I’ve talked a lot about how young visionaries are re-shaping the financial industry. John Collison was 19 when he founded Stripe with his brother Patrick, and Ollie Purdue was 21 when he dropped out of university to found neobank Loot. In fact, there are many innovators under 30 out there, as highlighted last week by Forbes (article pasted at end of this blog).

What amazes me is the difference today to when I was a lad, so to speak. When I started my career, we were encouraged to join large, reputable companies to have a job for life. There is no such thing, of course, but back in the 1980s, that’s what people believed back then. You start as a graduate and retire forty years later on a full, fat pension. That’s how it used to be. Not anymore.

I guess it was because, back then, the old ruled the world. Respect the elderly and only speak when spoken to if you’re younger. That was the culture. I was slapped down for speaking out about the inefficiencies of my company when I was in my 20s, even though these inefficiencies were obvious to me and could be easily fixed.

The company didn’t want to know because my manager, in his 50s, saw it as disrespect and exposing him to failure to have these inefficiencies exposed. Is it still the case today? I hope not.

The fact that I see so many young people carpe diem – seizing the day – is brilliant. And it’s not just that they’re young, but diverse too. There are many female entrepreneurs and founders from different ethnic backgrounds here. This is also a testament to change and enlargement. Sure, the world is a very different place to the one I entered in the 1980s. It is far more global and far more transparent; it encourages change and challenge, rather than suppresses it; and it recognises that young visionaries are probably far more capable of harnessing the power of technology than the last generation.

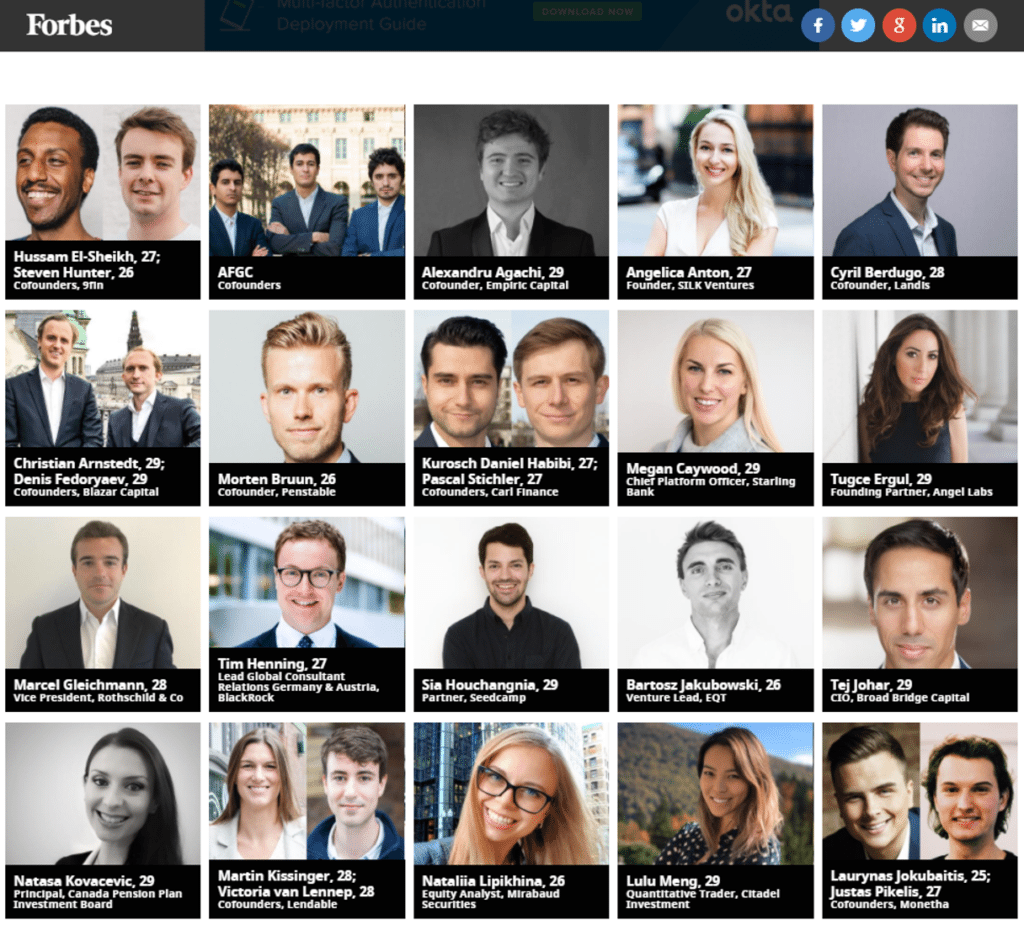

30 Under 30 Europe: The Financiers Shaping Global Markets In 2018

The financial industry is not typically known for being on the forefront of innovation. But the Finance Forbes 30 Under 30s are disrupting the stodgy industry through fintechs and AI-based technologies. In turn, they are forcing the sluggish, traditional corporates to evolve along with them or be left behind.

Victoria van Lennep and Martin Kissinger, both 28, founded Lendable in 2014. The idea behind their platform: offer personal loans at fair rates. Using machine-learning, their company is able to automate credit decisions. This allows them to offer small loans to people at better rates than credit cards or banks. Lendable has processed more than $250 million in lending capital to date.

At only 27-years-old, Angelica Anton heads SILK Ventures, a $500 million fund investing in growth-stage technology companies that want to enter the Chinese market. The Oxford-grad is particularly interest in companies on the forefront of science and technology, primarily investing in Internet of Things and robotics companies.

Kurosch Habibi and Pascal Stichler of Carl Finance, both German and 27, created a transaction marketplace for small and medium-sized enterprises (SME). It allows owners of private companies to streamline the process of raising capital and selling their company. In less than 18 months since founding Carl Finance, the deal volume has exceeded $700 million.

Turkish-born Tugce Ergul, 29, runs Angel Labs, the first investor accelerator based in Paris. At the intersection of VC, international development and education, the company’s goal is to empower sustainable, inclusive and diverse tech innovation through mentorship, education and funding. As a Managing Partner of Angel Labs, Ergul has invested $100 million in more than 40 countries.

Charlie Meraud, 24, Zahreddine Touag, 25, and Karim Sabba, 26, founded Association Francaise pour la Gestion des Cybermonnaies (French Association for the Management of Cryptocurrencies) to increase exposure for the new asset class. Now they are working with regulatory offices across the continent to gather the major institutions around the topic. The non-profit is part of a working group at the European Parliament.

Lithuanians Laurynas Jakubaitis, 25, and Justas Pikelis, 27, are cofounders of Monetha. Their platform is a decentralized trust and reputation system for global commerce combined with a mobile payment solution built on the Ethereum blockchain. While buyers gain certainty when purchasing, sellers profit from a transparent reputation to boost their commerce. Their ICO raised $37 million in less than 20 minutes.

A space-physicist by training, Chinese-born Lulu Meng, 29, now focuses on quantitative trading based on a combination of fundamental research with rigorous mathematical models and daily risk management of fixed income assets. Her employer, Citadel Investment, has more than $25 billion under management.

Mathias Nestler, 28, co-founded Friday, Germany’s first digital full-service car insurer. The fintech operates a platform that provides advanced insurance solutions such as the first monthly-cancellable car insurance and a pay-per-kilometer model, offering a new level of flexibility and fairness to German motorists.

All candidates on Forbes' 30 Under 30 Finance list for Europe were carefully selected by a first-class panel of judges including Dr. Jens Ehrhardt, Chairman of Munich-based DJE Kapital AG, Luciana Lixandru, Partner at Accel in London, and 30 Under 30 alumnus Ramin Niroumand, CEO of fintech company builder Finleap.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...