You’re probably familiar with an app. Maybe you even have some on this thing called a smartphone. I apologise for the few financial guys I know who are still using blackberries, as what follows may blow your mind. Ok, I know that was patronising but there are actually still a few people who don’t know what an app is. App, short for application, is a code for smartphones that provides some funcitonlaity. You might know what it is as your bank has one that customers use. Equally, there are many other apps out there like the Facebook app, the Twitter app, the airline apps and others that are out there. Some apps allow in-app purchases. These are maninly the gaming apps, fo which some encourage kids to spend their parents monthly mortgage money on in-app upgrades. Be careful with those apps.

What has surprised me recently however is the dicsusion of DApps and Super-Apps. These are two distincitly different things, but both have import for the future of finance.

DApps are defined in different ways, but I quite like this one from the Ethereum Stack Exchange:

DApp is an abbreviated form for decentralized application.

A DApp has its backend code running on a decentralized peer-to-peer network. Contrast this with an app where the backend code is running on centralized servers.

A DApp can have frontend code and user interfaces written in any language (just like an app) that can make calls to its backend. Furthermore, its frontend can be hosted on decentralized storage such as Swarm or IPFS.

If an app=frontend+server, since Ethereum contracts are code that runs on the global Ethereum decentralized peer-to-peer network, then:

DApp = frontend + contracts

In other words, DApps are related to Distirubted Ledger Technogies (DLT), allowing data to be secured through decentralised networking. One of the potential key DApp uses is in digital identity. As Coindesk puts it:

In the digital age, the increasing risk of financial crime arising from fraud and identity theft demonstrates the importance of a reliable means to safeguard the individual's identity.

To that end, KYC-Chain aims to provide consensus on the identity of individuals at the "highest level of trust".

The service, which is currently under construction, utilises existing know-your-customer (KYC) regulations, and plans to bring "ease and simplicity" to the process of identification for businesses wishing to onboard new customers.

The platform's "identity wallets" will allow users to share only the information necessary, and nothing more.

KYC-Chain employs Ethereum and will work primarily via the use of "trusted gatekeepers", who can be any individual or legal entity permitted by law to authenticate KYC documents – for example, notary publics, people of diplomatic status, lawyers, governments, and so on.

A trusted gatekeeper would perform an individual check on a user's ID using KYC-Chain's platform and authenticate them. The files would be stored in a distributed database system, which can later be retrieved by the trusted gatekeeper, or the user, to demonstrate with certainty that the ID is genuine.

This is important as the DApp would allow identity to be shraed without concerns of security breaches, because the data is decnetralised and far less likely to be accessible to hackers. That is why this is one of several use cases being discussed actively.

But I was more surprised to hear discussions of Super-Apps recelty. A Super-App is an app ecosyusteem that allows everyone to put fucnitnoality onto the app, enriching its capaiblities. The term has emerged from China, where WeChat became oen fo the first Super-Apps.

Like DApps, Super-Apps are ill-defined but, in my clumsy view fo them, it is one app to rule them all. The reason why WeChat got this lable is because the users can do everything they want in a single app. It is like integrating and merging Facebook, Twitter, WhatsApp, Snapchat, PayPal, Venmo, Amazon, iTunes and more in one service. You have your complete social, financial and commercial world, all locked into one app. That is the power of WeChat.

When I was in China recently, I asked many people if they prefer Alipay or WeChat Pay and the answer was overwhelmingly the latter for day-to-day things “because it is so convenient”. You’re chatting with your friend on WeChat and send them a gift of one yuan; your friend asks if you’ve seen the new series with Xie Na, and you stream it there and then for five yuan; you see Xie Na is wearing some nice Semir trousers, and ordre them whilst watching the programme; you share your comments about the programme with your friends in real-time, and then both agree to meet at Luckin Coffee, where you pay ofr the cappuccino with WeChat Pay of course.

You get the idea. In case you don’t, a slightly dated clip from the New York Times explains all:

I also liked this overview from Fleximize:

Platforms developed in the western world just wouldn’t work in China, as the government would be largely unable to monitor everything. The solution? Create ‘copycat apps’ that are incredibly similar to their western counterparts but approved and monitored by the Chinese government. For Google, there’s Baidu. For YouTube, Youku. For Twitter, Sina Weibo. And the list goes on … most importantly, one of them was becoming the world’s first ‘Super-App’ …

It's safe to say that the most ardent of technophiles will probably have at least 100 apps on their smartphone. Speaking as one of them, I am not ashamed to say that I currently have a grand total of 127 apps installed on my own device. I have Facebook Messenger, WhatsApp, Telegram, Skype, Google Hangouts and Duo installed to cover my instant messaging needs, and that’s excluding my text messaging apps. I have Uber, Lyft, Citymapper, Waze, Tripadvisor, AirBnB and Skyscanner, all installed for when my inner globetrotter takes over. Likewise, when I’m feeling a bit peckish, I turn to one of Deliveroo, Just Eat, OpenTable, Zomato, Yelp or Urbanspoon. That’s 19 apps to cover three essential functions. WeChat? It’s got them all covered. For WeChat isn’t just the messaging app that many assume it to be. It’s a whole lot more.

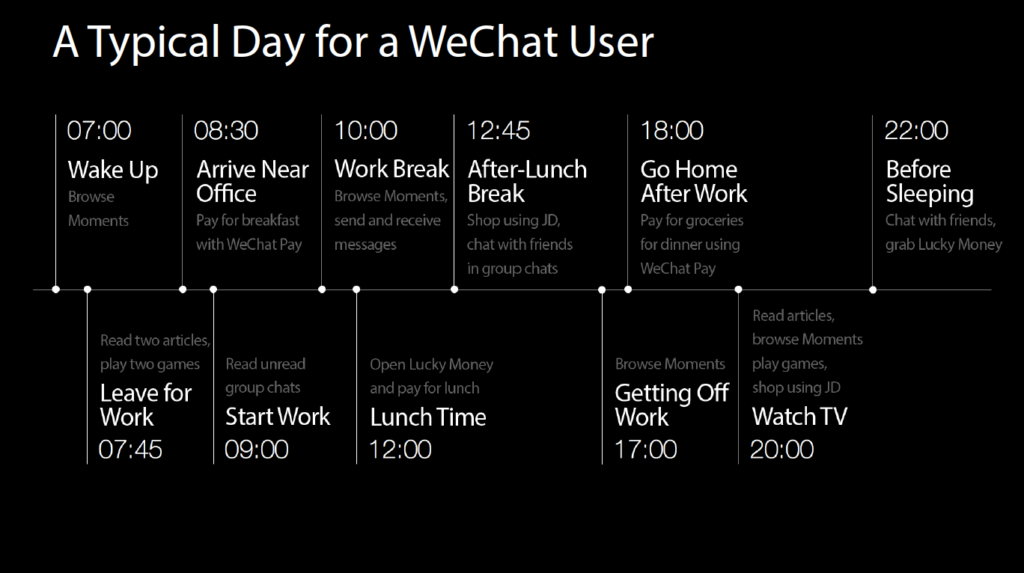

A DAY IN THE LIFE:

WeChat users benefit from the vast array of features available through the platform (Image courtesy of WeChat)

Apps, DApps and Super-Apps … how does your bank fit into this world?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...