I just got back from Russia recently where I was interviewed by one of their leading journals. The journalist had read Digital Human, and took a very Russian take on it.

His first question was along the lines of: if we are automating so much, then the people who own the robots will get richer but the majority will get poorer, do you agree? How can we manage such a divide? What about future jobs, what will the future jobs be?

You get the drift. I surprised myself with my answers, which led to something I’ve blogged about before (just last month in fact), but I’m coming back to it again as it is important.

The general focus of the conversation was on who owns the robots, for those who own the robots will control the future world. If you look at the US model, a few bright individuals will be the owners. In yesterday’s world it was Bill Gates and Steve Jobs; in today’s world, it’s Mark Zuckerberg and Jeff Bezos; in tomorrow’s world, it will be the descendants of Marc Raibert and Shinichi Tanzawa.

But this is where the discussion got interesting for me. You see, I’ve worked for American companies most of my employee life (pre-2002 when I was deemed ‘redundant’). American companies are ruthless with people. If you get laid off, you are walked off premise that day, in order to avoid taking company secrets with you. It doesn’t matter what age you are, and you have no rights. Often, you’re thrown out without a bean. From Greenfield Stein’s law website:

Many people operate under the assumption that they have a right to severance pay. There is, however, no general right to severance. There is no law which states that employers must provide severance pay to employees who are being laid off. Severance is voluntary on the part of the employer. The employer can offer to pay severance or it can refuse to pay severance. It is entirely up to the employer.

I saw many of my American colleagues quiver and quake as job cut rounds occurred again and again. It was different in the UK. In the UK, there is a mandate that employers have to pay based upon years of service.

Employees are entitled to redundancy payment provided that they have been continuously employed for at least two years with the same employer. The number of weeks’ pay due depends on the age of employee, the length of service, and is to be calculated, as follows:

0.5 week's pay for each year of service where the employee was below the age of 22;

1 week's pay for each year of service where the employee was between 22 to 40 of age;

1.5 week's pay for each year of employment where the employee was 41 and over.

It is different again in many European countries, where many firms find it difficult to fire anyone. This is the reason why Deutsche Bank’s staff numbers have stayed fairly constant over the past two years, whilst JPMorgan Chase and Barclays have slashed their workforce. German law dictates:

In businesses with more than ten employees, the termination of employees that have been employed for more than six months must be "socially justified". "Socially justified" termination will usually be based on person-related reasons (for example, long-term illness), conduct-related reasons (for example, repeated breaches of employment terms after prior warning) or operational reasons (for example, the shutdown of a business) … dismissals for operational reasons must be based on compelling operational reasons. The employer must prove that the job position permanently ceases to exist and that there are no vacant positions in the company.

The employer must conduct a social selection among comparable employees, which is based on age, years of service, marital status, number of dependent children, and severe disability.

In addition, in the case of significant operational changes, the employer may be required to consult with the works council on a change of the operation. While the works council in the end cannot avoid the implementation of the measures, the works council can heavily delay the process.

A dismissal must always be the last resort.

Now Germany is quite a successful country, but laying off people is just not done. This is where the discussion with the journalist got quite interesting, as I made the slip that if you are working in a country that operates pure capitalism, then the world becomes difficult.

He asked me what I meant by pure capitalism? I realised I was in Russia.

I explained that the pure capitalism focus is purely on shareholder return, profitability and revenues. The firm is driven by the stock price, its’ management are driven by stock bonuses and their ruthlessness to achieve this at any cost is beyond imagination.

Greed is good.

Fact is that it’s not.

Greed is one of seven deadly sins and I am now intrigued by countries like Germany and China that I believe practice social capitalism.

Social capitalism focuses upon raising not just one individual, but all. It does not allow a Zuckerberg, Gates or Bezos to exist, laying people off at will and paying minimum wage, if they don’t look after their people. They have to raise all, not just one. It is not socialism, but the social good.

Now there are two extremes here: giving everyone equal opportunity and, if they achieve, they can take all the spoils; or supporting everyone to take opportunity and, if they achieve, they must share the spoils.

Some say that if the 1% get richer and stick the middle finger up at the 99% that it will lead to revolution; others say that if everyone gets everything, then where’s the incentive to try to be the 1%?

In the middle of these two is what I call social capitalism. It’s what Jack Ma preaches and embodies in Alibaba. Yes, you have the rich, but the rich must do good.

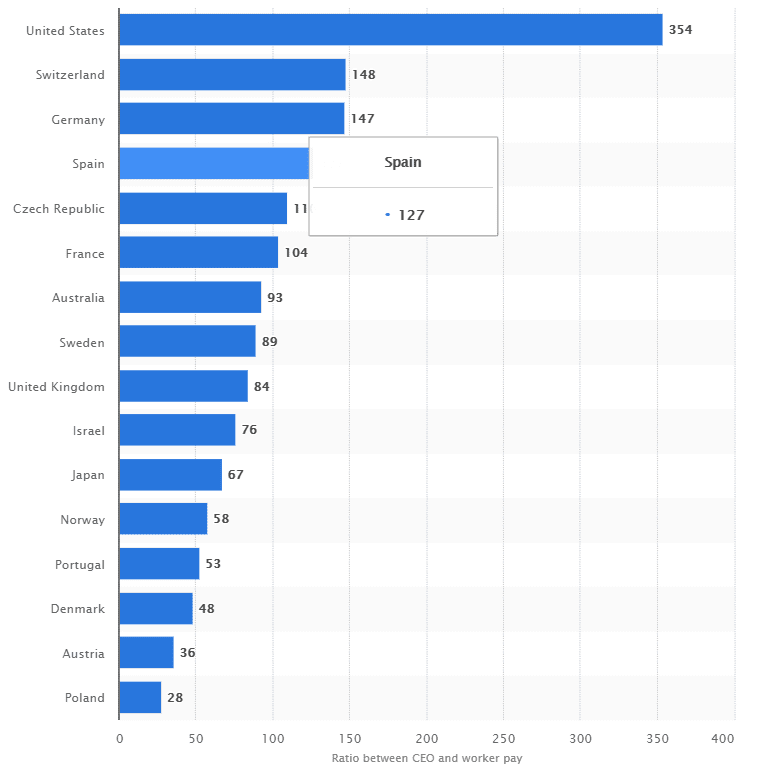

Ratio between CEOs and average workers in world

Source: Statista

I’m not trying to be political here, although I did fall into political statements, but I whole heartedly feel that the future world will see technology democratise work and life. In the process of doing that, it will raise not just one but will raise all.

[I hope so anyway]

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...