I was quite taken by a headline in yesterday’s news where Marcus Schenck, Deutsche Bank’s Co-Head of Corporate and Investment Banking, forecast that deposit accounts might disappear in the not too distant future. He was on a panel at Bloomberg’s European Capital Markets Forum and was asked by an audience member how he was responding to technology change. His reply is interesting:

“Technology is impacting the different businesses we are operating in in different ways. There is a completely new normal evolving … there's a thesis that at some stage in 5, 10, 15, 20 years – who knows – accounts will disappear, and be replaced. That would be a game changer to what we're doing.”

I was reflecting upon this and I agree. The traditional bank account is unsustainable long-term. That may sound like madness today, but here’s a theory I’ve been working on for a while, ever since a friend of mine told me they don’t have a bank account anymore.

I asked him how that could be, and he told me about his PayPal life. He opened his PayPal account years ago, with a bank account validation. The thing is that some time after that, he closed his bank account and transferred the balance to PayPal. He took out a PayPal credit card (0% interest for 4 months on all purchases of £150 or more), and has all of his payments paid direct to his PayPal account. He lives on the revolving balance and pays no fees, except those incurred on FX which are quite steep (it’s free to use PayPal to buy something unless it involves a currency conversion).

It made me realise that he had constructed a new way of working with an app and a card. It’s a little like Monzo, raising millions and gaining 500,000 users with just a prepaid card, although now they’re going for the full bank. But why do you need a deposit account? As a guaranteed bank store of value for your fiat currency. What Marcus was getting at is that the deposit account could be replaced with a decentralised store of digital currency interacting with an app via APIs. Interesting.

I actually believe that banking is being reinvented from the ground up for the digital age. I’ve talked about it often enough in terms of the imagination I’m seeing in financial services in Asia and Africa, and they don’t think about deposit accounts. They think about micro payments, micro savings and micro loans. By micro, I mean anything being invested or borrowed for any amount for any period of time. I might borrow $10 for 48 hours, save $1 for one day, or invest $100 for a month. It doesn’t matter the amount or period of the money movement; it just matters that the money can move.

Over time, this means that you combine digital currencies (fiat or crypto) with open finance and the imagination of people who never had a deposit account, and you get a new form of banking.

This gets interesting in that I was quoted, after a recent presentation, as saying the problem with banking is legacy leadership. The specific quote was:

“My problem with most banks is that when I walk into the boardroom I am greeted by a group of old men. It doesn’t have diversity, it doesn’t have youth, it doesn’t have many females, it doesn’t have a lot of vitality.”

As a result, I believe that bank boards don’t get digital transformation, as I’ve blogged often, and proven with research ranging from Harvard to Gartner Group to Accenture.

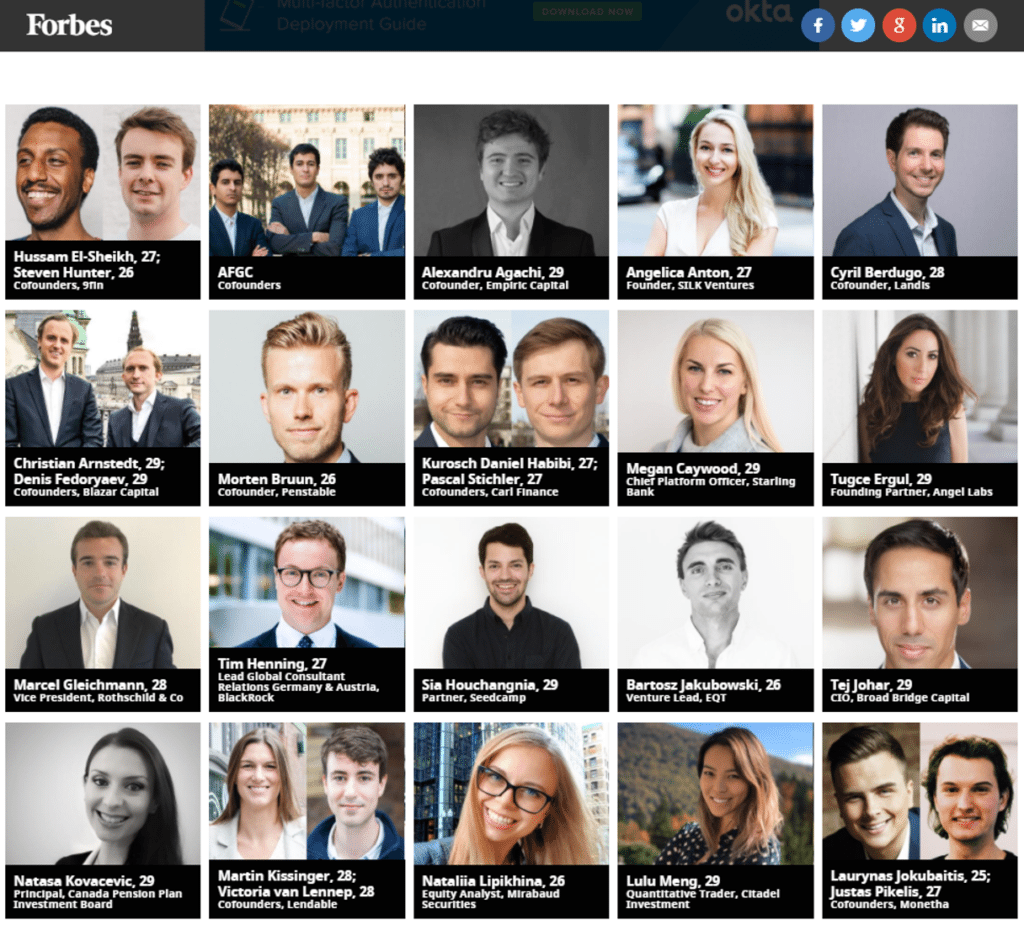

Most people agree with my thinking here, but one called me out saying that “the ‘old men’ referred to in the article is a proxy for experience and appropriate risk appetite”. I agree. I just don’t agree if the whole leadership team comprise those people. Maybe half, but the other half should be a diverse range of visionaries who understand finance, have youth on their side and get technology. After all, look at this range of people and ask whether you have anyone on your bank’s leadership team like them and, more importantly, how many?

30 Under 30 Europe: The Financiers Shaping Global Markets In 2018

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...