It’s interesting looking at banks’ strategic updates and how integral digital is to everything in the banks now. Now I don’t have time to read all of these updates and reviews, but two did catch my eye recently: Lloyds Banking Group in the UK and JPMorgan Chase in the USA.

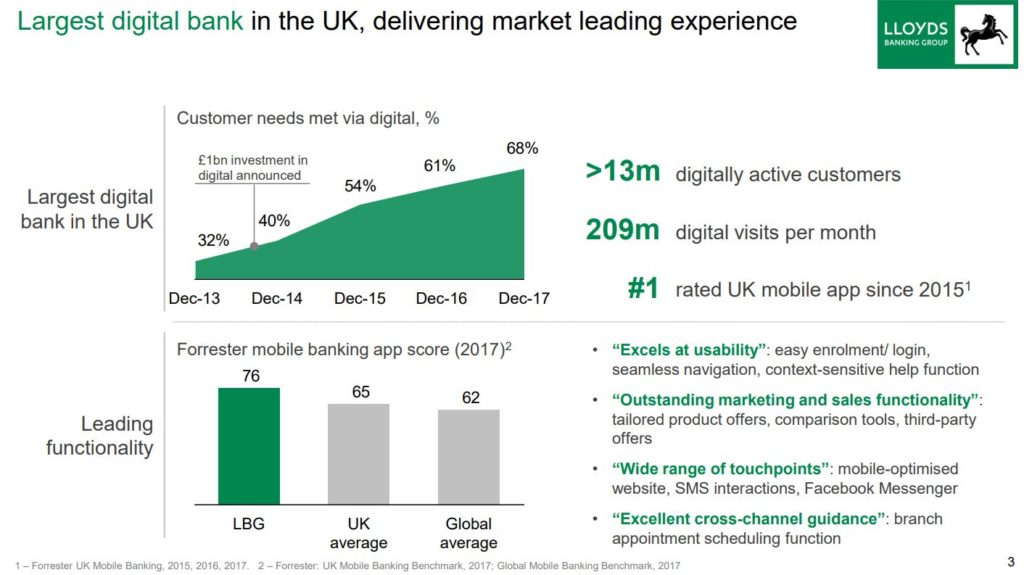

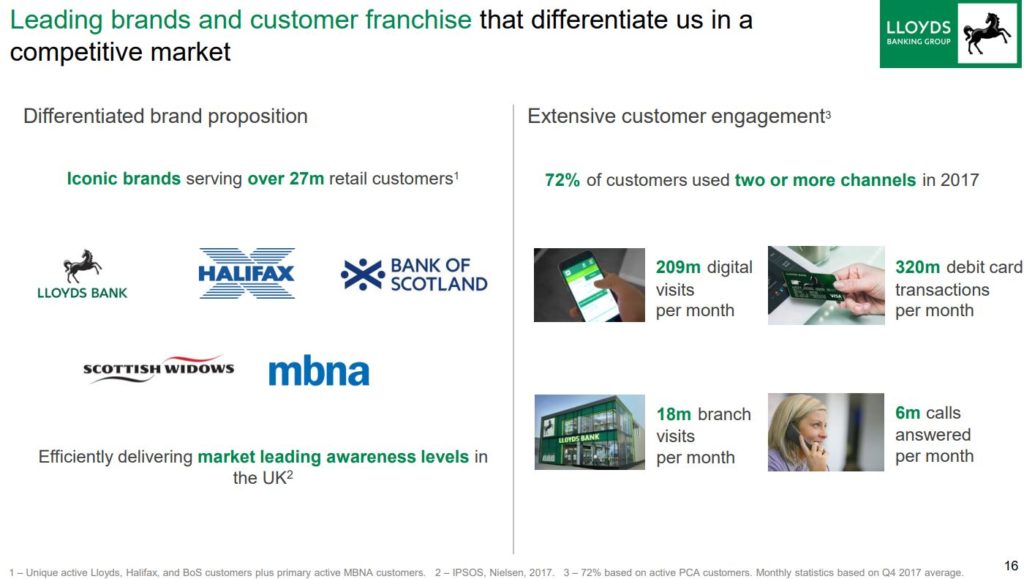

Lloyds’ CEO’s presentation was titled: “Transforming the Group for success in a digital world”, and explains how the bank is the UK’s largest digital bank, with 13 million active users of their app.

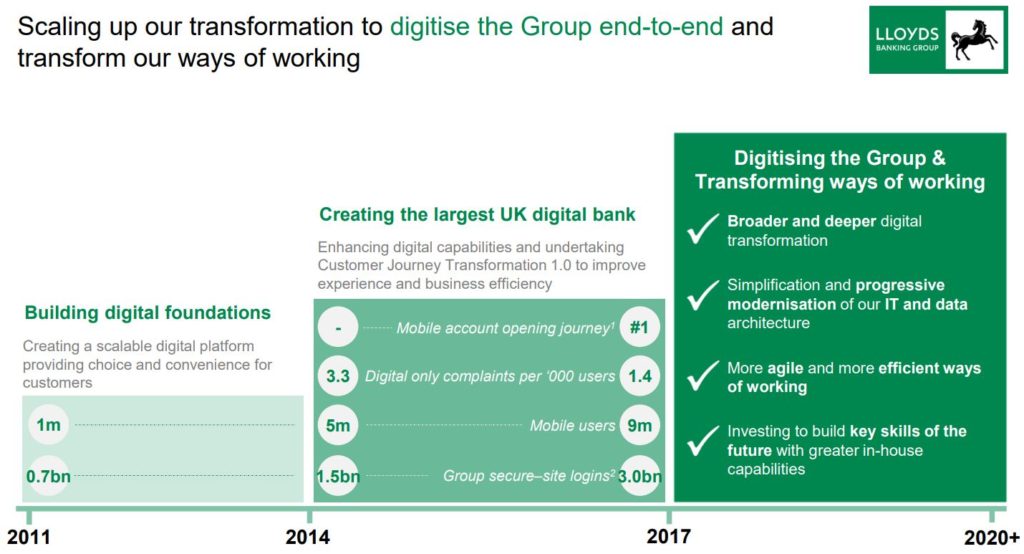

They also announced a ramp up in digital investment, from £1 billion announced in 2014 to a further £3 billion over the next three years.

Investing in a digital transformation, closing branches and reducing the workforce has been a priority for the bank, although some of this is about cost reduction, e.g. when it announced the £1 billion investment in digitalisation in 2014, it also announced 9,000 job cuts. Today, the bank is using technology to target a cost-to-income ratio in the low 40s by the end of 2020, which would make it one of the most efficient European banks.

I have to say that for all the strategic outline, I still have questions when the focus seems to refer to digital as an app and channels, cost reduction, etc are the focus. In fact, I saw the talk the talk of digital in the update, but I couldn’t see the walk the walk.

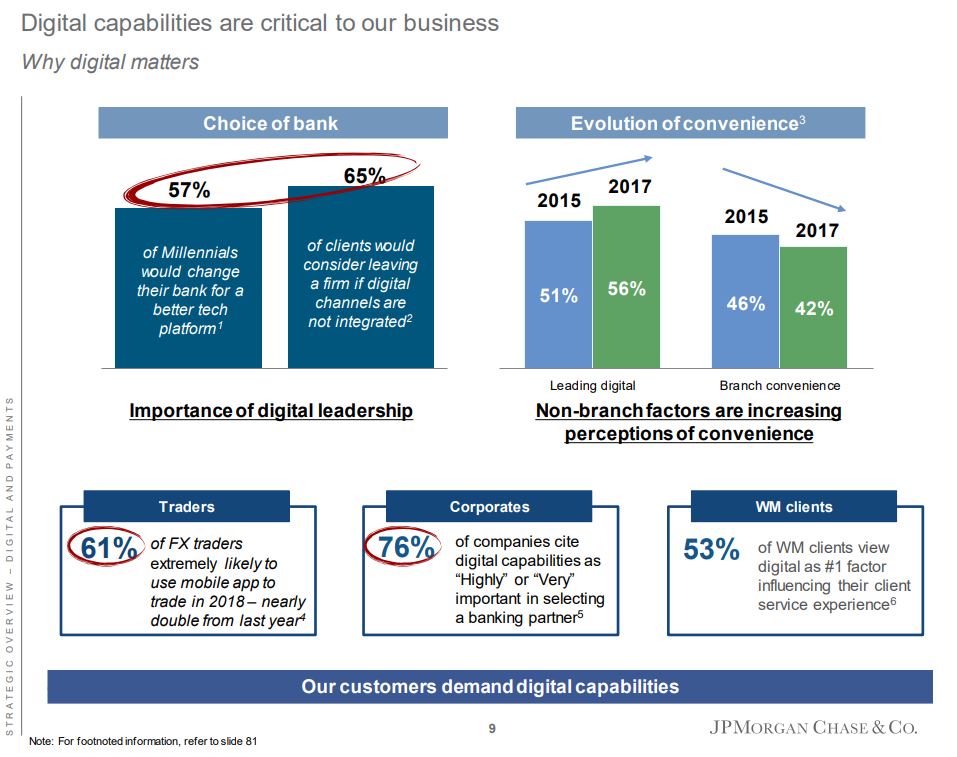

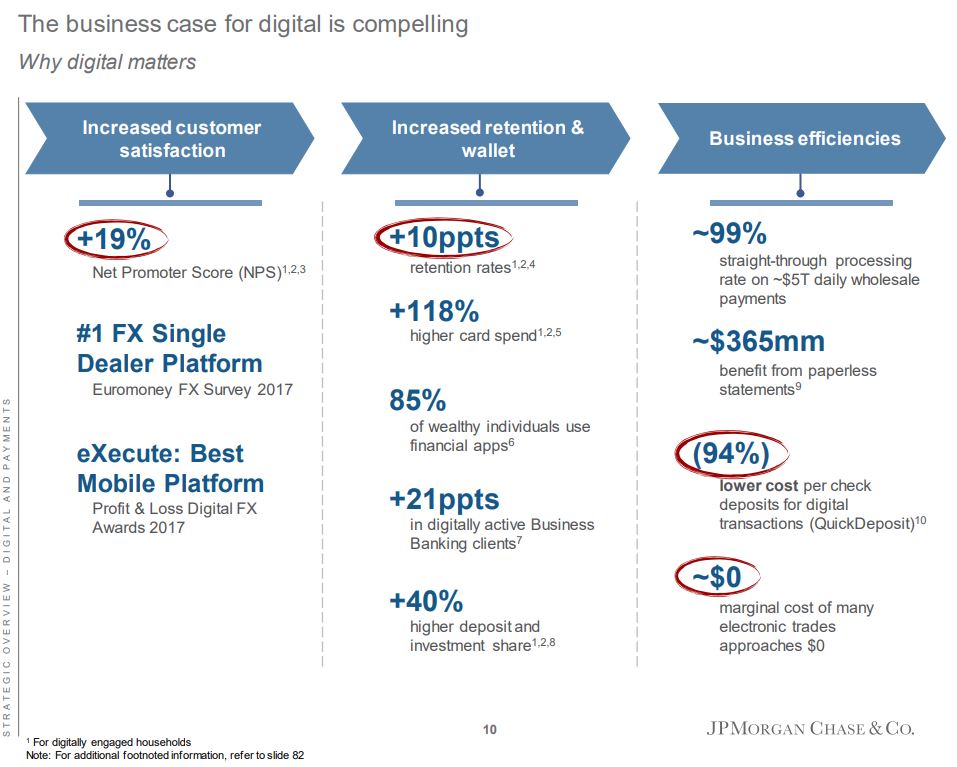

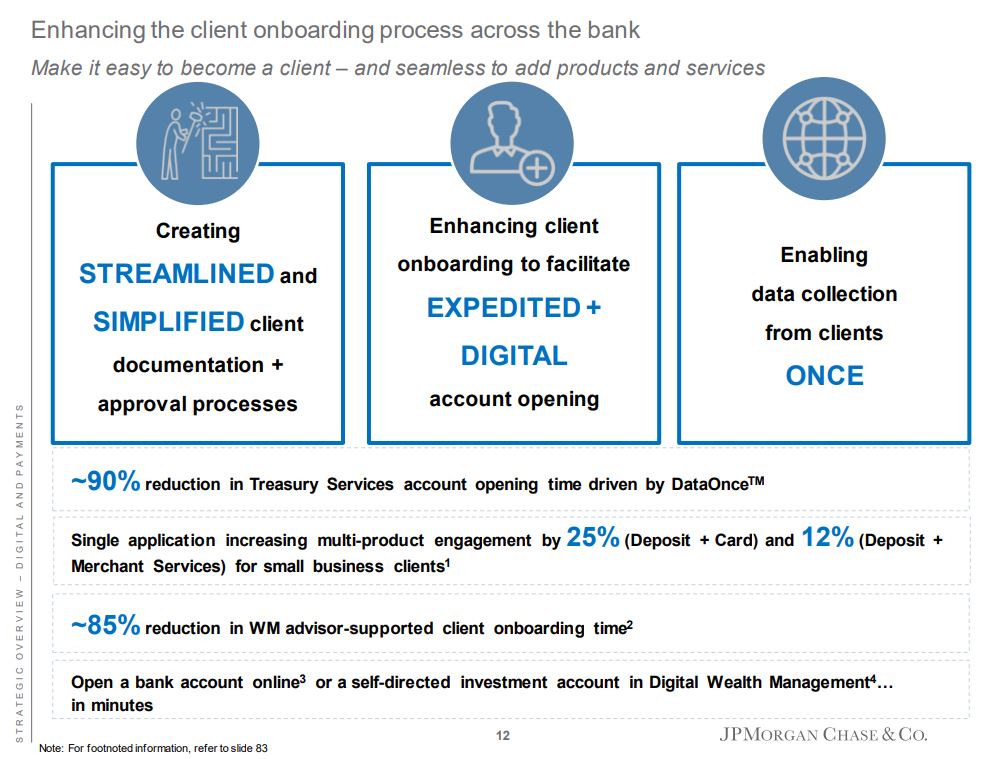

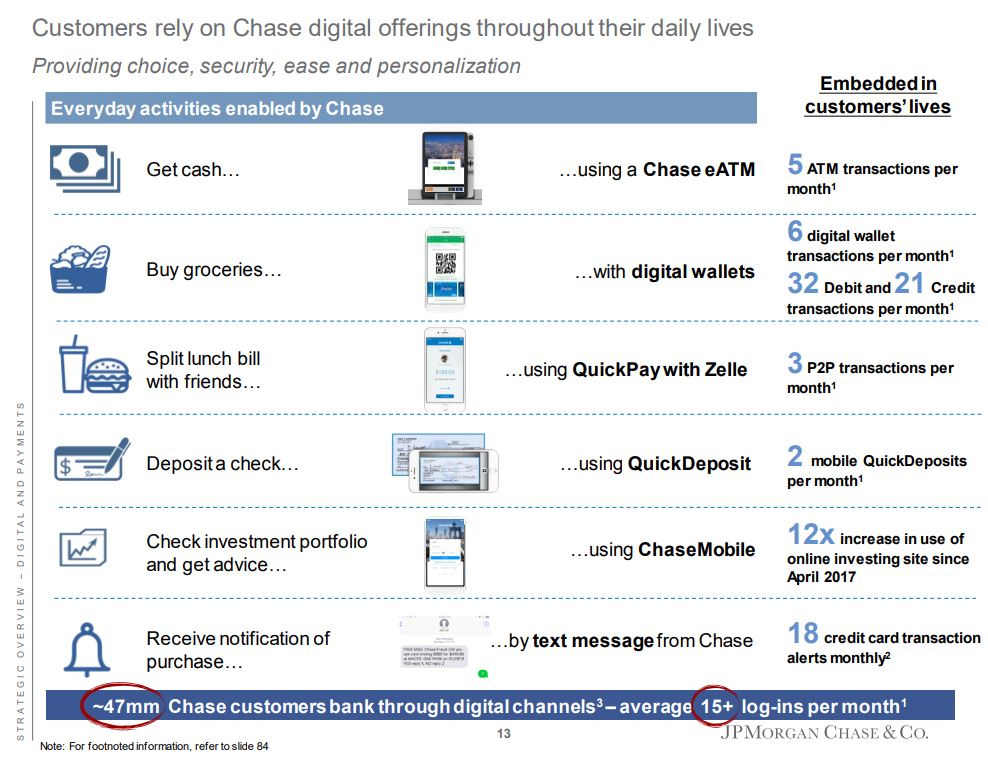

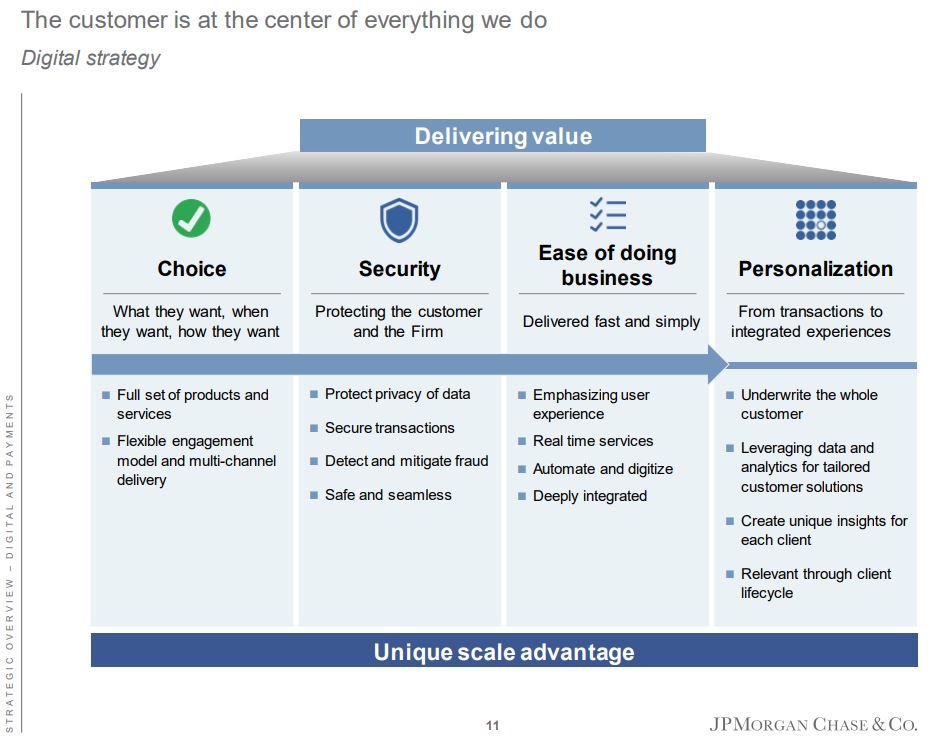

So then I look at JPMorgan Chase’s update and there seems to be more focus and more data checkpoints. It does not talk so much about cost reduction as customer. It has a wealth of good stats.

This data analysis tells me a better understanding of digital than Lloyds. For example, for all the insights offered in their update, it seems to be about self-serve and cost-income ratio.

And I didn’t see a slide like this in Lloyds up-front.

Now both banks may have the same objectives, but the language of digital is important, as I’ve stressed often. Talking about digital as an app, and focused on product rather than customer, channels rather than access and functions rather than culture, are keys to whether digital is really understood or not.

My gut is telling me that Lloyds’ focus is cost-efficiency. It is also telling me that JPMorgan Chase understands digital better. It is all in the nuances of language and numbers. You can tell me otherwise of course. I’m always open to being told I’m wrong.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...