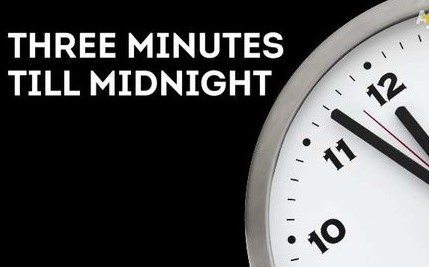

Last year I wrote about the ten year ticking timebomb, and I thought I’d come back to it as my mind has moved on a bit. That’s why I now talk about three minutes to midnight. Midnight is when it’s too late for the bank to change their systems into an enterprise data architecture. It’s too late when other players will have grasped the opportunity the banks cannot take.

Let’s start at the beginning. Today, the big platform players are giving away services that banks make money from today, namely payments and lending. Amazon, Alibaba and more are keen to give free loans and payments to their buyers and sellers, because it drives more traffic to their platform. As a result, they’re not interested in making money from banking products and services. They will just give them away for free, if it increases commerce on their platform.

That’s today.

In five years, most of these players will be leveraging Open APIs to drive more service through their platform. They will be taking all of our social and commercial digital moments and aligning them with finance. The vision I’ve had of a predictive, proactive, proximity-based provider will have come true. These providers will know my daily routines and movements, and will watch what I’m doing and where and, based on my digital lifestyle, will be giving me smarter spending and saving throughout the day. Automatically. For free.

Therefore, in five years, banks will make no money from what they do today and will need to be competitive in this new, proactive, augmented world. What that means is that a single view of the customer will be mandatory.

A bank will not survive with product-focused systems and structures, which is what most banks systems and structures are today. The old back office systems are focused upon payment transactions, deposits and loans. They are often separated and fragment the single view of the customer.

The view of many banks is that clever middleware can overcome this problem, but I claim the clock is at three minutes to midnight. At midnight, the bank will no longer be effective if they have not changed those product-focused silo systems and structures.

I’ve been saying this for a while (2011), but I truly believe that those minutes are the years that a bank has left to move to an Enterprise Data Architecture (EDA) with a Single View of the Customer. The bank must do this by 2021 or it’s too late. After all, most banks will take five years to implement the EDA, so that’s 2026.

2026.

We don’t know exactly what the world will look like in eight years, but I do know that the irrepressible march of change from industrial era to digital world is unstoppable. The platform players will have continued to dominate through building in adjacencies, like free loans and payments, and looking for data intimacy with our digital lifestyles through artificial intelligence and machine learning. Those big guys are already doing this, and they’re a long way down that road. Think of AI and who are the leaders? Google, Alibaba, Facebook. Who are leading in other technologies like distributed ledger? Same. In fact, I was surprised to hear last week at Money2020 that Ant Financial and Tencent are leading the world in production-based blockchain systems that are live, and that Ant Financial has more blockchain-based patents than any other company in the world.

The platform players are leading the march of technology into automated customer intimacy, intelligent marketing and frictionless money. How is a bank going to compete with that if it still has product-focused silo systems?

Answer: it won’t.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...