Yep, there's a clickbaiting title if ever I saw one. But it seems to be true.

Ten years ago, we had a global financial crisis. Now, ten years later, the banks are heavily regulated, their risk-capital ratios stabilised, their leverage reduced and the regulators breathing down their necks, promoting competition and supporting technology innovators. The world is safer and less likely to have another financial meltdown, right?

Urmmm, no.

Seven years ago, I forecast the next financial meltdown would occur in 2045. I think I’m wrong. It’s going to be in the next few years, but hopefully won’t be as big as the last one. Or maybe bigger.

Where’s this coming from?

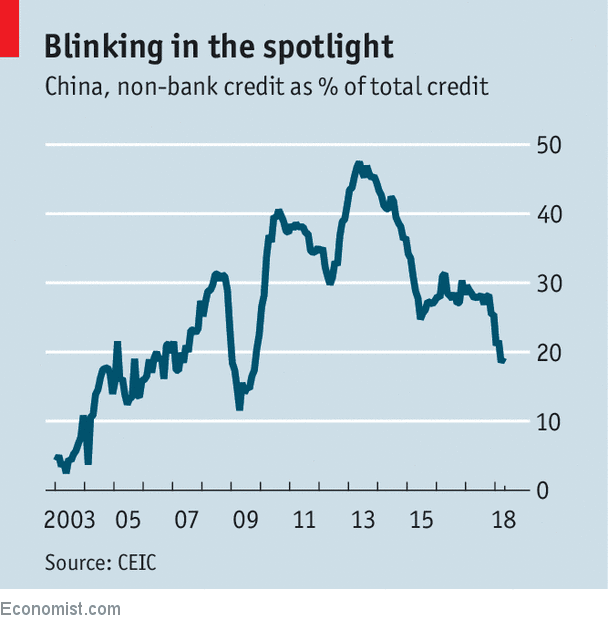

Well, I’ve heard over and over again that China’s economy will collapse due to shadow banking. It hasn’t, yet, but it is of concern. As Bloomberg reported last year:

Shadow banking in China has ballooned into a $10 trillion ecosystem which connects thousands of financial institutions with companies, local governments and hundreds of millions of households. The practice is now at the center of a Chinese government-led regulatory crackdown aimed at defusing financial risks that threaten the wider economy. Unlike in the U.S., traditional commercial banks drive shadow banking, or unregulated lending, in China. That’s because the banks have been able to keep shadow-banking assets off their balance sheets, thereby sidestepping regulatory constraints on lending.

From The Economist

A $10 trillion meltdown in China would be a pretty big issue. No wonder the government is acting upon it but at a high cost. For example, the peer-to-peer lending markets that had millions of Chinese workers yuan saved collapsed last summer, driving thousands of people into mental breakdowns. Not a great story. From The Financial Times:

About 169 million Chinese, or about 12 per cent of the population, have invested in wealth management products online, a rise of 66 per cent from two years ago, according to a Moody’s report published this month. Essentially, they are putting money into the shadow banking system.

China’s growth was predicated upon access to funding at low cost. That funding came from Chinese savers, and that’s what the PRC are now trying to sort out. From The Economist:

THE teller at ICBC, China’s (and the world’s) biggest bank, ushers a new, well-heeled customer into a private room. It is not for VIP treatment but a stern warning. The customer wants to invest in products offering higher returns than a basic savings account. The teller fixes a camera on her and reels off a series of questions. Are you aware that prices can go down as well as up? Do you understand that the bank does not guarantee this product? Only when the customer has been recorded saying “yes” does she get her wish.

Some complain that these videotaped agreements, now mandatory at Chinese banks selling similar investment products, feel like interrogations. But for the financial system, they are a step away from the precipice.

But hey, that’s China. We’re safe in Europe aren’t we?

Urmmm, no.

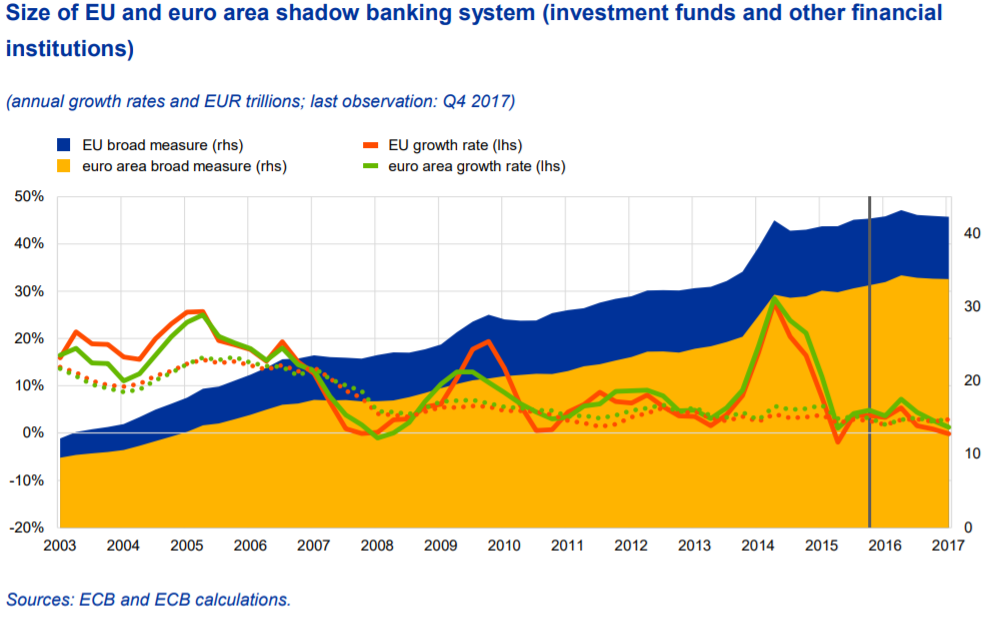

According to Richard Portes, Co-Chair of the European Systemic Risk Board (ESRB) Committee on Shadow Banking:

“The picture is different in the European Union. Here, the shadow sector now accounts for perhaps 30–40% of total financial intermediation. But it is growing. Between 2012 and 2016, shadow banking as broadly measured expanded by almost 40% in the eurozone. The reasons are quite easy to divine. Banks have been forced to reduce their leverage and new lending has been low. And with the banks contracting, in what looks like a classic case of regulatory arbitrage, the increased intensity of banking regulation has prompted activity to migrate to the more lightly regulated non-banking sector.”

Source: EU Shadow Banking Monitor, September 2018

Should we worry about EU shadow banking? Well, to be honest, I’m more worried about EU banks, but regardless, we do have an issue. In an interesting report on the connectivity between EU banks and the rest of the world came up with some interesting insights:

In a recent paper (Abad et al. 2017), we aim to fill this gap by mapping the exposures of EU banks to shadow banking entities using a unique dataset collected by the European Banking Authority (EBA) in March 2015. We find that 60% of EU banks’ exposures are to shadow banking entities domiciled outside the EU, with approximately 27% of the total exposures to US-domiciled shadow banking entities.

Ah, but exposure to America is not an issue is it? After all, America is the global superpower, AAA rated and solid gold, isn’t it?

Urmmm, no.

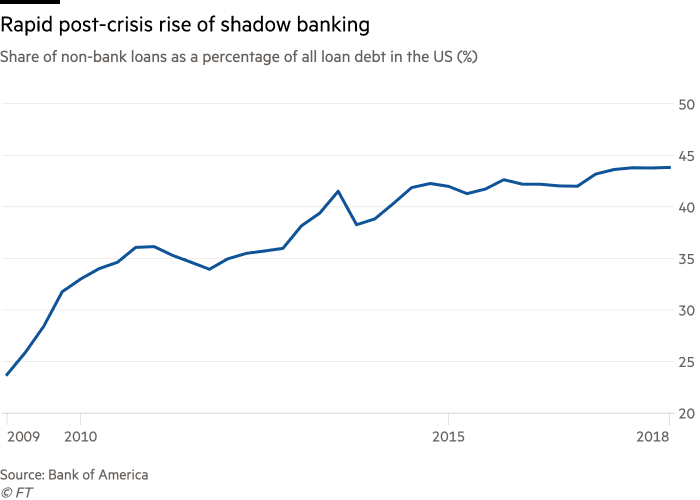

A fascinating insight into the US shadow banking markets was revealed by The Financial Times this week:

“There are a lot of parallels with the subprime crisis,” (head of a credit hedge fund) concedes. “As long as [companies] can keep refinancing things are fine. But if there are redemptions then it means some people won’t get a seat on the musical chair. Someone will be crying.” [Chuck Doyle, Managing Director of Business Capital] says that lending standards have improved a little but is confident that the recent boom will end in tears — especially in the shadiest “merchant cash advance” part of the market, where companies get a quick shot of money by selling their receivables at a discount. “MCAs are the crack cocaine of the credit market,” he says. “It’s going to get interesting, for sure.”

The rise of shadow banking in the US markets is made clear by this chart from the FT article:

And is best summarised by this comment, again from the head of a credit hedge fund:

“They’re lending to complete shit at a spread of 100-150 basis points above high yield.”

That doesn’t sound good, does it?

All in all, we have a $50 trillion shadow banking challenge, which equates to around 15 percent of all global financial assets. If it were to all meltdown? Well, of course it won’t, will it?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...