The United Nations Principles for Responsible Banking were released last Monday. The aim is to help any bank – whatever its starting point – to align its business strategy with society’s goals.

It’s a nice idea, but is it practical?

In a guest column James Vaccaro, Director of Corporate Strategy at Triodos Bank, walks us through it.

STEPPING UP TO THE CHALLENGE OF RESPONSIBLE BANKING

There are about 25,000 banks worldwide: how responsible are they right now? And how does their concept of responsibility compare to the people who are impacted by their financial decisions? Whilst a few are advancing quickly in their sustainable impact, others are only at the cusp of understanding and integrating environmental sustainability or social purpose.

However, a recent IPCC report gives the world a mere 12 years in which to have any chance of limiting climate change to 1.5oC , and there are still significant gaps in meeting the challenges set out in the UN Sustainable Development Goals by 2030. So, the pace of change in the decade ahead really matters and banks need to start playing a key role in the transition towards a more sustainable world.

The momentum for making this change in the banking sector is widespread. Customers and stakeholders expect banks to help make this worldwide shift. They are demanding genuinely sustainable financial institutions that are a part of the solution, not part of the problem.

Today, in 2018, it’s been particularly relevant to discuss the contribution of the financial sector to a sustainable economy. Ten years since the global financial crisis and the shockwaves are still being felt around the world. The focus on banking for the last decade has been around regulation and stabilising capital. Now it is time to focus on how the global banking industry can proactively contribute to the real economy and meeting real needs like the transition to a sustainable and inclusive economy.

A major global initiative to accelerate progress

We see more and more national, European and global initiatives helping banks on their journey towards taking sustainability more into account. For instance, the development of methodologies for measuring the carbon footprint of loan portfolios (such as the Platform for Carbon Accounting Financials) and the growth of the network of values-based banks through the Global Alliance for Banking on Values. We also see more regulators and politicians demanding more scrutiny and transparency around environmental and social risks and impacts.

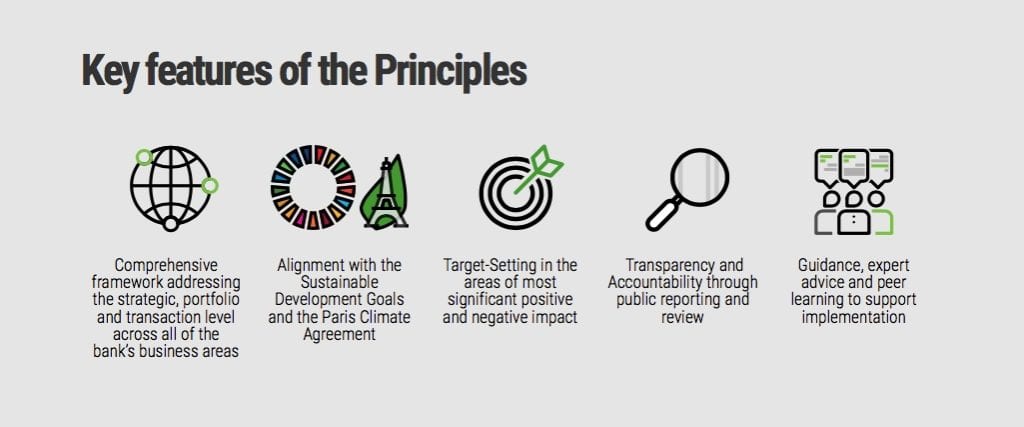

And in Paris on November 26th a global initiative has been launched for the banking sector: The United Nations Principles for Responsible Banking. These have been developed by the UN Environment Finance Initiative (UNEP FI) – itself created out of the Rio Summit over a quarter of a century ago – and 28 banks from across the world, including Triodos Bank. The Principles set out what it means to be a responsible bank and aim to ensure that banks create value for both their shareholders and society. They provide the first global framework that guides the integration of sustainability across all business areas of a bank, from strategic to portfolio to transaction level.

By signing the Principles for Responsible Banking banks will commit to being publicly accountable for their significant positive and negative social, environmental and economic impacts. They agree to set public targets on addressing their most significant negative impacts and scaling up their positive impacts to align with and contribute to national and international sustainable development such as the Sustainable Development Goals and climate targets such as the Paris Climate Agreement.

By increasing transparency, customers, investors, regulators and other stakeholders will be able to see the progress made against relevant areas of development, for example if or when banks’ portfolios and activities will be compliant with a 1.5oC or 2oC scenario for climate change. Or it could be about the mitigation of negative impacts – such as reducing exposure to polluting industries or those with negative social consequences. The topics chosen will be those deemed most material in the operating context of the bank through engaging with stakeholders, so not all the targets will be the same. But signing the Principles will be a serious commitment: banks that continuously fail to meet transparency requirements, set adequate targets and demonstrate progress will face removal from the list of signatories.

Signing up does not mean that banks will automatically be at the level of what could be described as ‘fully responsible’ on day one. There will be major differences between the starting points of different banks, in geography, business model, and how much sustainability is integrated into the core of their business. Rather than being a static benchmark, the principles act as a ladder to climb, continuously stretching the ambitions of all banks – in a collective ‘race to the top’ to inspire and gain traction across the entire global banking sector. The Principles set a trajectory for developing as a responsible bank and provide actionable guidance on how to get there.

So why, as one of the most sustainable banks worldwide, is Triodos Bank involved? We believe that, given the magnitude of the global challenges we face, a global initiative such as the UN Principles for Responsible Banking is important to achieve a systemic change. We view the Principles as a catalyst to accelerate the journey of the financial sector towards a sustainable business model. This journey will be difficult at times, but the financial sector’s alignment towards sustainability is critically important to shared progress. Every financial decision makes impact after all, and the Principles provide a good roadmap for achieving more positive impact.

Therefore, we call on banks to endorse and sign up for the Principles, no matter what their starting point. The more banks that adopt them, the greater impact the banking industry will have in leading society to meet its goals for a sustainable, equitable and prosperous future. No one should be complacent about the scale of change that is needed here. There is still too much money in the banking sector flowing in the wrong direction that needs to be turned around. To change everything, we need everyone – and the world does not have the luxury of time to wait for this to happen.

ABOUT JAMES VACCARO

James is director of strategy for Triodos Bank and represents Triodos Bank on the core group of banks developing the UN Principles for Responsible Banking.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...