I wasn’t going to post this blog but the more it sits in my head, the more I felt I had to write it.

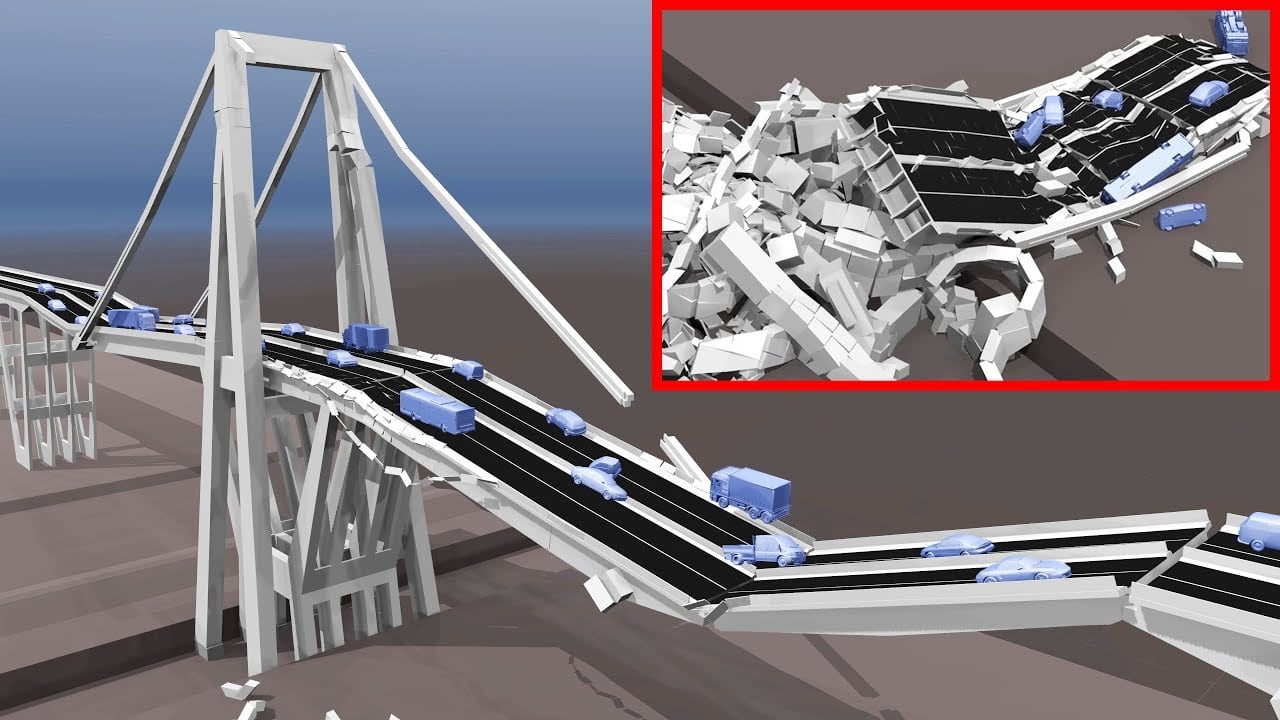

Like everyone I expect, I was really shocked by the Genoa Morandi bridge collapse that killed 43 people this month. The idea of driving happily along a major road and then suddenly it disappears is one of the worst nightmares imaginable. In the aftermath, there have been lots of discussions about what happened, what went wrong, how was it allowed to happen, who is responsible.

The Italian government blames Autostrade per l’Italia, the company in charge of operating and maintaining the country’s motorways. I then cringed as I watched a news conference with the Chief Executive of Autostrade who refused to apologise for the incident. “Apologies and responsibilities are things that are interconnected. You apologise if you feel you are responsible,” he said, implying that the firm is not responsible.

“The works and state of the viaduct were under constant monitoring and supervision,” the company said in a statement, and they were repairing the foundations in the weeks before the incident happened.

Yet it is claimed that the bridge collapsed due to a major flaw in the supporting piles, meaning the structure could not support the weight of heavy traffic.

Six years ago Giovanni Calvini, then the head of the Genoa branch of the Italian employers’ organisation Confindustria, warned in an interview with Genoa's Il Secolo XIX newspaper: “When in 10 years’ time the Morandi Bridge collapses, and we all get stuck in traffic jams for hours, we will remember the names of the people who said ‘No’”.

Mr. Calvini was begging the bosses of Autostrade and the Italian Government to invest in road renewal projects. This is due to the fact that many of the roads were in a poor state of repair and many news reports point out that the Genoa bridge was a particular weakness.

Built in the 1960s, the Morandi Bridge provides a vital link for the A10 highway that connects North West Italy to France, and is one of the busiest bridges in the country carrying freight and tourists to and from the port city. The technology used to build the bridge was fatally flawed, according to some engineers, and required renewal just twenty years after the bridge was opened.

All in all, there are questions and recriminations across the board but, the bottom-line is that 43 people died and the reason: legacy structures.

I guess you now know why I’m posting this, and why I hesitate to do so. I don’t like using this analogy of a collapsed bridge with a real human death toll as a metaphor for core systems renewal, but the post-collapse dialogue made me think of this too much to not use it.

The post-collapse dialogue was all about how the bridge should have been refreshed years ago, and how the management kept refusing to do the work as the disruption would be too great. The risk of renewal to the business was too high. The loss of profits would be too great. That appears to be the real reason why the bridge wasn’t closed years ago, and why the technologies used to build it were not replaced.

Antonio Brencich of the engineering faculty at the University of Genoa stated in an interview with broadcaster Primocanale in 2016 that the bridge was an ‘engineering failure’.

“There are steel cables that are weighted and run inside sheaths, and then there is a system to fill the sheaths to prevent corrosion that can damage the cables. But the system didn't work as it was supposed to. The weighing of the cables didn't work as planned. Protection from corrosion wasn't what was hoped for. This caused the structure to deteriorate at great speed. Just think, the east tower was reinforced just 20 years after the opening of the bridge, evidence of premature decay. Twenty years is nothing, a blink of an eye in the life of a bridge.”

The problems were known but the tough decisions were ducked.

This is what I see in most banks old legacy structures: tough decisions being ducked; and if you ever want a reason to stir you into action, think of the Genoa bridge collapse. It is a sad indictment of poor management decision making, and one that has cost lives. Losing money does the same thing, and changing core systems isn’t without risk, as demonstrated by TSB’s recent renewal fiasco. But it has to be done for, if it is not, then you can see the consequences.

Don’t be an ostrich. Fix the issues of legacy before it’s too late.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...