A few years ago Jamie Dimon was renowned for saying that bitcoin developers “are going to try and eat our lunch” and that silicon valley was coming to get the banks.

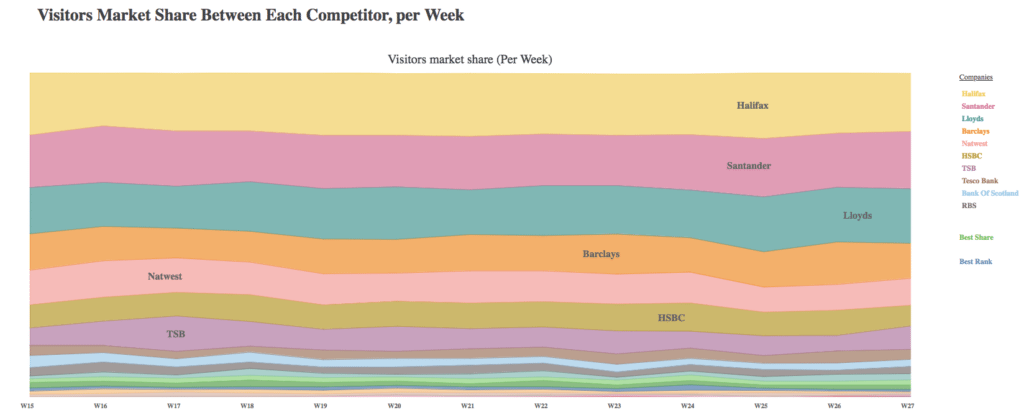

Three years later, it’s not quite the case. The big banks are getting bigger, and the FinTech community is nibbling at the ankles and not biting much yet. This is demonstrated by recent stats from mobile data analytics company Ogury, who analysed what British consumers are doing with financial apps. What they found is that Halifax, Santander, Lloyds and Barclays are the most used apps (doubleclick image for larger version).

If you combine the stats for Halifax and Lloyds, as they are one and the same company, it shows that over a third of the most frequently used apps are from Lloyds Banking Group. This reinforces Lloyds claim that it has the #1 banking app in the UK.

However, there are a few nuances not covered here. For example, I log into my big banks’ app three or four times a day to see if there have been any monies deposited from customers. I don’t need to do that in my FinTech apps, as they alert me when money is received. This would therefore imply that I use my big banks app four times as much as my FinTech app, which is true; but I’m far more satisfied with my FinTech app, as it alerts me to activities rather than me having to find out.

It’s the push-pull syndrome. FinTech apps push a lot of information to me because they’re intelligent; big bank apps force me to pull the information because they’re dumb. FinTech apps can predict and present my financial lifestyle to me intelligently; big bank apps show me what I’ve spent in a traditional debit and credit ledger that has no insight at all. Or that’s my experience of two of the most frequently used big bank apps. They’re pretty dumb. Meantime, my experience of some of the most popular FinTech apps is the opposite.

The Financial Times reports much of the information, with this being the telling part:

Top of the fintechs is established payments unicorn TransferWise, with just 0.5 per cent of the visitor share in the most recent week. Revolut, which recently announced it had signed up 1 million UK users, has just 0.3 percent of the market share, while Starling Bank has 0.2 per cent.

Traditional banks even dominate the new downloads list, though Starling manages to sneak into the top 10, with 4.6 per cent of downloads in the most recent week (compared with Barclays' 15.7 per cent if you include its “Pingit” app with its regular banking one).

It intrigues me that the start-ups with the most traffic however, are the ones that focus on foreign exchange such as TransferWise, World Remit, Skrill, Azimo and Fair FX.

Source: Ogury research, November 2017

UK-based TransferWise is a standout performer, registering in the top two in each territory bar Italy, where it placed third. This included number one spots in the UK, France, and Spain. This is unsurprising to me, as we live in a global world where many people travel across borders and currencies. For example, I recently had to send a large amount of money from the UK to Europe. My bank offered to do this transfer for an exchange rate that turned out to be £700 worse than the exchange made via TransferWise. Oh, and TransferWise made the transfer is under 24 hours compared with days with my bank. In other words, anyone dealing with FX and cross-border payments has woken up to the speed and cost of the old system versus the new. And that, to me is the crux of what will make people change over time. As they wake up to high speed, low cost finance, they will start to wonder why they deal with the old system that is low speed and high cost.

Works for me anyway.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...