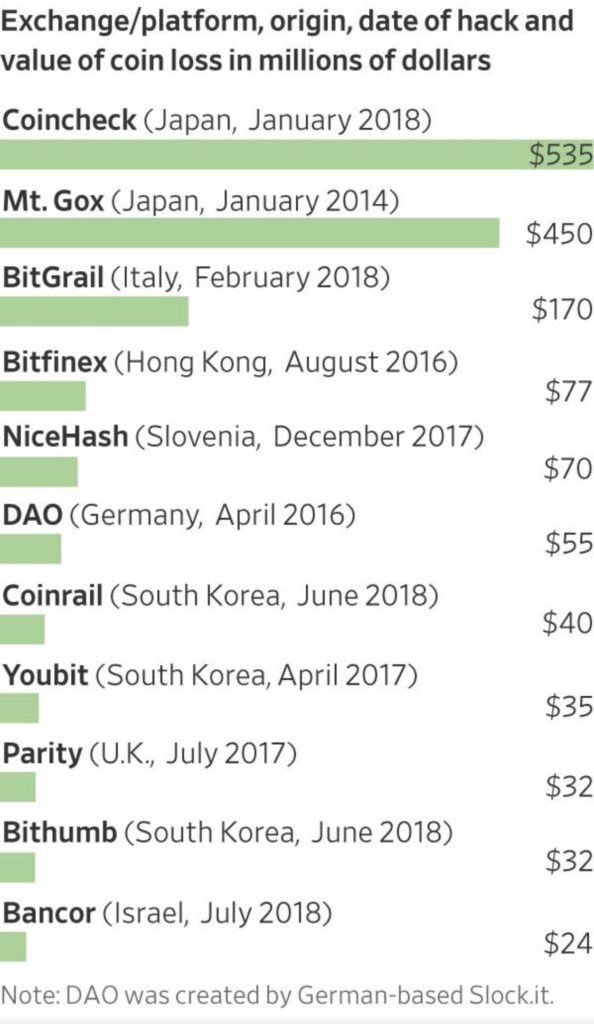

I spotted a chart the other day showing the millions of dollars lost on cryptocurrency platforms …

Source: The Wall Street Journal

Since 2011, there have been 56 cyberattacks directed at cryptocurrency exchanges, initial coin offerings and other digital-currency platforms around the world, according to Autonomous Research, bringing the total of hacking-related losses to $1.63 billion.

Unregulated, unlicensed, unsubstantiated and unsophisticated, many of these platforms have launched as a joke. There’s been the Jesuscoin ICO – decentralising Jesus on the blockchain – and the dogecoin crypto, a joke coin that gained billions of dollars invested on the crypto mania wave.

In a review of documents produced for 1,450 digital coin offerings, The Wall Street Journal found 271 with red flags that should make them uninvestible as they include plagiarised investor documents, promises of guaranteed returns and missing or fake executive teams.

So, I often say that most of the activity in ICOs and cryptocurrencies are suspect, and to be avoided unless you’ve done in-depth due diligence.

Then there are those who rail against me … and rightly so. As one commenter said to me: “You think they’re more unstable than banks? Just look at 2008!” Another comment was made around fiat currencies: “Just look at Venezuela and the other crazy currencies out there. Crypto will stabilise and take over, and the bears will be licking their paws.”

OK, OK. The financial system isn’t perfect and, if you live in a country that has an unstable economy, you may find that it’s better to invest in crypto than keeping your own basketcase currency.

However, the craziest thing about the banking system is AML, anti-money laundering. A raft of regulations has arisen to try to crackdown on bad actors in the financial system. It began with the Bank Secrecy Act of 1970 and grew into the monster that is FATCA, the Foreign Account Tax Compliance Act, in 2010.

The result is that opening an account with a bank requires an onerous amount of effort. In the UK, it generally requires producing a valid government-issued identification – a passport or a driving license – and documents that verify your residential address, such as three utility bills. These silly rules resulted in my wife being told she doesn’t exist, even though she does in reality, and has huge challenges for the banks to manage such checks.

In fact, many banks don’t manage such checks. They fail dismally. There are trillions of dollars washed through the financial system every year, and only around two percent is traced, tracked and caught. How dismal is that?

Banks have checkers checking the checkers checking the checkers, and yet anyone can walk into most bank branches with a million dollars in cash, a fake passport and driving license, and open an account. What is the problem?

The problem is that most identification is paper-based. Paper documents like utility bills and passports can be faked and, in many bank instances, they don’t do proper checks on the paper documentation. I remember Metro Bank saying their account opening technology was unique. This is because every branch has a passport scanning system that links to the government databases and verifies if the passport is true. If it is not, police are called and generally arrive within ten minutes to arrest the suspect individual.

But Metro Bank is unusual, and most banks don’t have such technologies to check and verify identities in branches. As a result, you can open an account in most banks with what looks like bona fide identification, but is fake. For example, the Daily Mail found that criminal gang scammed 5,000 people of £15 million using over 80 fake bank accounts, half of which were with HSBC.

HSBC, as one of the largest banks in the world, has been particularly poor at AML, with heavy fines on several occasions and so, as a result, have been shutting down many accounts. Brett King was hit with such a closure – When HSBC Closes Your Bank Account Without Telling You – and I was also hit with the issue recently.

My COO told me that HSBC had given us five days to verify identities for the Financial Services Club account, an account we opened in 2003 and have held for fifteen years. Unfortunately, my COO had not updated my details since the account opening and they had my residential address from 2003. I’ve moved twice since then, but they wouldn’t accept my current address without visiting a branch and showing verifiable identification documents as outlined above. This is for someone who actually never uses the account. I have no direct access, no usage and no link to the account apart from being a director of the company. Quite ridiculous.

And, after all of this, we have a system that enables trillions of dollars to be laundered without worry. Hmmm. Maybe digitalisation through cryptocurrencies will be a better thing after all. After all, at least you can trace who sent what to whom through their traces on the digital network (unless you use Monero of course).

Postscript:

This blog post was part inspired by Edan Yago’s update on Coindesk.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...