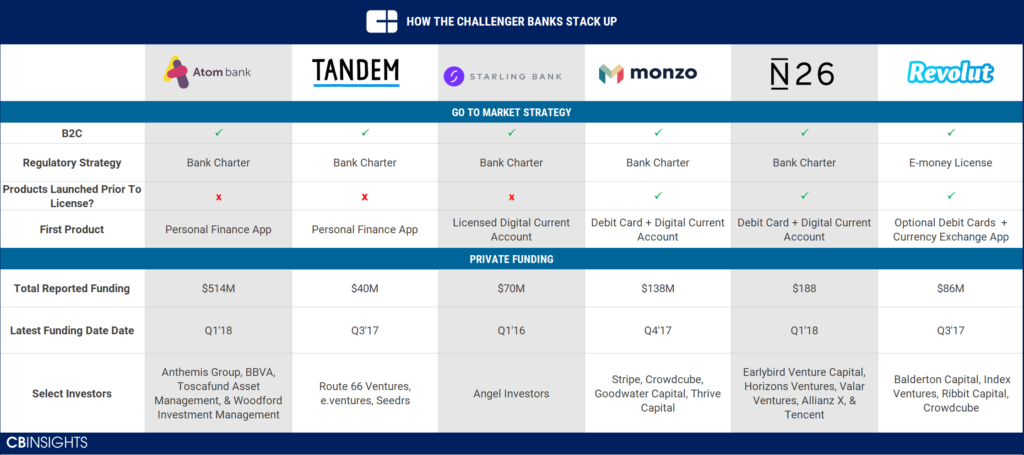

The UK’s challenger banks are busy getting on with it. They’ve got their licences, they’ve deployed their services, they’re partnering with third parties and creating marketplaces. Much of this was cited in a report by CBInsights, comparing the features of the five most notable new ones: Atom, Starling, Monzo, Revolut and Tandem.

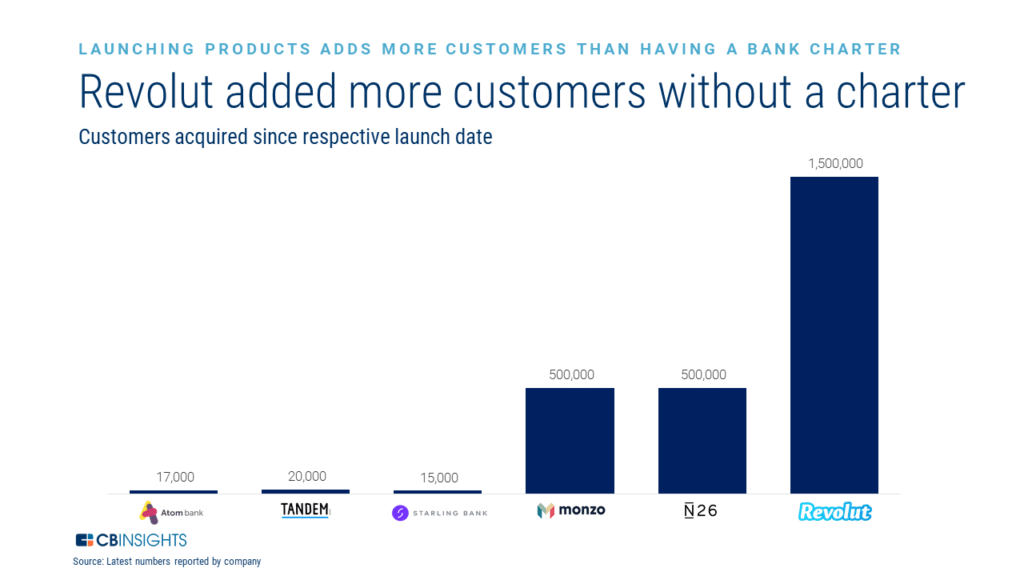

N26 were also included, but is not a UK start-up and their report builds on the one I blogged about last month from Optima. The thing I took from the CBInsights report is the massive numbers of users that Revolut and Monzo have already gained. At that time, it was 1.5 million for Revolut and 500,000 for Monzo.

This was notable because the other players – Atom, Starling and Tandem – had been building full-service banks. Revolut was a foreign exchange e-money service at the start and Monzo a prepaid card. Both have moved to become full-service banks, but they didn’t start that way. It looks like stripping back to a basic starting point was a good initial move.

But now I see numbers coming out that show a similar pickup for Starling and Tandem. This week, Tandem announced they’ve just gained their 250,000th customer – admittedly including all those folks who purely registered the app – and Starling are saying their user base is by growing 20% per month.

Who are all these people? Where are they coming from? What are they doing? Have they actually switched, or just playing around with the software?

Well, Monzo gives some insight into this. Announcing increasing losses as it ramps up its operations, the bank also shows it is not really yet a bank:

It expects to have an impressive 1 million current account customers by the autumn, but four in five do not deposit their salaries with it. The figures show that customer deposits were £71.2million, the equivalent of less than £150 per account.

Now, I’ve heard it often said that the strategy of challenger banks is not to be a customers’ main account … yet. They want people to purely try them out and hope that, over time, the benefits they see will make them switch.

More insights came from a December 2017 research survey released by data management company Relay 42. In this survey 2,000 UK consumers were questioned about whether they were thinking of moving to digital-only banks.

27% have moved to an online or mobile-only bank already, while 26% are considering the switch. More than half of these cite a better online experience and functionality, while 29% are drawn by attractive finance rates and fees and 28% by a better quality of service. Meanwhile, just 13% of respondents are not interested in exploring new technologies to help them manage their money.

Maybe it is for these reasons that I now see many of the large banks launching new brands and digital-only services. Nearly every large UK bank is developing a digital bank app that they think will be as good as, if not better than, those offered by the challengers. Equally, if any challenger gets big enough to be a threat, I’m sure their big bank coffers will stump up and make an offer they cannot refuse for a buyout.

Mind you, if I were a challenger, I’d probably turn around and tell them to go and do an Elon Musk, and put their offer in the same place as his submarine. After all, it’s not as though challenger banks are finding it hard to find funding.

According to FinTech Global, challenger banks have raised over $2.4 billion in capital since 2014. Atom Bank raised $207.1 million of venture funding from BBVA and Toscafund Asset Management in Q1 2018, the largest single investment in a Challenger Bank to date. Since inception, Atom Bank has raised over $500 million and has lent out more than $1.5 billion. In fact, the UK boasts some of the most well-funded Challenger Banks with Atom Bank, Starling Bank, OakNorth, Monzo, Tandem Bank and Revolut all having raised over $1 billion combined.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...