I was talking the other day to a colleague about the phenomenon in Asia, India, Africa and South America taking place with mobile payments and the lack of take-up in the USA. Why is this, I wondered? Then got my answer, although it isn’t a singular factor but a combination of factors.

First, there are many payment methods already deployed and available for most American consumers including cash, cheque, credit or debit card, PayPal and more. Second, it is not just the choice of payment methods but also the breadth and depth of acceptance. For most US stores, their preferred payment method is cash or card, and that’s pretty much the same in Europe; whilst China’s stores all take QR codes. Third, there has to be a reason for consumers to change their payments behaviour and the US has not created any yet; China’s red letter days made the difference when Tencent and Alibaba went head-to-head, and Singles Days and other events since have created the behavioural change. Finally, there has to be scale and support for change, and the USA doesn’t have it as there are too many financial providers with too many different interests. If the USA had Facebook and Amazon offering simple payments in apps, it might have taken off far faster than it has; but the fact that Tencent (800 million users) and Alibaba (540 million) pushed mobile payments hard into the Chinese consumers hands made the transformation easy.

This is why it surprises me that after all the hoo-hah razzamatazz announcements of Apple Pay that it turned out to be such a damp fizz. In fact, I claim it’s one of Apple’s failures. I don’t use it. I have no incentive to use it. I don’t like it. I don’t find it functional. In fact, I hate it.

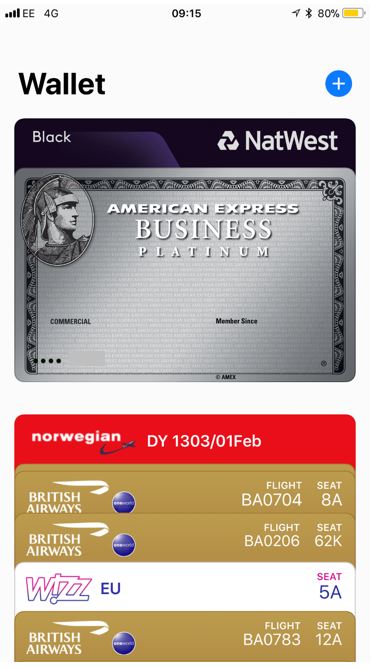

I realised how much I dislike it when the new iPhone keeps brining up Siri and Apple Pay rather than opening my apps when I press the home button. Then, when I want Apple Pay to come up, I have no idea how to get it. Then I realised it’s in my wallet, and then I realised the wallet is now just a digital representation of my card.

And it’s not just me saying it but firms like Goldman Sachs and more, including Apple CEO Tim Cook.

This showing the card in the app thing, reminded me of the comment that I make about how most bankers think digital is rolling out a mobile app; in a similar vein, it seems that most US tech titans seem to think that rolling out a digital version of the physical financial thing will make it happen. Google rolls out something that looks like a shopping basket and call it Checkout. It bombed. Apple roll out a payment system and call it a wallet with a card inside. It bombed.

It surprises me that these giants can fail so badly, but then I did write the other day that you shouldn’t look to America for innovation. We should look South to Asia, Africa and South America. This is because these countries are not hampered by legacy payment infrastructure and their internet innovators are thinking far more out-of-the-box because they didn’t have a large scale mass consumer payment system in place, other than cash. Most Chinese citizens didn’t have bank accounts or credit or debit cards and so they could leap across straight to mobile payments.

Anyways, if you want the actual stats, here they are.

Generally, mature market countries with highly developed infrastructure find mobile payments a much harder sell than in countries that have more recently developed infrastructure.

Ipsos, a global market research and a consulting firm, produced this fascinating report into China’s mobile payments analysis last August (so note that this is six months old):

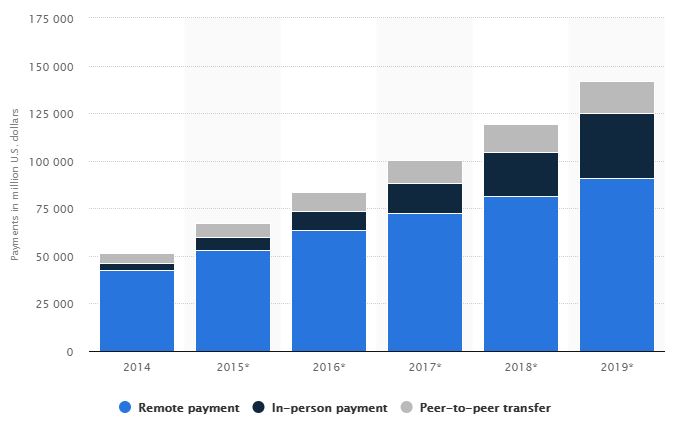

Meanwhile, the American statistics are not impressive. The total payment volume is under $150 billion, according to Statista.

The lion’s share of these payments ($75 billion) are via Zelle, the US bank supported mobile payments app. A further $35 billion went through Venmo, the PayPal owned social payments wallet.

No big deal when you’re processing 100 times less than the Chinese mobile wallet providers. By way of example, the stats I’ve seen for 2017 were that the Chinese wallets processed over $15 trillion in 2017, a figure I am comfortable to use although some report it is nearer $50 trillion. Xinhua News reported that consumers spent almost $3.5 trillion (23 trillion yuan) in mobile transactions during Q2 2017 alone (a 22.5% increase on Q1), which is why I’m going with the lower figure.

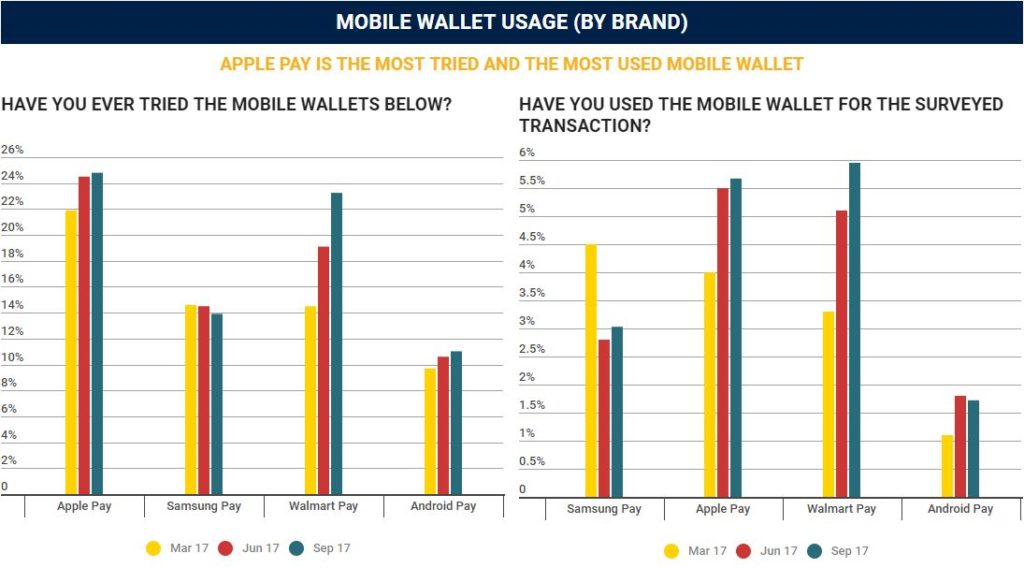

Oh and just to report back on Apple, Android and Samsung Pay, there are some interesting comparisons and stats on PYMNTS.com.

Starting with Apple Pay, around 5 to 6 percent of iPhone users used it for their last transaction. When asked why they didn’t use it, most say that they forget it’s there, prefer using cash, weren’t sure if the store accepted it or have more incentive to use other payment methods.

Android Pay is used by less than 2 percent of Android phone users in the USA. What is interesting here is that far more users are aware that Android Pay is there, but they just don’t like it and prefer other payment methods.

Samsung Pay fares better, with around 14 percent of users selecting this payment method. That is probably because Samsung Pay uses different technology so it’s not merely limited to NFC contactless terminals, but can be used with most Point-of-Sale systems. Mind you, of those how don’t pay with Samsung Pay, the majority don’t because they are more comfortable with other payments methods or are worried about security.

Meantime, the most used wallet in the USA is Walmart’s.

Ah, so that’s the innovator I missed … or shouldn’t that be Starbucks?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...