I’ve recently noted a number of reports about Open Banking, with many published recently due to its imminent arrival on January 13, 2018.

Source: IBM

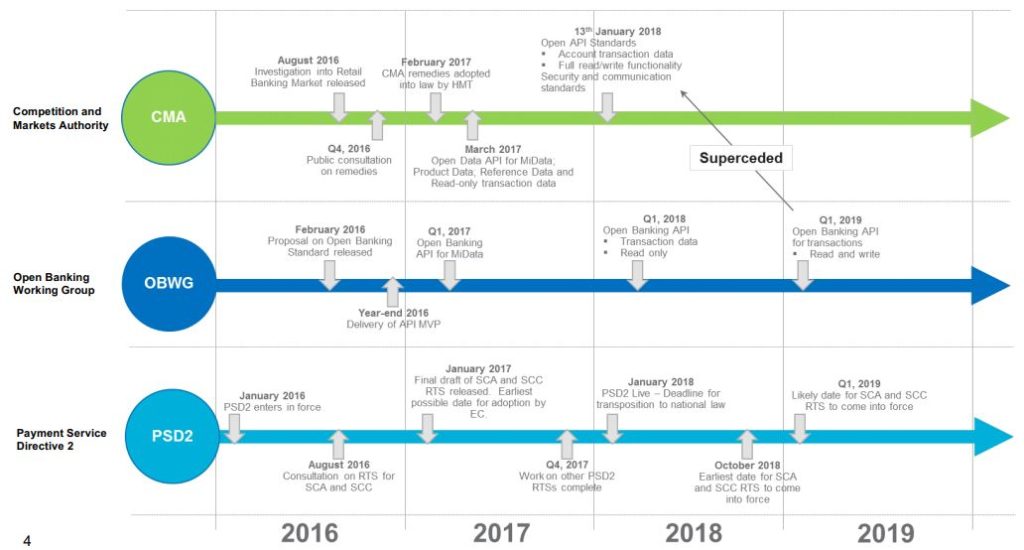

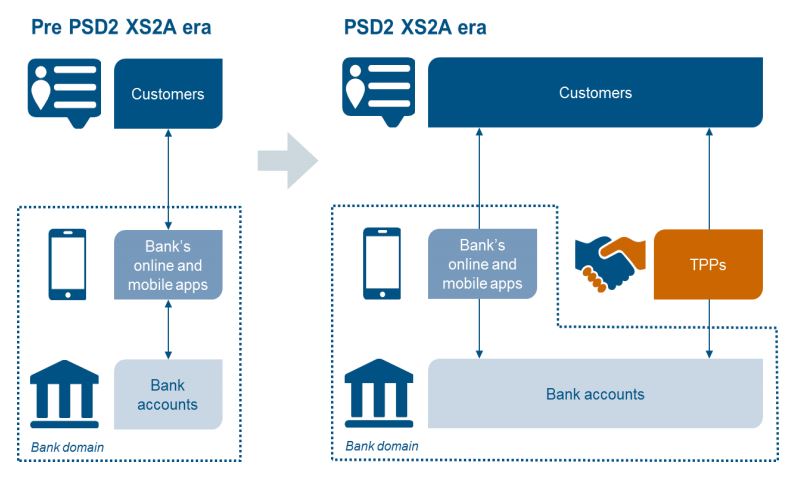

As can be seen, we have several different groups working on Open Banking. There’s the Payment Services Directive 2 (PSD2) with Open APIs for payments, Open Banking regulations which are UK-based rules from the Competition and Markets Authority (CMA) and extended by the Open Banking Working Group (OBWG), thought I would highlight a few of the many that are out there.

Barclays produced some consumer focused research in January, which defines Open Banking as a requirement for firms to:

- Make it possible for people to share their financial transactional data far more easily with third parties online.

- Allow third parties to initiate payments directly from a person’s account as a bank transfer as an alternative to credit or debit card payments.

- Make public and openly share their product information and importantly, their customer satisfaction scores and separately other ‘service level indicators’.

Source: Nordea

The report has some interesting stats, such as the research conducted by Ipsos Mori for Barclays in 2015 which showed that, even before people were having products marketed to them, almost 40% would be happy to share their data to receive personal financial management services. Almost 30% were undecided and only 30% rejected the idea. Later in 2016, Accenture conducted research with consumers which showed that 85% of 18-24 year olds would trust third parties to aggregate their financial data. In contrast, 48% of 55-64 year olds were neutral or positive.

The Barclays report goes on to look at the pros and cons of Open Banking for consumers and small businesses, and notes the Treasury Select Committee’s comments about digital exclusion:

25% of people don’t have smartphones, broadband hasn’t been fully rolled out, we had another report over the weekend about the weak mobile phone signals and…there is financial exclusion and all of these things… are correlated with people who are elderly, on low incomes, live in rural areas and have disabilities.

Not everyone is digital. The report concludes:

For interviewees, the potential power of Open Banking to disrupt the financial services market – and indeed, other markets – is evident. It will bring new products that make it easier to manage money and shop around. It could widen access to existing products, like credit, debt advice or financial advice. And bring new products to market from overseas or the UK, at the click of a button. The ‘tools’ of Open Banking will make things simpler, quicker and more convenient. But consumer experts have concerns that those same tools could create obstacles that undermine its potential. New third parties will further complicate the landscape for consumers. It’s unclear if they will be trustworthy or who will protect people if they’re not. And there’s lots of innovation but it could by-pass those who would stand to gain most from it as people who are less ‘commercially viable’ get left behind. Simultaneously, research shows that digitalisation leaves people feeling concerned about the impact technology might have on their social or family life but feel unqualified and too disempowered to challenge it, even when they proactively try to be ‘responsible consumers’. They have lost control.

According to Forrester:

Open Banking Will Be Transformative

Open banking blows apart the insular nature of many banks and will transform the banking landscape. This will take a decade or so, but the seeds of change are being sown now.

The Power Of Open Lies In Ecosystems

Ecosystem-based business models will become mission critical as open banking and regulator driven innovation builds collaboration into the value chain. Banks will deliver customer outcomes with partners, exploring new models based around marketplaces and open service provision.

Put Customer Outcomes At The Heart Of Open Banking

Open banking promotes innovation, transparency, and greater choice for customers, and it places customers at the centre of the value chain. Flexibility to respond to new customer expectations or competitor developments is paramount.

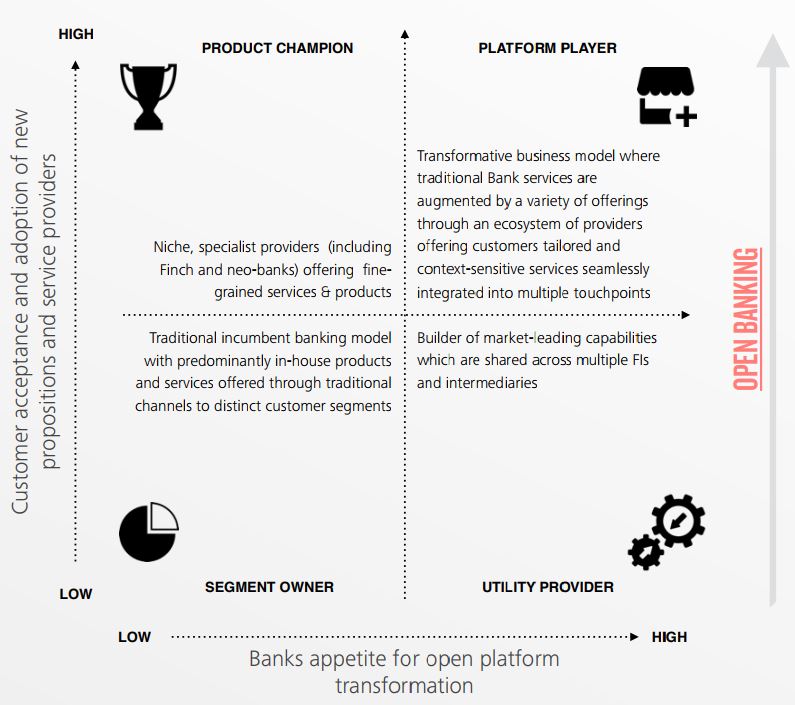

Deloitte see this leading to new market structures and players …

… and believe this creates some fundamental questions for the bank that need answers:

What will be the role of our bank in the unbundled, open banking landscape?

What will drive customers to maintain their relationship with us vs. traditional and new competitors?

What capabilities will we own to generate differentiation from traditional and new competitors?

How will we evolve our technical architecture to support our changing role?

These are core questions for the bank, but the key is not to see Open Banking as a threat, but an opportunity. As this report from Innovate Finance and Pinsent Masons points out:

The new world under PSD2 and Open Banking offers a myriad of opportunities. For banks, there are opportunities for those that embrace Open Banking to expand on the range of services they offer in the payments space. Banks start from a position of strength, with the largest share of the market and existing customer relationships. In addition, banks benefit from greater trust among consumers on issues such as data security and business viability, having had the opportunity to gain their confidence in safeguarding their money over significant periods of time. For innovators, whether fintech business, large technology company or other disruptive force, there is a chance to get a better foothold in various existing, new and previously unaccessible banking markets. Using new rights of access to bank account and transaction data and combining this with the opportunity to collaborate with the existing financial services players and other new entrants to the market (including retailers, utility providers and technology companies) could provide important insights on consumers’ and business customers’ financial lives, giving them the power to make informed financial decisions.

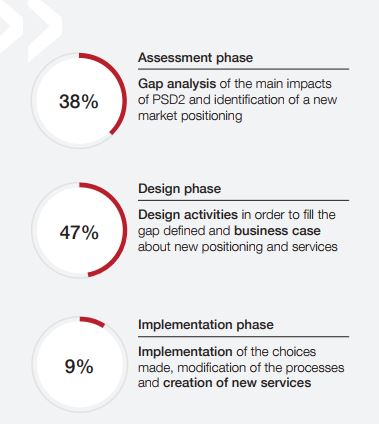

So it’s surprising, with all of these things bubbling away for the last couple of years, that banks aren’t ready for Open Banking according to PwC. In the first half of 2017 PwC surveyed senior representatives of 39 leading banks in 17 countries (Italy, Denmark, UK, France, Slovakia, Czech Republic, Finland, Luxembourg, Poland, Ireland, Switzerland, Spain, Portugal, Germany, Netherlands, Austria and Norway). The findings are startling, with only 9% of these banks in implementation phase for PSD2 Open APIs and 38% were still just thinking about it.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...