Banks need to make money on new products and services, from things that don’t exist yet, in the same way that children will need to find jobs that don’t exist yet. You may not have seen it, but it is estimated that two-thirds of the jobs of the future are yet to be created, and so there is a challenge educating children for a career which no one can predict. In the same way, banks have historically made money from lending and payments and advice, but most of that will disappear in the next few decades. So what will banks be doing?

Well, they will make money from products and services yet to be created. The most likely products will involve information analytics, predictive analytics and location analytics. Note: it’s all about analytics. Equally, the products will no longer be big ticket items of major payments or large loans, but it will all be micro. If I want to read this article, maybe I charge you $0.001c. No problem. Maybe I need to cover the weekend and rather than getting a payday loan, I get a bank loan. In this case, for three days at 0.1% interest and no loan opening or closing fees.

This is all very different, but I have seen it in operation already in Ant Financial. Ant Financial helps Taobao merchants with their working capital. An example is a Taobao shop owner who sells beef jerky. Each time they make a sale, they can immediately turn that sale into cash through a short-term MYbank microloan (MYbank is Ant Financial’s Chinese bank). This particular store owner has had 3,795 such loans in the last five years, an average of two loans a day, with the amounts varying from 3 yuan (50 cents) to 56,000 yuan ($8,000).

That is the model of product for the future.

Meanwhile, what about service? Service is no longer going to feature advice in branches or dealing with me over a counter, but more working out my activities and personalising automated advice around my lifestyle. A great example here is Monzo, who analyse your spending and work out how to improve it. The illustration given is that they may notice that you’re buying a train ticket every day for £12.50. The bank’s algorithms will recognise that am annual season ticket would be £2,000 (saving at least £800 a year). Why haven’t you purchased an annual ticket? Because you don’t have £2,000 available. Within the bank’s app, it will point this out to you and then ask if you’d like to get the annual season ticket and pay just £170 a month, giving you an extra £80 a month to spend elsewhere? Of course, you’re going to say yes. What is actually happening is that you’re taking a £2,000 loan at 3 percent interest, but you don’t see it that way. You see it as the bank that knows you, loves you and gives you great service.

It is the combination of microproducts and personalised advice that will be the future model, not pushing big ticket loans or payments down the channel to cross-sell the consumer with high margin items.

Meanwhile, talking of the model of the future financial firm, I liked this report Deloitte, developed with the World Economic Forum.

The report says that the future banking service will be fully virtual, customer-driven, seamless, customised and externalised through open platforms. Payments will be cashless, connected, data-driven, cheaper and invisible. Capital markets will be low cost with easy access, more efficient and flexible and easily controlled by users. Wealth management will be easy too, with low cost, transparent, personalised and easily managed services. Finally, insurance will be much more accurate at a personalised level, with transparent pricing and usage. Well worth a read.

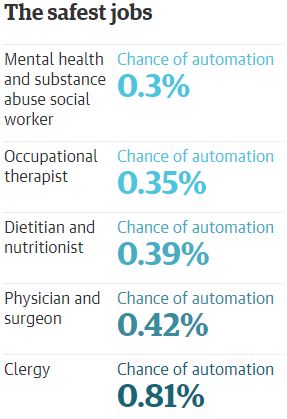

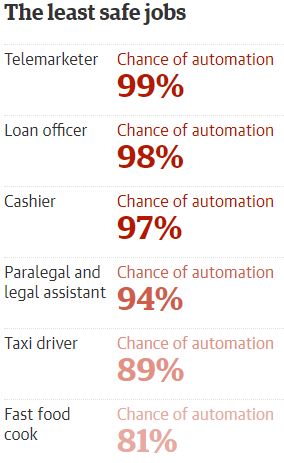

Equally, if you’re interested in the future jobs for your kids, it would do you no harm to read The Future of Employment report. The report is from Oxford University academics, and analysed over 700 jobs of today to see how easy it would be to automate them. I suggest you avoid letting your kids do anything that is repetitive or predictable.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...