I’ve had a lot of conversations with bankers and technologists, and realised something recently. That realisation is a simple but important one, and it is this: dealing with technology is very different to dealing with money; furthermore, dealing with money through technology is very different to dealing with technology through money.

It may sound like a strange thing to talk about or write, but it is important as it explains why technology companies like Amazon and Alibaba will struggle if they ever try to open a bank.

Let’s start with the basics. We all use technology a lot these days. Most of us have smartphones and Facebook accounts, and most of us don’t get that angry if our call drops or our update gets few likes. However, if our money transfer fails or our salary payment does not arrive on its due date, then we get really angry. The difference is obvious: money is a key control factor in our lives, but technology is not.

This si why we can upgrade our smartphone every couple of years but never change our bank account. With money, we want security and safety; with technology, we want excitement and experiences.

This is also why I find it amusing to hear about technologists claiming that banks will shut down, be destroyed and disrupted by technology. It is not going to happen (as long as banks adapt and change, which they tend to do).

Adding more nuance to this, we are seeing banking and technology collide. We are seeing banking and technology meld and merge in the 21st century. Then, as mentioned earlier, dealing with money through technology is different to dealing with technology through money.

What I mean by this is that when I deal with technology through money, I am just looking to pay for stuff typically. So we have Square, Stripe, PayPal, Venmo, Alipay, WeChat Pay and more. They let me pay for stuff online. Great. But that is not dealing with money through technology, but dealing with technology through money. It lets me pay for stuff online and on my mobile.

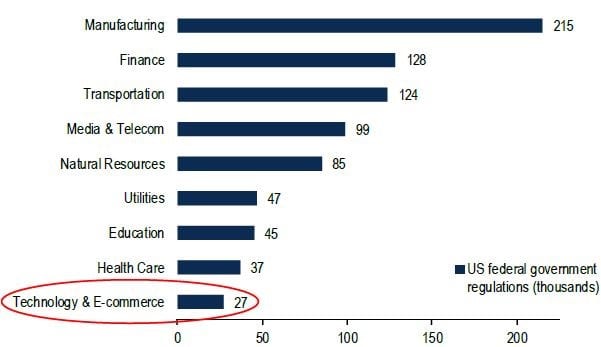

But move to something more complex like trading and investing, corporate treasury, deposit accounts and full-service banking, and that’s different. It’s more complex and has thousands of regulations and centuries of development. There is a reason why banking is regulated the way it is, and why banking has five times more regulation than technology.

According to an analysis of regulations by Bank of America Merrill Lynch in 2018, the average technology firm deals with 27,000 government regulations whilst the average bank deals with 128,000. There is a reason for this. Technology is disposable but money is not. Money needs to be safe and secure. Technology needs to be flexible and adaptable.

These are core tenets of the way forward and is why it is interesting as banking and technology melds and merges. We call it FinTech – the integration of Finance and Technology – or some call it TechFin – the integration of Technology and Finance. I call it change, and I call it dramatic change.

Those approaching technology from finance will be firmly grounded in rules and regulations, safety and security, resilience and reliability; those approaching finance from technology will be firmly grounded in innovation and change, adaptability and flexibility, obsolescence and upgrade.

The approaches are very different, and it is why it is very different dealing with technology through money and dealing with money through technology. They are not the same and the way in which these markets merge are not the same. Don’t get me wrong. They are merging. But the way they merge will be interesting as who is right? Is it better to deal with money with complexity of regulations or deal with technology with simplicity and ease? How do these two extremes come together?

The answer for me is that we will deal with money with simplicity and ease, but with a backdrop layer of strongly simplified regulations to keep our money safe and secure. And there is the rub. Simplifying finance and financial regulations so that we can use money as data with simplicity and safety.

A tough job, but we are all involved in making it happen whether we are in banking or technology. After all, today there is no difference.

The average number of regulations (000's) faced by firms in each industry:

Source: BofAML Investment Strategy 2018

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...