Another presentation that was enlightening was delivered by Jean Claude Gaga, CEO of RSwitch Ltd, the national e-payment switch of Rwanda. Jean Claude gave an overview of how Rwanda is moving towards a cashless economy and I was particularly interested as I chair Dot Finance in Kigali each year, and so it gave me a greater insight into the country of Rwanda, as well as their move towards eradicating cash.

Before visiting Rwanda, all I knew is that it was the country that suffered one of the greatest genocides in history. Having been to Rwanda, the country recognises that history – it has an amazing genocide museum that is very emotional but also keeps the memory alive. The country doesn’t forget but recognises it must never happen again.

So, here’s some things that may surprise you about Rwanda. It is the #1 African country for women, for transparency and for safety and security, as well as being highly competitive and easy to do business with.

I felt that when I was there, it’s an incredibly friendly place, and I can thoroughly recommend a visit if, for no other reason, that you can go and visit the gorillas in the mist.

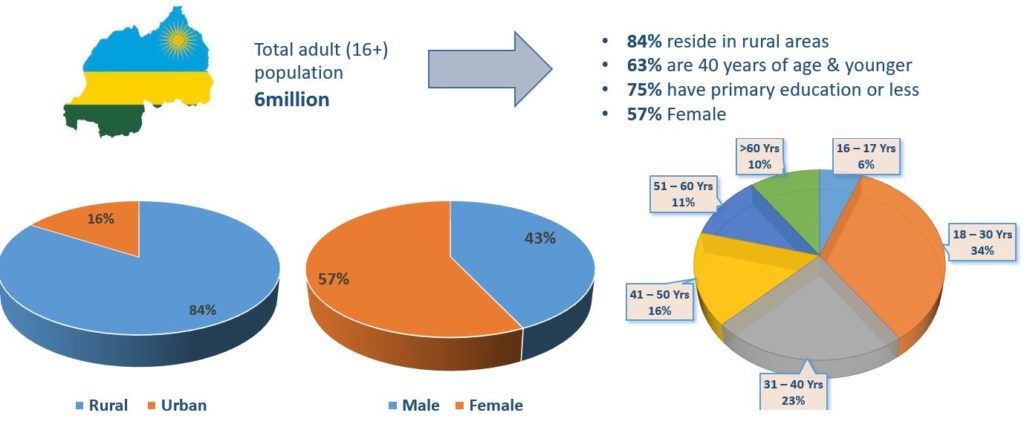

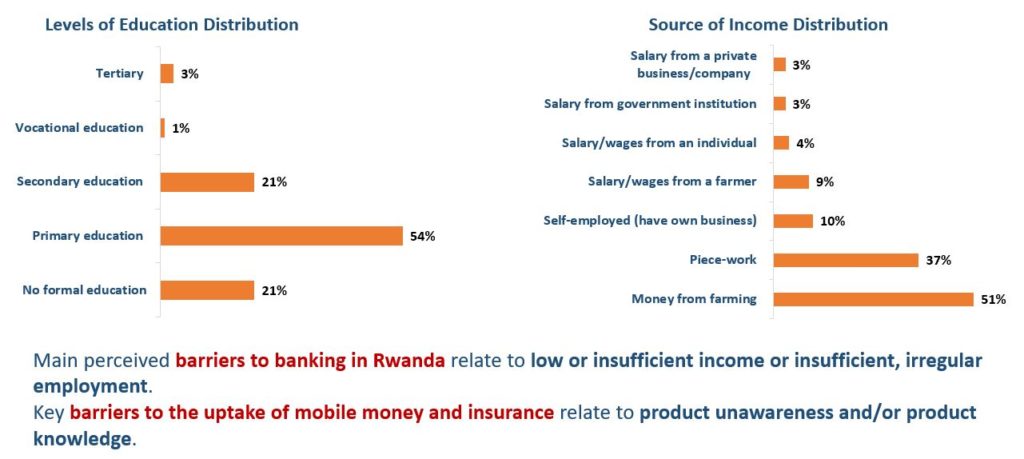

Like most African countries, it is a young population – two out of three people are under 40 – and most (84%) live in rural areas, working on farms.

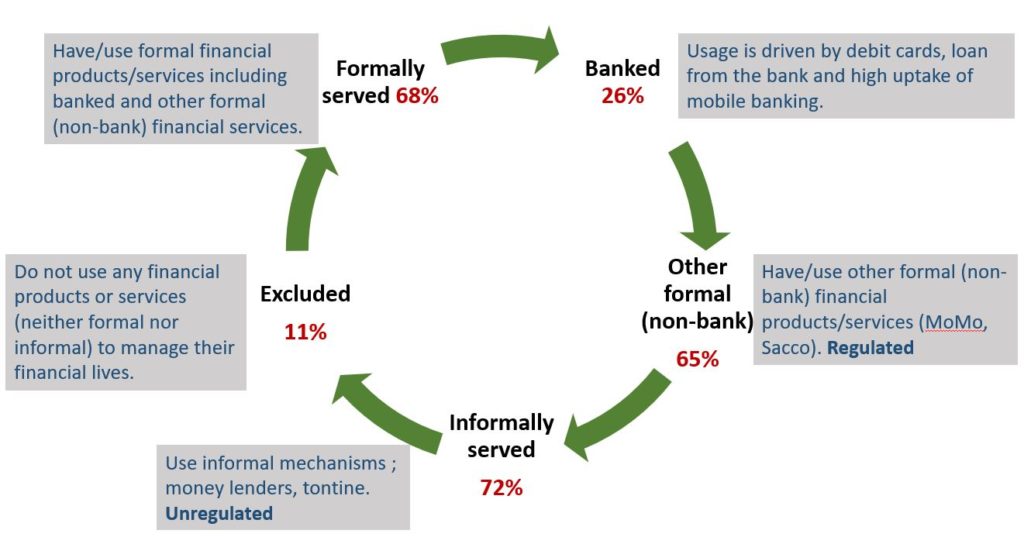

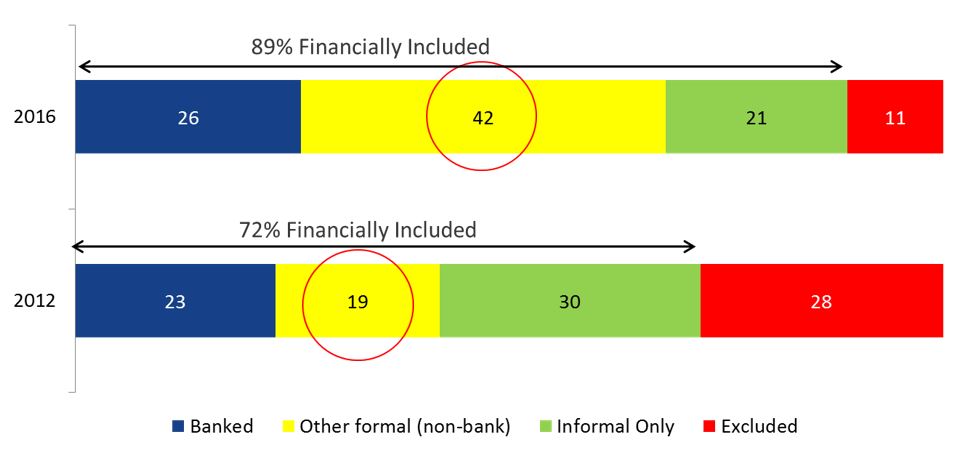

What is interesting is that when I visit other countries like Sudan (4% banked) or Pakistan (20% banked), Rwanda has moved ahead. Although only 26% of Rwandans have bank accounts, 65% are using some other formal financial services such as Mobile Money (MoMo) and savings and credit cooperatives (SACCOs). This means that 89% of Rwandans are included in access to financial services with only 11% excluded by the end of 2016, which is a big change in just four years from the 28% excluded in 2012.

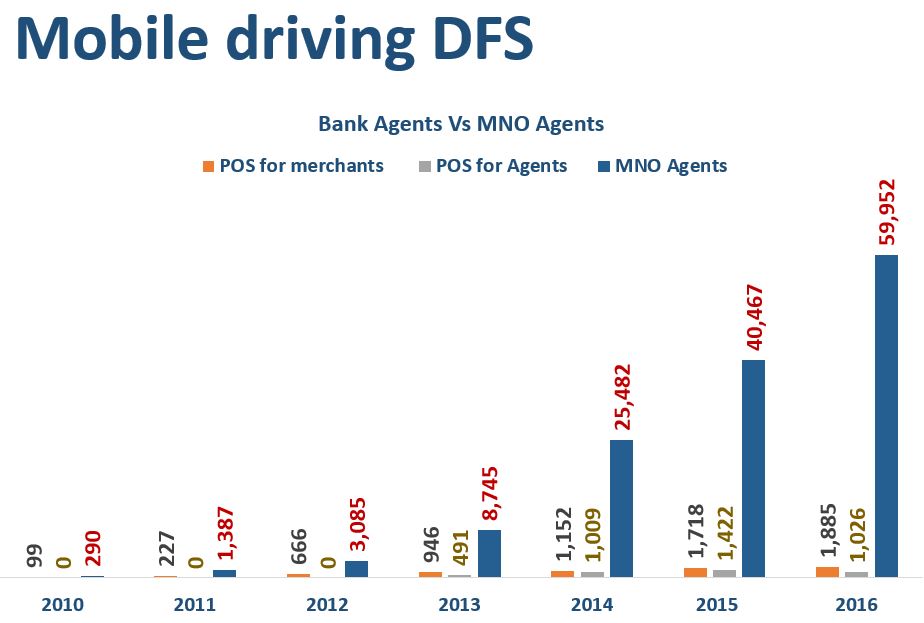

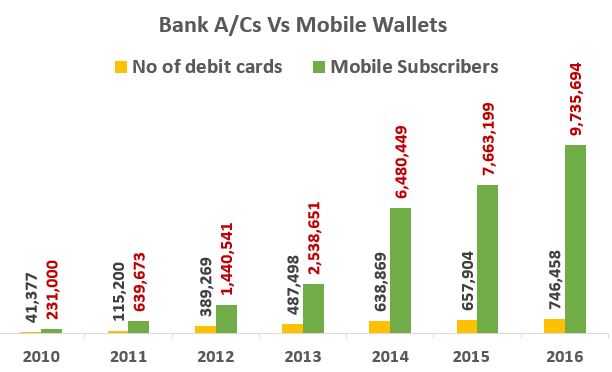

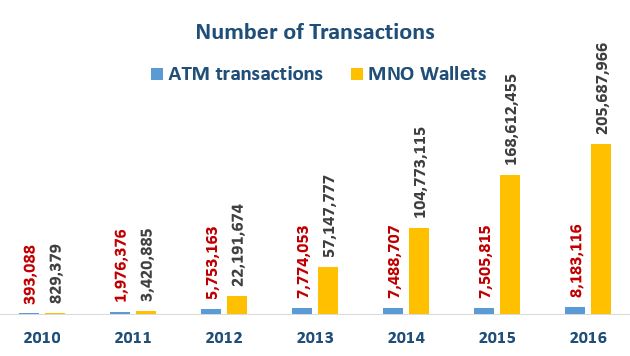

It’s all about mobile financial inclusion …

You can see the whole of Jean Claude’s presentation below, and it really is eye-opening to see the rapid move in all African countries, but particularly Rwanda, from exclusion to inclusion and from cash to cashless.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...