There’s a quote I’ve stolen off John Oliver that bitcoin combines everything you don’t understand about finance with everything you don’t understand about technology. It’s a great line, and considering banking and technology are probably some of the most complicated things in our world, one that hits the nail on the head: how many people truly understand both?

I guess I’m an exception, as I do, and that’s why FinTech is so interesting. FinTech people have to integrate these two fields of complexity - banking and technology - and merge them together.

Often, we fail.

I fail. I admit it. I’m a technologist and have spent most of my life delivering technology to banks and insurance companies. I understand banks and insurance companies, because I’ve worked closely with their people from retail, commercial, private and investment banks to general and life insurance companies, and even taken exams, research and post-degree courses in financial services. However, it can still be beyond me. For example, ask me to explain the nuances of Basel IV and I get a hernia.

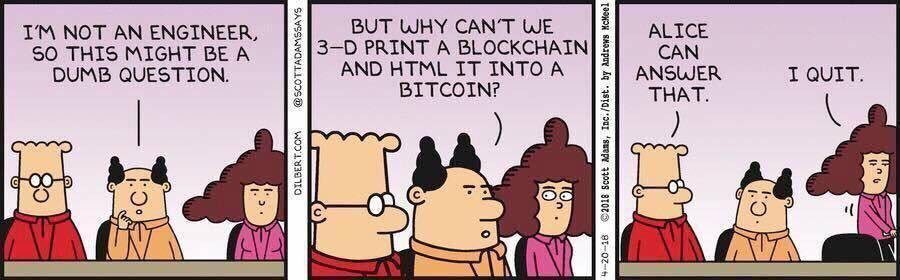

Nevertheless, I do revert often to type which is why I like sharing great Dilbert moments by Scott Adams so much. A recent one nailed the non-technologists view of the technology world:

Now, blockchain and cryptocurrencies, along with AI and machine learning, are both the hottest technology areas in banking right now, and also the most complex. Try and get me to explain the way in which consensus mechanisms work and the difference between R3’s and Ripple’s, and I get a double-hernia, but it is obvious that our Data Engineers are relishing this.

But when I posted this Dilbert strip on twitter, someone made the comment that technologists struggle in the same way when they join a finance meeting. True. A good example is this slide from JPMorgan’s Strategy overview, that I referred to the other day:

How many of my technology friends can explain all of those acronymns and percentage rates?In fact, if you take all of the financial indicators and compliance requirements of a bank and put them together, you get Alex:

So, for every technologist out there laughing at the bankers, just remembers that there’s the same number of bankers laughing back at you.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...