I often talk about faster horses and how banks think digital is doing banking cheaper and faster. It’s all about efficiency and effectiveness. So, I was asked the other day: where is the car? After all, it’s easy to call out banks for doing banking as usual but, if I cannot show them a car, what’s the point?

Good question, and yes, I can see some cars out there. The one that I normally come back to is the next generation of retail banking. It is being created as a new generation of banking, not an extension of banking-as-usual, in Africa and Asia. It’s called financial inclusion.

In fact, I tweeted the other day that today’s financial inclusion is tomorrow’s finance, and I truly believe this. After all, if Asia and Africa create radical new models of moving money in real-time at almost no cost, why wouldn’t we all use those innovations?

Mobile Network Operators (MNOs) in Africa have focused upon payments and then gradually extended into microloans, microsavings and microinsurance. Alibaba and Alipay started with making payments and then gradually moved into investments and loans. Payments is just the start. The United Nations are now looking at how to manage digital identities at low cost through mobile. If we all have KYC digitally at almost no cost, why wouldn’t we all use that system for onboarding?

I’ve written a lot about this – in fact, the new book Digital Human focuses upon this – but I saw two examples recently of where the faster horse meets the car stood out.

The first was in Spring at Dot Finance in Rwanda when M-PESA were on a panel with three banks and I asked them the question: so how do banks compete with M-PESA? The answer was telling when the Safaricom guy said: “They don’t … they just try to copy what we do whilst we focus upon the customer”.

Banks pride themselves on being fast followers. When they see a competitor with a good product, they copy it as fast as they can. But why not focus upon the customer rather than the product? Oh yea, that’s too difficult. I guess that’s why M-PESA has the Kenyan mobile wallet market sewn up and the banks go what happened?

There are those who make things happen; there are those who watch what’s happening; and there are those who just wonder what happened

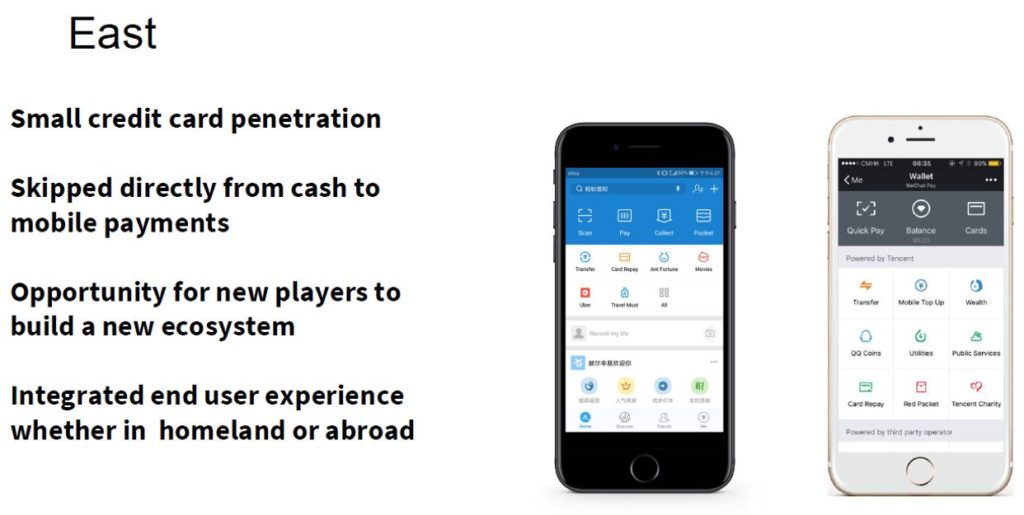

The second example is far more recent when Risto Virkalla, the CEO of ePassi, was talking at our recent NFI meeting in Oslo and put up this slide:

He said that he was astounded how banks and Western firms focused so much on cards and payments, as illustrated by Apple Pay. Apple’s wallet has taken the old, outdated way in which we used to pay and put it in an app. In fact, it’s so innovative that they even put a picture of the card in the app, so we can see we are paying by card in an app. It’s ridiculous. In fact, the display of the card shows that Apple, along with of the Western banks, focus upon replicating the old horse into the digital age as a faster horse. It’s all card and payment focused, and forgets the customer.

That is why Alipay, which is serving customers who never had cards or cheques, focuses upon the customer journey. The customer journey and the customer experience is the singular beacon that shines through their app, and making payments is a by-product of the app.

The banking world and the Western World need to turn their thinking upside-down and stop trying to replicate the last century world into this century’s. in fact, as I now often say, we all talk about GAFA and look to the West and all look the wrong way as the cars are coming from the East.

The horses are riding out to the sunset in the West.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...