A final reflection on the way of the world before getting back to FinTech and banking. Whilst on holiday, we became interested in buying a property in Dubai, and began making enquiries. It soon transpired that this would be a dream, as the average price of a villa on the Palm was over $4 million, which is not the sort of loose change I’m carrying today, even with my cryptocurrency investments.

It then struck me that in many of the most desirable cities of the world, the average property price is over $1 million. In London, it’s $1.5 million in most boroughs, with the most elite areas like Kensington averaging over $7 million. The same is true in Moscow, Hong Kong, New York and most big cities. Who has $1 million to spare?

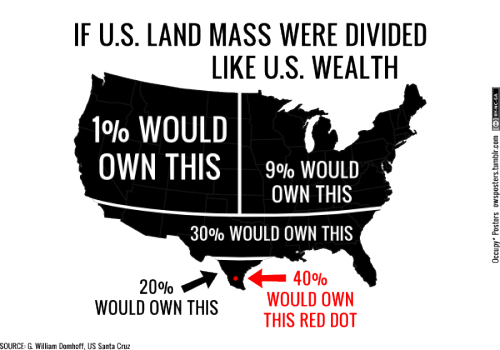

As I reflected on this, I came to a realisation that the 1% are taking over the world, and pricing the 99% out of it. The 1% are 76 million people. The 99% are the 7.6 billion left over. The 1% are those who can walk into a new off-plan development like the Royal Atlantis Dubai, and buy three off-plan apartments for $10 million as a trophy investment (which someone did last week). That’s how it goes.

This extreme is widening because many of the 1% are buying property, and have been for a long time. It means that the 99% and their children, are finding it harder and harder to find anywhere to live. This extreme has been widening for some time, and governments seem to be ignoring it.

When I was a lad, for example, I could get on the property ladder with a 3.5 times salary mortgage for my first house. At the time, I was earning a meagre graduate salary, age 25, and borrowed the deposit for the house off my parents. Today, the same house would have required a 20 times salary mortgage. The same house.

Of course it is all about the laws of supply and demand, but if the demand is coming from just 1% of the world, what does the other 99% do?

In my own mind, having been ingrained in films like Metropolis, it will lead to a civil backlash. It is unsustainable for 1000’s of properties to be owned as investments and left languishing, empty and vacant. It is especially unsustainable as the ranks of the homeless and struggling to keep a home increase.

Here are the stark figures.

Rich foreigners are buying most property. According to The Economist, “these rises can be attributed to the influence of foreign money. Since autumn, 2014 $1.3 trillion of capital has flowed out of China. Some of that cash has found its way into residential property in some of the world’s most desirable cities. In America, Chinese investors bought some 29,000 homes in the 12 months to March 2016 with a total value of $27 billion, according to the National Association of Realtors. Much of this money is focused on a handful of cities: Seattle, San Francisco, New York and Miami. Foreign money has helped propel skyrocketing prices in other places, too. In Vancouver, home values have risen by 47% in four years; in London they have risen by 54%; and in Auckland the rise has been a whopping 75%.”

On the other hand, hardworking Americans, Brits and New Zealanders are increasingly homeless.

In December 2017, the U.S. Department of Housing and Urban Development released its annual Point in Time count, a report that showed nearly 554,000 homeless people across the country, up 1% from 2016. Of that total, 193,000 people had no access to nightly shelter and instead were staying in vehicles, tents, the streets and other places considered uninhabitable. The unsheltered figure is up by more than 9% compared to two years ago.

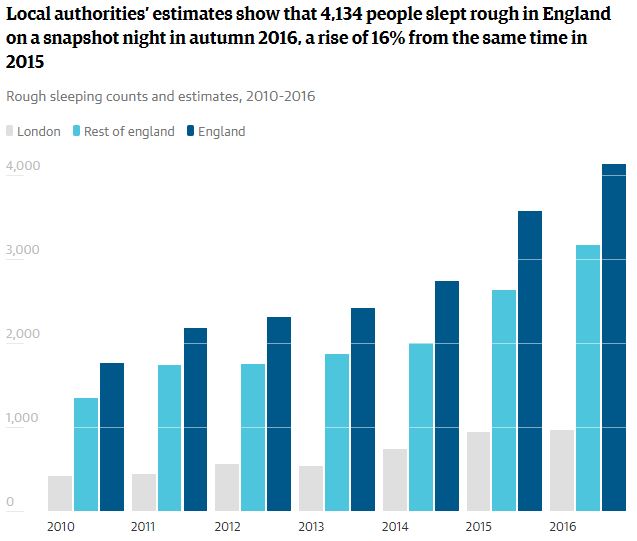

In the UK, a report released by the Department for Communities and Local Government, reveals there were 57,750 homeless families in financial year 2015-16 – a rise from 54,430 (6%) from 2014-15, and up 54% from 2010. It is the sixth consecutive annual rise, with households becoming homeless in London increasing to 17,530 (9%) in the last year alone and 58,000 households across the whole of England.

Meanwhile, New Zealand has the worst levels of homelessness in the world. At the last census, there were roughly 41,705 Kiwis who were "severely housing deprived" - about 1% of the population. Using data from the Organisation for Economic Co-operation and Development (OECD), a Yale study has compared the statistics to those from other developed nations, which put New Zealand on top of the list on a per-capita basis.

Bear in mind that homelessness represents extreme poverty. What is the level of poverty in these countries?

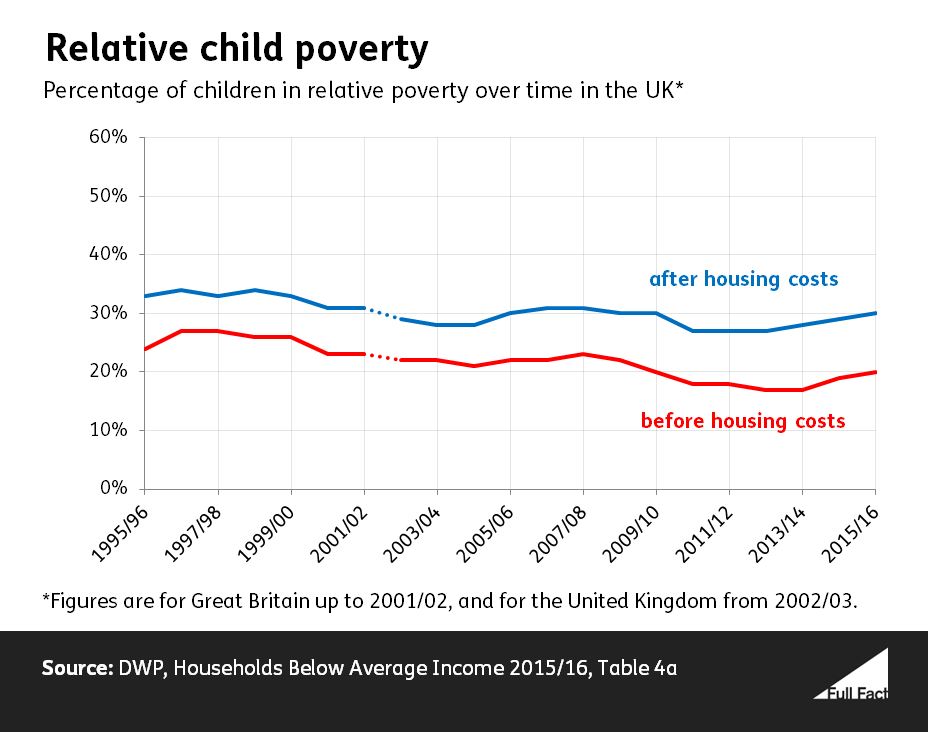

There are around 682,500 people in poverty in New Zealand, or one in seven households including around 220,000 children. In the UK, 3 out of 10 children live in poverty.

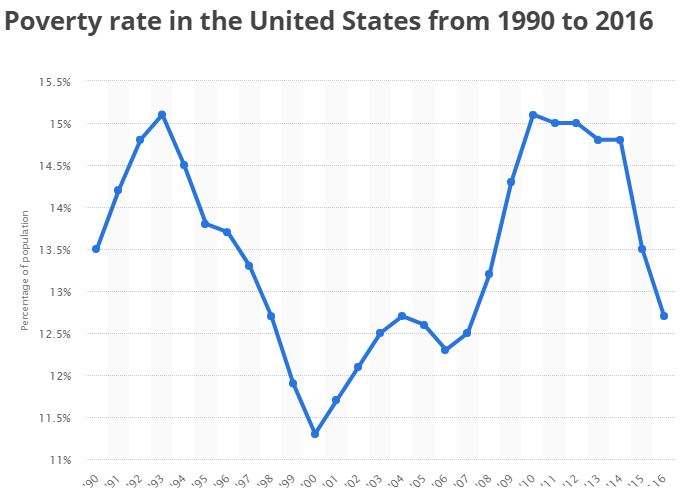

In the USA, around 1 in 7 households live in poverty, or 15% of the population.

What am I getting at here?

Well, Theresa May’s forlorn election campaign last year was meant to focus on families “just about managing”. According to research, about 30% of people in the UK live below the minimum income standard and are just about managing. Virtually half, or 49%, of all Americans are still living paycheck-to-paycheck.

So my point is this: when half the people in a developed country are just about managing and can barely afford their homes they rent off the 1%, whilst the 1% buy up all the land in the world, increasing the pricing of property so it is unaffordable for all … do we really think that this is a model of the world that is sustainable long-term?

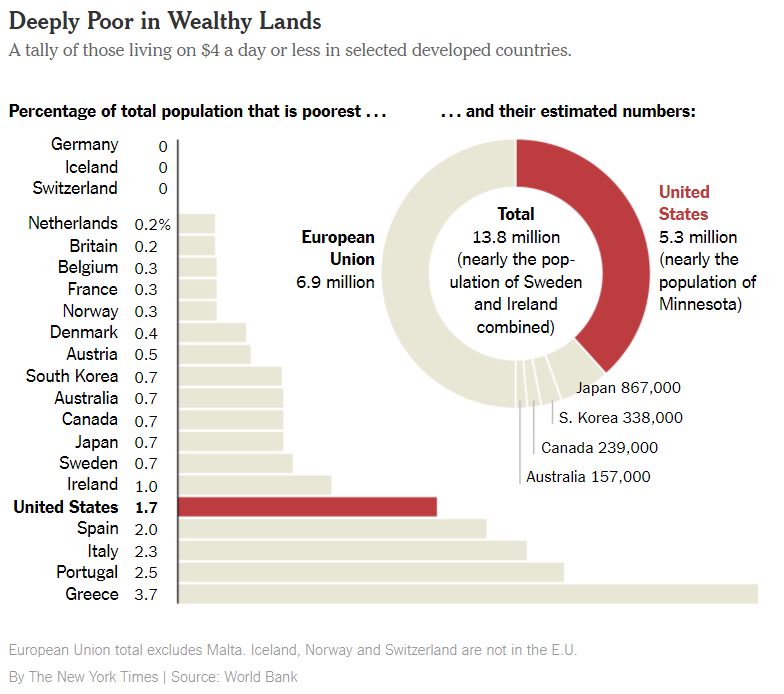

From the New York Times:

According to the World Bank, 769 million people lived on less than $1.90 a day in 2013; they are the world’s very poorest. Of these, 3.2 million live in the United States, and 3.3 million in other high-income countries (most in Italy, Japan and Spain). There are 5.3 million Americans who are absolutely poor by global standards.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...