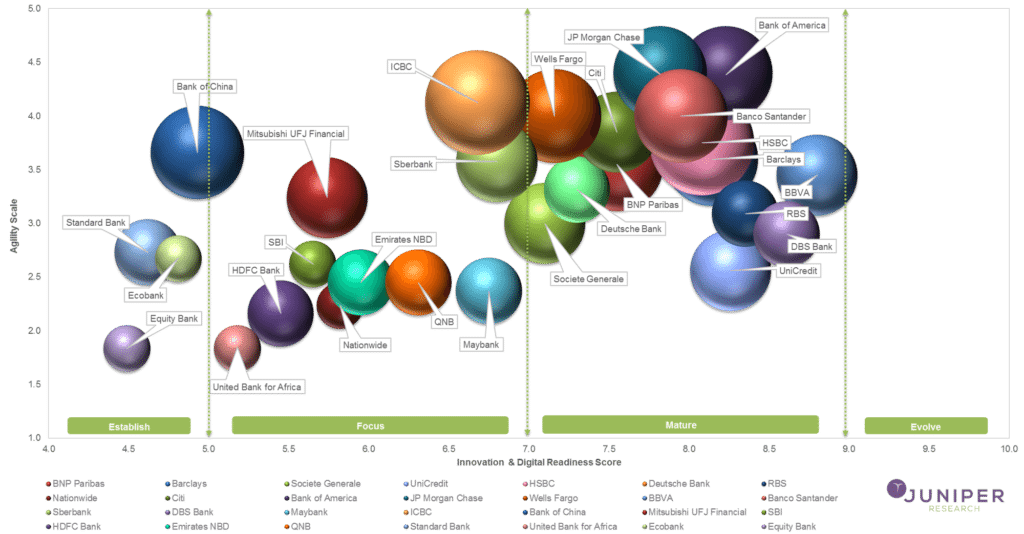

I shared this list of banks that are supposedly the most digital of the large players on twitter the other day:

- Banco Santander

- Bank of America

- Barclays

- BBVA

- BNP Paribas

- Citi

- DBS Bank

- Deutsche Bank

- HSBC

- JP Morgan Chase

- RBS

- Société Générale

- UniCredit

- Wells Fargo

People came at me, stating that it was a biased and short-sighted list, but they failed to notice that I had put a question mark over the list and a link to the company that had compiled it, Juniper Research.

The most digitally mature of the large banks, according to Juniper, are BBVA and DBS. I can agree with this. However, as many pointed out, it’s a strange list. The banks closely following BBVA and DBS, according to Juniper, include HSBC, RBS, Santander, Unicredit and Bank of America, none of whom I would have anywhere near the level of transformation that BBVA and DBS have achieved. Equally, where are other players like USAA and Capital One, who are the top of my tree for digital readiness alongside BBVA and DBS. I wonder why they also assessed Barclays, HSBC and RBS and missed out Lloyds, arguably one of the leading UK big bank digital players. There are also many smaller players who would be in the top quadrant too, such as mBank (Poland) and Denizbank (Turkey).

So I downloaded their report and see that their assessment is made on the following criteria to derive weighted scores for innovation and digital readiness, and the banks’ overall agility score:

- Profitability;

- Customers & Branding Strength;

- Ecosystem Enablement;

- Digital Enablement & Offerings;

- Digital Investment; and

- Innovation & Personalisation.

They then put the banks into different categories based upon their agility and readiness for the digital age. The categories are:

a) Evolve Phase

We did not assess any of the banks included in the Index above to have completed a successful digital transformation roadmap, and/or be working towards setting up future technological innovation path.

b) Mature Phase

A number of banks were found to be in the mature stages of digital transformation, reaching the final stages of the objectives defined in the roadmap. These players have already invested in digital enablement and have successfully completed parts of their current digital transformation roadmap. These banks continue to offer a wide ranging digital portfolio, as well as investing in rapid development of technology and customer enablement. People investment is critical for the completion of a successful banking transformation, and these banks lead others in customer and people training and enablement.

c) Focus Phase

As the name suggests, the banks positioned in this Phase have begun their digital transformation process and offer a selected number of digital products and/or offerings to its customers. These banks are expected to focus on the next level of digital transformation in terms of organisational changes, automation of services, integration of other stakeholders and the development of innovative business models.

d) Establish Phase

Juniper also profiled a few banks in this Phase; these are mainly banks with a digital transformation roadmap in place. They have started product enablement, offering digital solutions including mobile banking services and often have a significant user base.

Anyways you can read it all yourself, but lots of people came back and asked me what my list would be. Assuming it’s just looking at the big, established banks, as the list would be too long if I included all the new digital banks and smaller players, my list would definitely include the ones I’ve named:

- BBVA

- DBS

- USAA

- Capital One

I’d wouldn’t consider adding any others right now, as my criteria is based upon whether the C-suite is truly transforming the bank to digital or just investing in digital. As I keep saying, a bank has to have a digital culture, not just invest in it. That means having a leadership team who truly believe in transformational digital change, and I haven’t met many of them yet. Although Bank of America, Barclays, Citi and Lloyds can make claims in this space, I think they are a year or two behind the ones I’ve mentioned. Equally, many big banks talk digital but aren’t actually doing digital in the way in which I’m discussing it here. Hence, I’m going to be cagey and not cast a vote to anyone else … unless they can show me the leadership commitment.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...