I am struck every day by the disparity in financial structures I see worldwide. Recently, I’ve visited Tunisia, Egypt, Sudan and Ethiopia for example, and am bemused how none of these countries has a strong mobile wallet operator. Instead, the nations seem to be 100% cash-focused, as my credit cards got hammered by their country’s ATMs every time I wanted to purchase anything. Meanwhile, move South in Africa to Kenya, Tanzania, Uganda and Ghana and the story is very different.

Similarly, as readers know, I talk a lot about China’s internet giants. The reason is that the country has scale. When you can generate over 500 million users in one country, it gives you great access to scale and capital, which can then be used to drive into other nations, as we see from the Chinese growth model. If you live in a country of 5 to 10 million citizens, it is much harder to see that scale coming.

That is why it was disappointing to see India doing little in the mobile money space until recently. Now, we have one of India’s bright young unicorns like PayTM, rise from near nowhere a decade ago, to being India’s second most valuable start-up. I was also quite taken with February’s figures that show PayTM’s transaction value grow four-fold in the last year to $20 billion moved by the mobile wallet in February 2018. $20 billion makes for around $300 billion plus being managed by the mobile wallet this year, and that is pretty substantial for a company that was just on the radar three years ago.

Then I look at America, the place that should be leading this, and the numbers are small by comparison:

Zelle — an in-app, person-to-person payments system backed by Bank of America, Wells Fargo and dozens of other major U.S. banks — is less than a year out from launch, but it has already rivalled industry leader PayPal in payment volume. Fewer than half of Zelle's 60-plus partner banks had launched the service as of late last month, but the payment system still moved $75 billion in 2017, more than double the $35 billion PayPal's Venmo moved in the same period.

In total, I’d say the US transacted no more than $150 billion through mobile payment services in 2017, compared to $15.5 trillion sent through Chinese mobile services. According to Analysys, as of Q4 2017, Alipay's mobile payment market share 54.3%, while WeChat Pay is 38.2%. That means that Alipay is processing almost $8 trillion a year and WeChat Pay $6 trillion. These are stunning stats, and I’ve blogged too often about the Chinese, but it does blow me away.

Meantime, an American friend shared some statistics from his US bank, and told me that last year 38% of all card transactions were mag stripe payments, even though all cards are EMV; 41% are Chip & PIN payments; 13% are Card Not Present; 8% are manual; and less than 1% were made using a mobile digital wallet, like Zelle or Venmo.

Hmmm.

But I’m not going to criticize the American model. It works and is based upon firmly entrenched consumer behaviours. I am used to a check book, so I pay by check. I am used to plastic, so I pay by card. What is this Apple Pay? What is this Venmo?

The thing is, as demonstrated by Zelle, when consumers get something they can trust in their hands from a bank, it starts being used faster. That is one key point: trust. Can I trust this payments app?

In China, consumers trust their payments apps because they are backed by Tencent and Alibaba, names that are well trusted in China today.

In India, I attribute much of PayTM’s success to simplicity, the partnership with Ant Financial and India’s demonetization which forced people to use an alternative.

In Africa, I attribute some of the Southern African nations move to mobile wallets in many ways to lack of trust of government. That is certainly true of M-PESA in Kenya and EcoCash in Zimbabwe.

Will America follow the mobile wallet revolution? Will Europe?

The answer has to be yes, as it is compelling. The question is when and how, and that answer is less compelling. Few of the American and EU bank wallets give me a great incentive to switch from card, and the same is true of start-ups. Is there any start-up that has scaled with a mobile wallet in EU or the USA? Not one that I can name yet. But it will come.

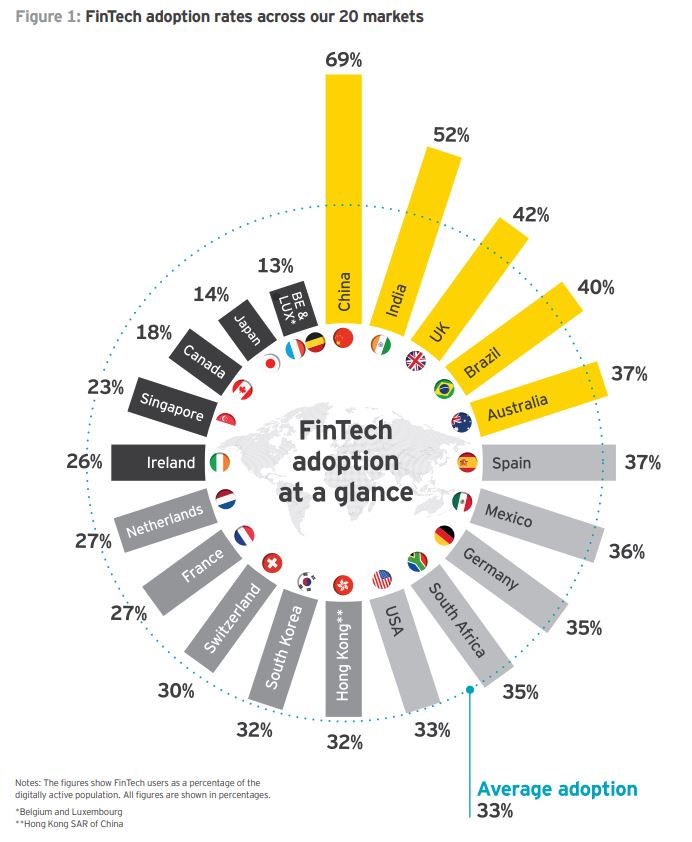

In the meantime, this chart from EY shows China to be the most FinTech oriented nation on Earth ...

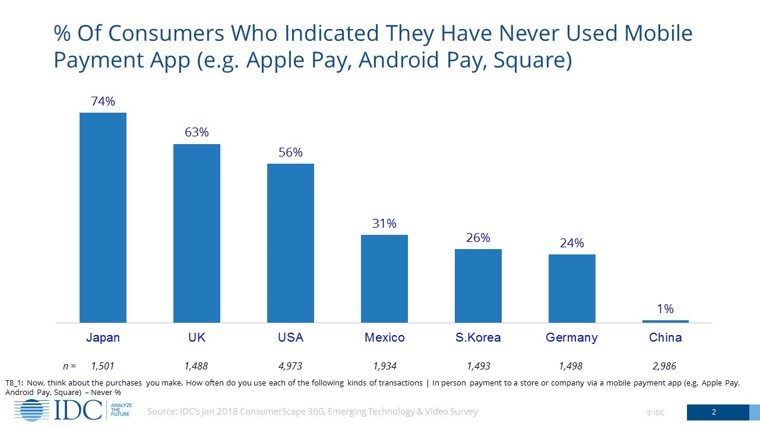

... which can be added to by this one from IDC, which shows that 99% of Chinese consumers are actively using mobile payments, compared to just 37% of UK consumers and 44% of Americans.

Things are changing, and changing fast, led by the East and followed by the West.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...