I just hosted a conference in Africa and you cannot attend a conference in Africa without financial inclusion, mobile wallets and microfinance coming up. It’s always on the agenda and top of mind, because most Africans have been excluded from financial services to date. In particular, focusing upon Sub-Saharan Africa (SSA)*, which includes Kenya, Nigeria, Uganda, Tanzania, Ghana and many other major countries with millions of people, there is a sea change taking place. Of the 590 million adults in SSA, 350 million do not have access to an account at a bank or with another type of financial institution. With only 34% of adults formally banked, there is huge potential for the development of financial services in Africa to meet the needs of the unbanked.

So, we are talking millions of people in rural and urban areas, who have nothing but a telephone. The telephone is more common than toilets or toothbrushes, according to some. The telephone can then link via USSD (Unstructured Supplementary Service Data) and use the Global System for Mobile (GSM) communications technology to send text. That is the phenomenon in SSA. Several speakers at the conference talked about USSD being the transformational technology. It’s what you and I would remember as our old Nokia phone back in the day. It’s not smart, it’s not pretty, but it works, has a long battery life and can text. That is the key.

Once you can text, you can make and take payments, and that’s why the mobile wallet phenomena across SSA is quite amazing. I was thinking about it and was trying to work out what it would mean to someone working in a village in Botswana, Kenya or Namibia. Now I am not qualified to imagine how a life of a villager in those countries plays out, but I was thinking of it as the idea that an Airtel or MTN or Vodafone/Safaricom comes along one day and says: “you can now have money on this phone”.

It’s pretty much where all of these things started. I had a GSM mobile phone and now, with a USSD text message, I can transact mobile money. All well and good.

But what was being described at the conference is the next network effect, after mobile money. Now, the microfinance lenders and MNOs say “you can have mobile loans”. These are short-term or long-terms loans of anything from $5 to $10,000, although most are small. They are to tide people over for when the rains don’t come or when the rains come early, wiping out the crops. They are for the investment in equipment or inventory or purely to allow the trader to trade smarter.

The network effect is that between the mobile money with a mobile credit history and the mobile microloan building a trust history, the people who were historically excluded can now grow businesses. It’s like pouring water on dry soil, the soil can bloom. People who had no opportunity, now have real opportunity and, from the stories I was hearing around the room, they are seizing those opportunities. More importantly, each time they seize an opportunity, they get an even bigger one next time. I start with a loan of $5 and show that my business is now trading $10 a week, so I’m now good for $10. Now my business is trading $20 a week, so I’m good for $20. You get the idea.

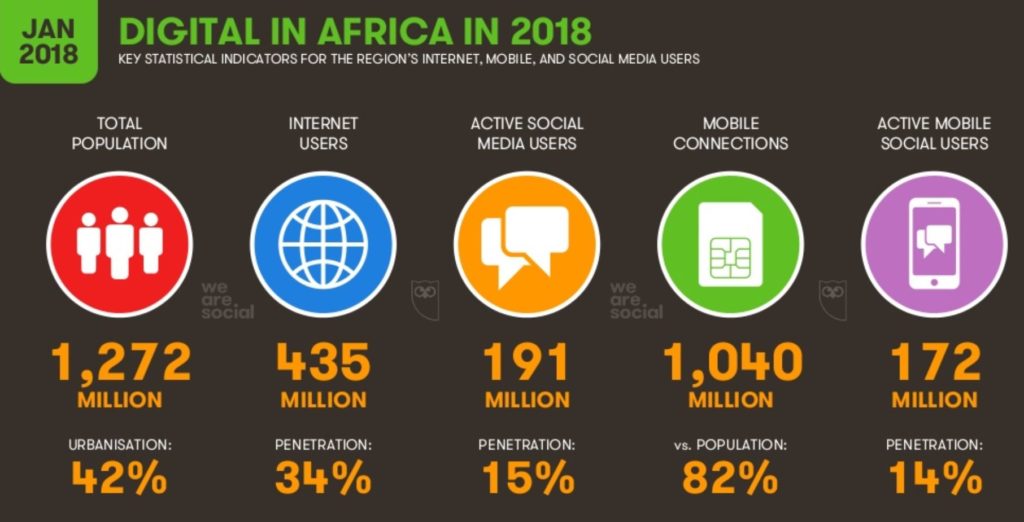

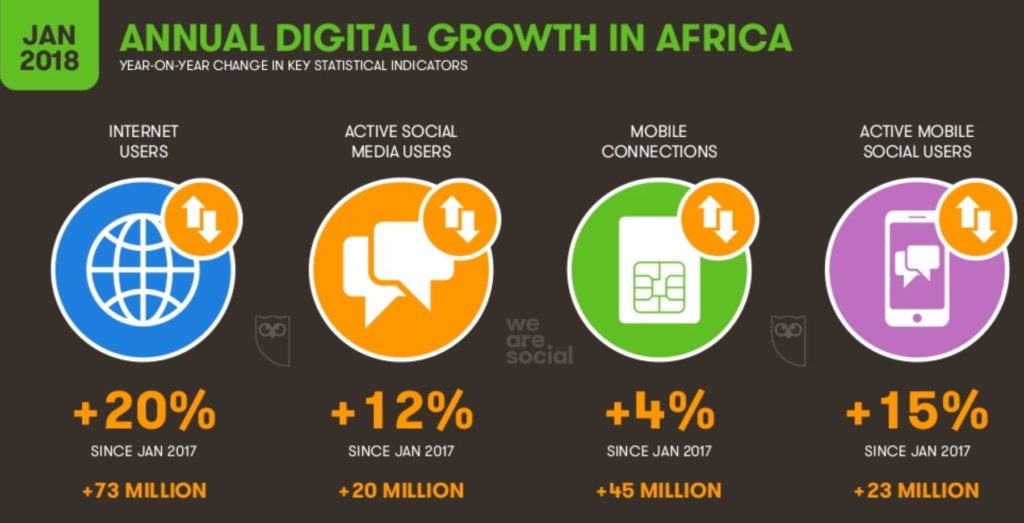

This will lead to an explosion of opportunity. McKinsey forecast that financial inclusion will lead to $3.7 trillion of new productivity in 2025, and that’s $3.7 trillion a year and growing, not just $3.5 trillion between now and 2025. McKinsey’s report goes on to say that “research finds that widespread adoption and use of digital finance could increase the GDPs of all emerging economies by 6 percent, or a total of $3.7 trillion, by 2025. This is the equivalent of adding to the world an economy the size of Germany, or one that’s larger than all the economies of Africa. This additional GDP could create up to 95 million new jobs across all sectors of the economy.” This is not even taking into account the additional developments moving at pace. For example, the explosion I’ve described thus far is based upon GSM and USSD, but now Africans are getting smart and social.

Smartphone penetration is increasing, mostly driven by services like WhatsApp and Facebook. These networks will continue to shift people to smartphones and inevitably the costs of data and smartphones will continue to diminish. What will happen in the next decade when this happens? How many new digital banks will start in Africa? When will the Euro digibanks come here? When will Facebook and WhatsApp launch their own financial solutions?

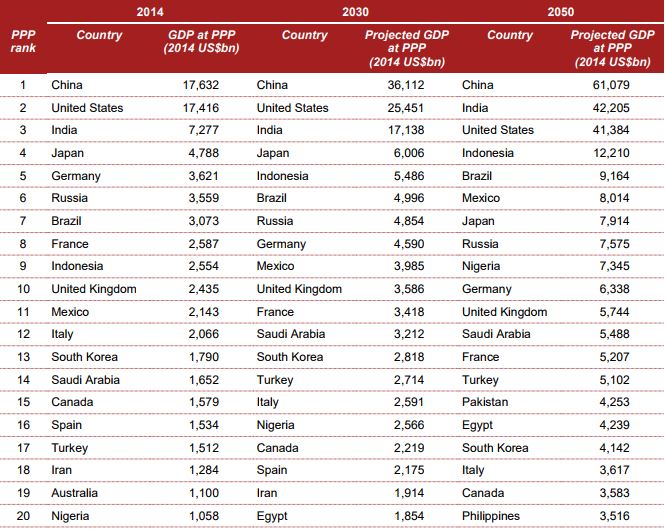

I’m just in awe of the fact that the world has an image of Africa from the last century of people malnourished, needing aid and charity. In just a few decades, that has turned around to this century where African people have huge hope and opportunity. By the end of this century, it would not surprise me if the greatest nations on Earth include Egypt and Nigeria and other African nations.

The G20 in 2050

Time to change some thinking.

* I use the term Sub-Saharan Africa (SSA) here to just bring together all those countries from East, West and South Africa that are being transformed by financial inclusion. I don’t like the term, as it has political implications, so please don’t think I’m talking politically about this thanks. I’m purely using SSA as all the stats and information I can get hold of, refers to the region that way.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...