Following on from Facebook’s announcement of its own digital currency Libra, the key regulatory body of banking – the Bank for International Settlements (BIS) – which sets standards like the Basel capital reserve requirements, has stepped into the debate and produced a report on their view of the threat and opportunity of Big Tech to banking.

The report is actually quite positive about Big Tech entry into financial services, as it can reach the parts of the system previously unreachable, banking the unbanked and underbanked. However, it does call for policy regulators to create a level playing field between banks and Big Tech and, bearing in mind that the average bank deals with five times more regulatory oversight than the average technology firm, that means a lot more Big Tech regulation.

The full report can be found here, with the key takeaways being:

The entry of large technology firms ("big techs") into financial services holds the promise of efficiency gains and can enhance financial inclusion.

Regulators need to ensure a level playing field between big techs and banks, taking into account big techs' wide customer base, access to information and broad-ranging business models.

Big techs' entry presents new and complex trade-offs between financial stability, competition and data protection.

The introduction of the report begins:

Technology firms such as Alibaba, Amazon, Facebook, Google and Tencent have grown rapidly over the last two decades. The business model of these "big techs" rests on enabling direct interactions among a large number of users. An essential by-product of their business is the large stock of user data which are utilised as input to offer a range of services that exploit natural network effects, generating further user activity. Increased user activity then completes the circle, as it generates yet more data.

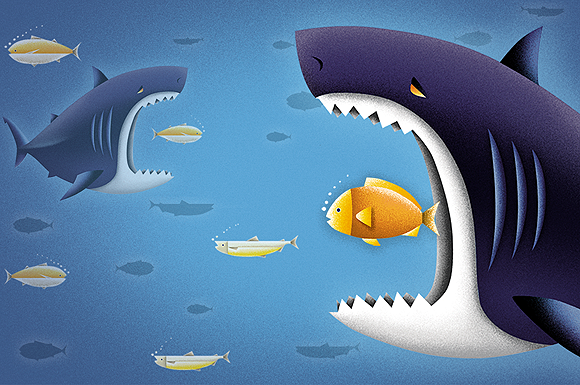

Building on the advantages of the reinforcing nature of the data-network-activities loop, some big techs have ventured into financial services, including payments, money management, insurance and lending. As yet, financial services are only a small part of their business globally. But given their size and customer reach, big techs' entry into finance has the potential to spark rapid change in the industry. It offers many potential benefits. Big techs' low-cost structure business can easily be scaled up to provide basic financial services, especially in places where a large part of the population remains unbanked. Using big data and analysis of the network structure in their established platforms, big techs can assess the riskiness of borrowers, reducing the need for collateral to assure repayment. As such, big techs stand to enhance the efficiency of financial services provision, promote financial inclusion and allow associated gains in economic activity.

At the same time, big techs' entry into finance introduces new elements in the risk-benefit balance. Some are old issues of financial stability and consumer protection in new settings. In some settings, such as the payment system, big techs have the potential to loom large very quickly as systemically relevant financial institutions. Given the importance of the financial system as an essential public infrastructure, the activities of big techs are a matter of broader public interest that goes beyond the immediate circle of their users and stakeholders.

There are also important new and unfamiliar challenges that extend beyond the realm of financial regulation as traditionally conceived. Big techs have the potential to become dominant through the advantages afforded by the data-network-activities loop, raising competition and data privacy issues. Public policy needs to build on a more comprehensive approach that draws on financial regulation, competition policy and data privacy regulation. The aim should be to respond to big techs' entry into financial services so as to benefit from the gains while limiting the risks. As the operations of big techs straddle regulatory perimeters and geographical borders, coordination among authorities - national and international - is crucial.

And ends with a call to change how firms are regulated.

Traditionally, financial regulation is aimed at ensuring the solvency of individual financial institutions and the soundness of the financial system as a whole. It also incorporates consumer protection goals. The policy instruments used to achieve these goals are well understood, ranging from capital and liquidity requirements in the case of banks to the regulation of conduct for consumer protection. When big techs' activity falls squarely within the scope of traditional financial regulation, the same principles should apply to them.

However, two additional features make the formulation of the policy response more challenging for big techs. First, big techs' activity in finance may warrant a more comprehensive approach that encompasses not only financial regulation but also competition and data privacy objectives. Second, even when the policy goals are well articulated, the specific policy tools should actually be shown to promote those objectives. This link between ends and means should not be taken for granted. This is because the mapping between policy tools and the ultimate welfare outcomes is more complex in the case of big techs. In particular, the policy tools that are aimed at traditional financial regulation objectives may also impinge on competition and data privacy objectives, and vice versa. These interactions introduce potentially complex trade-offs that do not figure in traditional financial regulation.

If you prefer, here’s a short two-minute summary of the thinking with Hyun Song Shin, Economic Adviser and Head of Research for the BIS:

And a longer 14-minute podcast.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...