My second and last day at Money2020 Europe was packed with networking, meetings, panel discussions, private events and more. Throughout the day, the themes of the first day kept bubbling over. I guess it was typified with the comment that the CEO of TransferWise announced how happy they are to be partnering with banks. This, from the company that has advertised we should screw our banks for the last five years.

And this sums up the new world in a nutshell: partnering.

I made the comment that it was the first year I had seen big banks investing heavily in a presence at the show, especially BBVA and ING. And it is true. Big banks have finally woken up to FinTech are muscling into this space. They want to build partnerships and co-creation, collaboration and curation. Not all banks, but the ones who get it are getting that message I’ve been spreading of a marketplace of FinTech start-ups driven by bright young things, who can offer apps, APIs and analytics in a community of complimentary services.

It reminded me of a recent comment from a banking friend who said that his bank saw things like Stripe or TransferWise and would say: “we should do that”. What he meant is that the bank would say: “we should build that” and they try. They try, but they fail. They believe they have to develop everything themselves because it is more secure and controlled. It is obviously not the case – the bright young things are always developing these things faster and better – but that control freak culture of traditional banks is the shackle that drags them down. Finally, this year, I felt that some banks had broken free of their shackles.

The other thing that kept recurring is that the technology companies need more regulation.

For example, we had a discussion about data without borders and Antti-Jussi Suominen reflected on the fact that we may have global technology firms, but we don’t have global financial firms due to the fact that regulation is local. I thought about this, and the fact that financial firms have tried to globalise, and believe his reflection is somewhat true. After all, if you’re a global bank, you have to deal with some form of regulatory change every twelve minutes, and keeping up with it all is nigh on impossible.

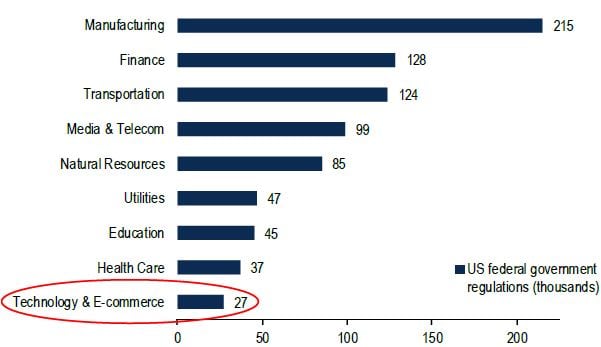

Equally, big banks deal with five times more regulation than technology firms, according to research by Bank of America …

and this begs the question: when will technology firms be regulated by banks?

It’s a question I’m coming back to more and more often as, if data is money, then data needs to be regulated like money. More importantly, if technology firms move more and more into the banks’ space, then the banks quite rightly will ask the regulators to oversee them like banks.

This was another recurring theme of the last two days: regulating the technology firms. It started with a dialogue around PSD2 which forces banks to offer Open APIs for other firms, particularly the technology firms and internet giants, to be able to access customer data if the customer gives permission. What about the bank accessing the technology firms’ data, the banks are asking? Where is the regulation forcing this through?

The answer is that it’s coming. PSD2 is just the first step towards regulating and requiring an Open API market of data. The next step is to force the Mobile Network Operators, Internet Giants and Technology Firms to do the same. In fact, my bet is that PSD3 will link with GDPR to build a regulated world of data. Whether that data is with a telco, an internet giant or a bank does not matter. It is all data and data needs to be protected if it is of value to the consumer.

That’s my real take-away. In the internet age, no matter what company you are, if you are dealing with customer data then do not mess with it. More importantly, if you are storing customer data, make sure it is protected. And if you compromise customer data, then the whole force of the law will come down upon you like a ton of bricks …

… nice one.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...