I grew up as a marketing guy. My first career roles were in marketing. I was trained by Kotler and Drucker, and still hold true to first principles of marketing: the 4 P’s or, if you’re not a marketing person, product, price, place and promotion. This is the original marketing mix:

- Product: The goods and/or services offered by a company to its customers.

- Price: The amount of money paid by customers to purchase the product.

- Place (or distribution): The activities that make the product available to consumers.

- Promotion: The activities that communicate the product’s features and benefits and persuade customers to purchase the product.

Each of the four Ps has its own tools to contribute to the marketing mix:

- Product: variety, quality, design, features, brand name, packaging, services

- Price: list price, discounts, allowance, payment period, credit terms

- Place: channels, coverage, assortments, locations, inventory, transportation, logistics

- Promotion: advertising, personal selling, sales promotion, public relations

And some people extend the 4 P’s to 7 P’s, adding packaging, position and people. Others reinterpret the 4 P’s as the 4 C’s: customer solution, customer cost, convenience and communication. There are lots of good theories in marketing.

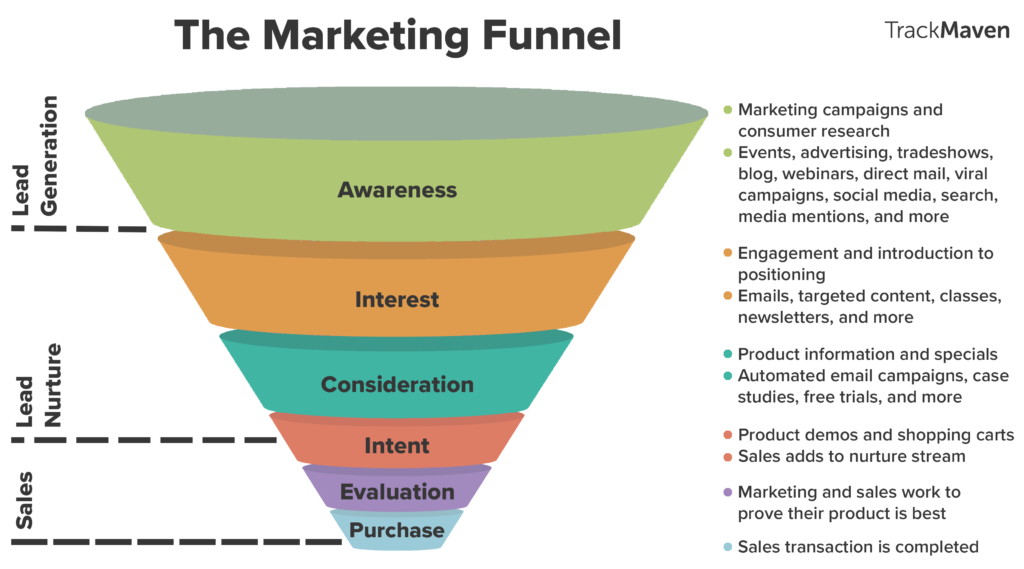

One good theory is The Marketing Funnel.

The idea is that promotion begins as a scattergun approach. You broadcast wide. That then attracts a customer touchpoint: a click on the website or a note of an ad. That touchpoint leads to interest and finally purchase. Like fishing in the ocean, the marketing mix is to throw a huge net into the broadcasting world’s ocean and eventually you catch a few fish.

The excellent website The Financial Brand recently challenged this notion in a write-up of a speech by Kristin Lemkau, Chief Marketing Officer at JPMorgan Chase. Instead of a funnel, scattergun or net, today’s marketeers should be working on a scalpel. Instead of thinking about broadcast in the old days of mass media, we need to work on a focus of individualisation in the new days of digital media.

I think some people are aware of this, but it is becoming more and more imperative that firms have people in marketing who can leverage data personalisation.

Lemkau illustrates this by referencing an advert that JPMC could deliver to a customer stating that “You spent $400 on Amazon purchases last month. You could have used the Amazon Rewards Card. Here’s $300 to sign up for one now.”

“That doesn’t even feel like an ad,” Lemkau says. “It’s much more like a way to show that you really have the consumer’s back.”

I totally agree with that sentiment, and it again shows the divide between industrial age and digital age thinking. Industrial age thinking was focused upon throwing as much noise out to the world as possible to get attention; digital age thinking is focused upon talking to each person individually with a personal message that makes the person believe you care.

In fact, it delineates between old banks and new banks. Old banks push products through channels to get the greatest share of customer wallet to make money through hidden charges and fees (punish the customer); new banks leverage data and offer access to ensure the customer spends and saves smarter and is rewarded by interest and offers.

There are so many differences between industrial and digital era thinking, and the marketing process is one big one, so change from a funnel to a scalpel and get personal not general.

If you want to know more, read The Financial Brand’s write-up of Lemkau’s speech.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...