I got into an argument after a presentation where I said that active fund management is dead. It wasn’t the best thing to say in front of a group of active fund managers, but I can’t help myself. It’s my background in dealing with program trading in the 1990s; then algorithmic trading in the 2000s; and now high frequency trading in the 2010s. It’s my background in saying that all finance is moving to machines and everything that can be automated, will be automated. It’s my background in commonly joking that investment markets can be run by one man and his dog: the man is there to feed the dog … the dog is there to stop the man from touching the computers.

This vision is coming true and, specifically, the developments around blockchain and distributed ledger (DLT) to record investment transactions and artificial intelligence (AI) to make the decisions is a critical part of all this.

Equally, I’ve blogged several times about monkeys making better bets than active fund managers. It is for this reason that Warren Buffett, a pretty good active fund manager I'm told, made a specific bet against active fund manager Ted Seides that a passive fund would outperform his active fund. Ten years later and that passive fund returned four times better profit on the investment, so he was right.

I guess I’m just not into the idea that human stock pickers are better than machines.

However, machines are only as good as the humans who program them, so I’m not arguing that active fund managers disappear completely. Just the ones doing any active trading. For, instead, I believe that the human fund managers who manage markets will transition to the educators of the machines, just not doing any trading themselves.

This is summed up nicely in the MIT research around AI, which argues that humans will rarely be doing any active anything. Humans will develop instead into trainers, explainers and sustainers of machines:

- Trainers teach AI systems how they should perform;

- Explainers will bridge the gap between technologists and business leaders; and

- Sustainers will help ensure that AI systems are operating as designed and that unintended consequences are addressed with the appropriate urgency.

Now the investment markets are already pretty well down this route. In the 1990s we were training neural networks to look for pair trading, where patterns of one stock rising when another falls show clear links. In the 2000s we were training black boxes to perform far more complex trading where, instead of a pair of stocks, events from currency fluctuations to stock patterns could all be intermingled to create far more complex algorithmic patterns. And now, we look at low latency flash trading, where the systems educate themselves based upon the original human inputs and just need sustenance to continue their performance.

The last piece – sustenance/sustaining – is more about constant fine tuning.

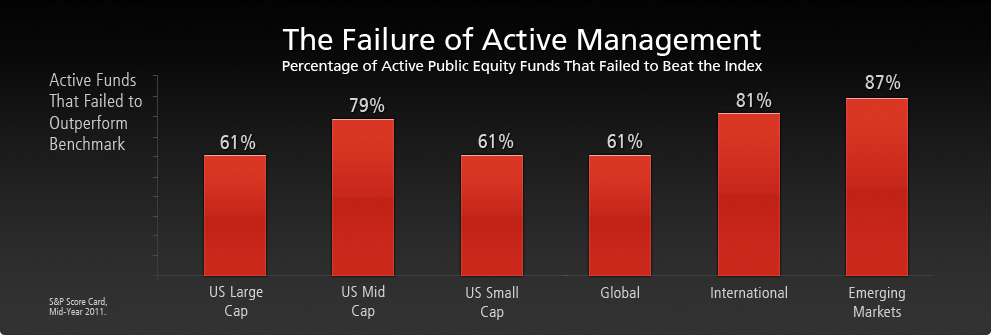

This, to me, reflects the real end-game of AI in all markets but, specifically, in fund management. It isn’t the machines passively doing all the work; it’s the humans using the machines to leverage. This is why there are some active fund managers who outperform passive indexes. However, they are the few. For example, checkout this chart.

Hardly a single active manager outperforms an index. But some do. Just not many.

This is why Warren Buffett, the poster child for the active fund management industry, followed up his bet by saying that most investors are better off using low-cost index funds:

“By periodically investing in an index fund, for example, the know-nothing investor can actually outperform most investment professionals. Paradoxically, when ‘dumb’ money acknowledges its limitations, it ceases to be dumb.”

In fact, he underscored this statement with the rider that, “for most people, active fund investment management is a losing bet”. Yep.

So, is there any case for active fund management in the future, other than as trainers and sustainers of the machines?

Well Maike Currie, an Investment director at Fidelity International writing in The Financial Times, has a go at it. She says that sideways markets – when it’s neither bull or bear, but a slow slide – is when active stockpickers come into their own.

Hmmm. Again, methinks we are at cross purposes as what I mean by passive fund management isn’t just index tracking, but using machine learning to outperform the markets. A machine learning environment would work just as well in a bull, bear or sideways market, so that’s the difference.

And I think this is where the whole thing gets confused: active versus passive to most people in fund management means actively managed versus index following funds whereas, what I mean, is actively managed by humans versus passively managed by machines with intelligence funds.

That’s the real difference.

Oh, and having said that active fund managers are nowhere near a match for passive, there is one group of managers who can outperform everyone. Monkeys! A study by CASS Business School found that monkeys are highly likely to be better fund managers than humans, even outperforming tracker funds. That's why I'm off to the zoo for some tips.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...