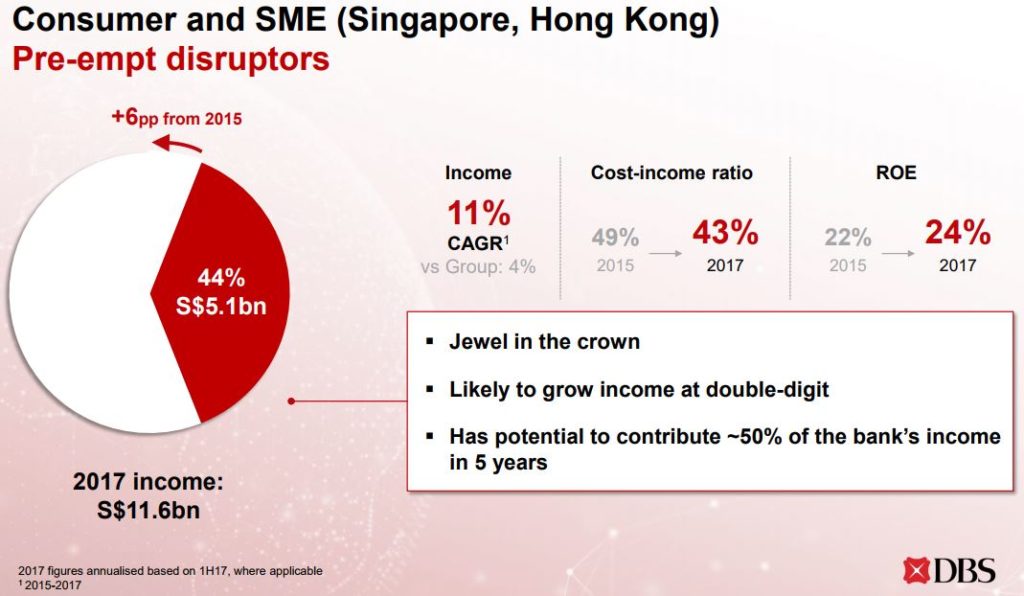

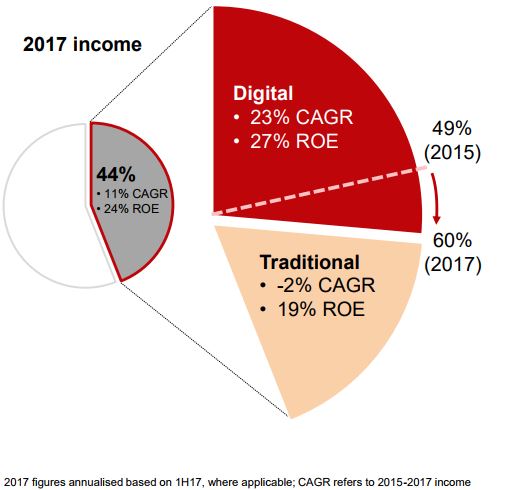

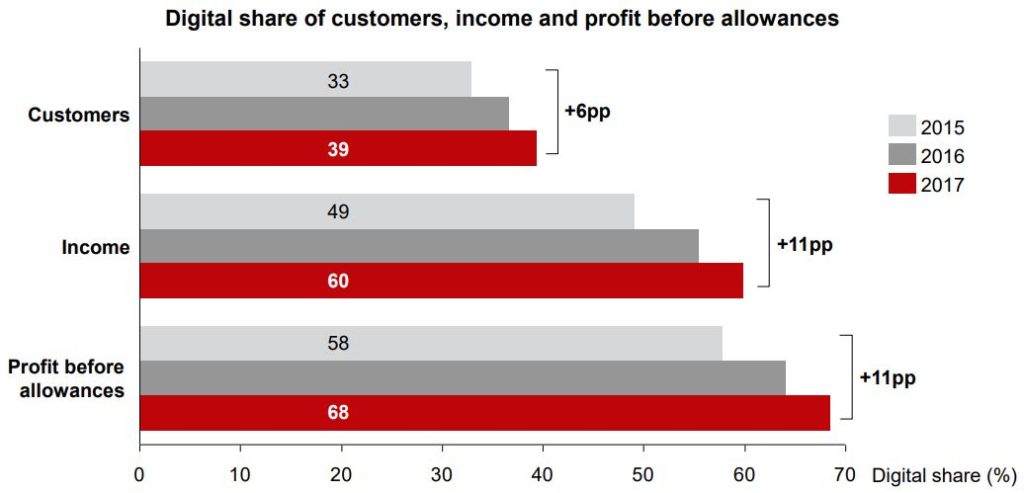

And it is delivering results that shareholder’s can recognise. For example, 38% of DBS’s 2015 S$10.8bn revenues were derived from digital platforms rising to 44% in 2017 (S$11.6bn).

Of those 2017 figures, what is really telling is the Compound Annual Growth Rate (CAGR) and Return-on-Equity (ROE) figures are for digital users versus the traditional, physical services (branch, call centre and offline).

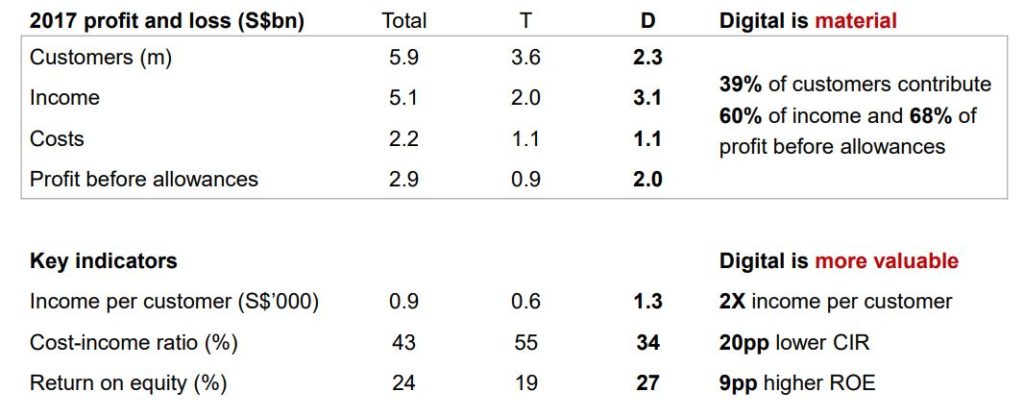

Figures are for the main retail bank consumer and SME services and these figures are from a second presentation

There are clear differences between customers who use traditional offline services (T) versus those who use digital online services (D).

In fact, they are finding that as digital customers grow, they are delivering far higher profitability. In 2017, 39% of customers are delivering 68% of profits.

This is because digital customers are:

- Lower cost-to-acquire

- Lower unit cost-to-serve

- Higher income per customer year on year

- Consistently faster growth in income per customer

A third presentation talks about their investment in growth markets of digibank, currently running in India and Indonesia. This is all about reaching high value customers in scale markets by offering an entire bank in a smartphone, and it’s all delivered by curating a marketplace of partners through APIs (ring any bells?).

Piyush summarised the whole day by stating that:

- The strategy leveraging Asia’s megatrends has paid off with diversified growth and higher returns.

- Digitalisation creates opportunity to pre-empt disruptors, disrupt incumbents and improve business profitability.

- DBS’s digital transformation is pervasive, encompassing technology, customer journey and a start-up culture. This is difficult to replicate and creates competitive advantage.

- The banks has established a management and measurement system to drive this transformation, and a robust methodology to track financials.

- Early results are encouraging. Digitalisation has accelerated income growth and lowered structural costs, boosting operating leverage. The opportunity space is significant.

I agree, and think there’s a lot other banks and start-ups can learn by immersing themselves in the three presentations embedded in this document which, if you missed them, are:

- DBS’s digital strategy

- How the strategy is creating shareholder value

- Strategies to grow in new markets

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...