In my presentations I regularly talk about legacy Europe and America and leapfrog countries from China to India to Kenya to Colombia. The reason the latter countries are leapfrogging Europe and America is that they didn’t have a large, ingrained existing infrastructure for payments and financial transactions in place until this century. Meantime, most of the European and American infrastructure was implemented in the 1970s.

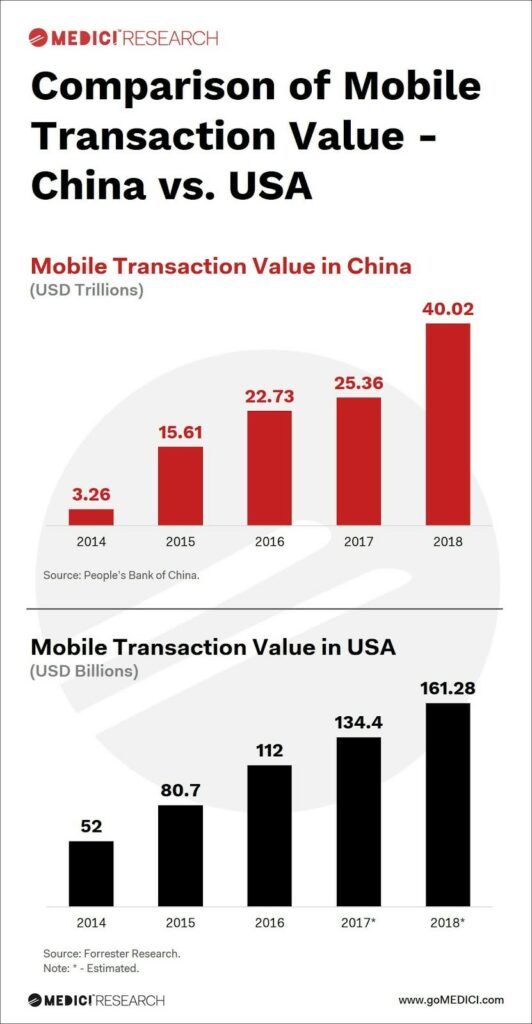

This point was rammed home by a GoMedici article I saw over the weekend, with a nice chart I can slip into my future presentations.

This clearly shows that chasm between China and America, where over $40 trillion is transacted by Chinese consumers through their mobile phones compared to a measly $200 billion in America*. Now, OK, China has a lot more people but, even so …

Then it occurred to me part of the reason for the slow to change world of America is because people are used to the old infrastructure. They have EMV, Chip & PIN and contactless coming, but they still like to use the good magnetic stripe and ID. They still send checks/cheques. Believe me, because I got one the other day in the post. I haven’t seen a cheque from anywhere else for a year or two now.

I wondered then if it’s not that consumers are slow to change, but the old infrastructure firms? Maybe Visa and MasterCard don’t want American citizens to switch to mobile payments because they have so much infrastructure out there already: POS, PIN terminals and now contactless systems. Making all of that redundant overnight would be a big sunk cost.

Similarly, the banks are still geared up for cheques, cheque processing and cheque books. It’s hard to get rid of that stuff. Look at the UK where the good old Payments Council said cheques would be eradicated by 2018 back in 2012. The outcry was huge, and so they had to reverse decision and UK banks are still happily processing cheque payments.

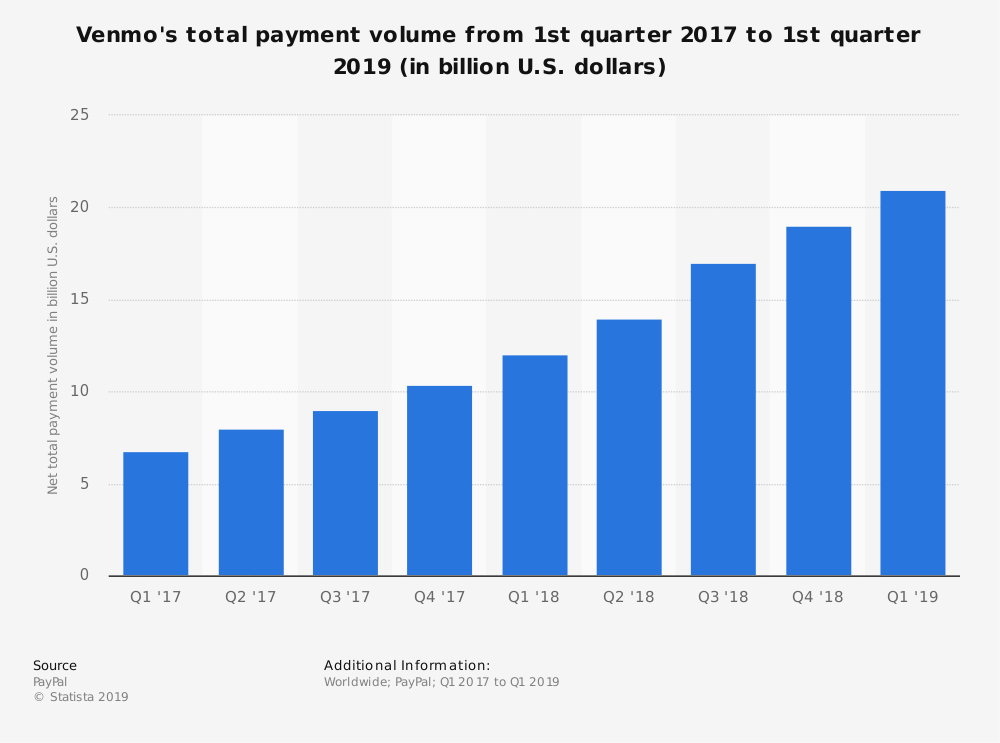

In fact, what gets interesting here is that we pat ourselves on the back for moving at a pace in the “war on cash”, but the war on cash is driven by the card companies. What they want is to replace cash with cards, not mobiles. Is that why the big-time rollout of Apple Pay and Android Pay has gone pretty much nowhere? And even with PayPal’s big drive towards mobile payments with Venmo, well, it’s still got a very long way to go …

… when compared with Zimbabwe, where over 90% of the economy runs on mobile phones.

Bottom-line: where there are vested interests to keep legacy in place, a change to the modern world of mobile money is unlikely to happen in the near-term.

* Forrester estimates are two years old. The US bank-issued mobile wallet Zelle processed almost $40 billion in mobile payments in Q1 2019, up from $35 billion in Q4 2018, whilst Venmo is now achieving over $20 billion a quarter. Add on Apple Pay, Samsung Pay and Android Pay, and we will easily see over $300 billion in mobile payments in US markets in 2019.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...