Building on yesterday’s blog about reports that are useful, I just found another one from UK Finance (formerly the British Bankers Association) on how they see AI in banking, released last week.

The report is in two parts that address what they see as the two key issues banks face in using AI:

- they see AI as a technology and not as something that requires organisational change; and

- they don’t know how to scale the usage of AI from an innovation stage to an enterprise-wide service.

Interesting. Here’s the conclusion:

The financial services industry has a rich history of analysis and decision making drawn from large data sets. With the wider availability, cost and ease of use of AI solutions, there is now an opportunity for viable and useful access to data driven-decision making at scale. However, with the opportunity comes the need to use AI responsibly and to consider the broader reaching implications of this transformational technology’s use.

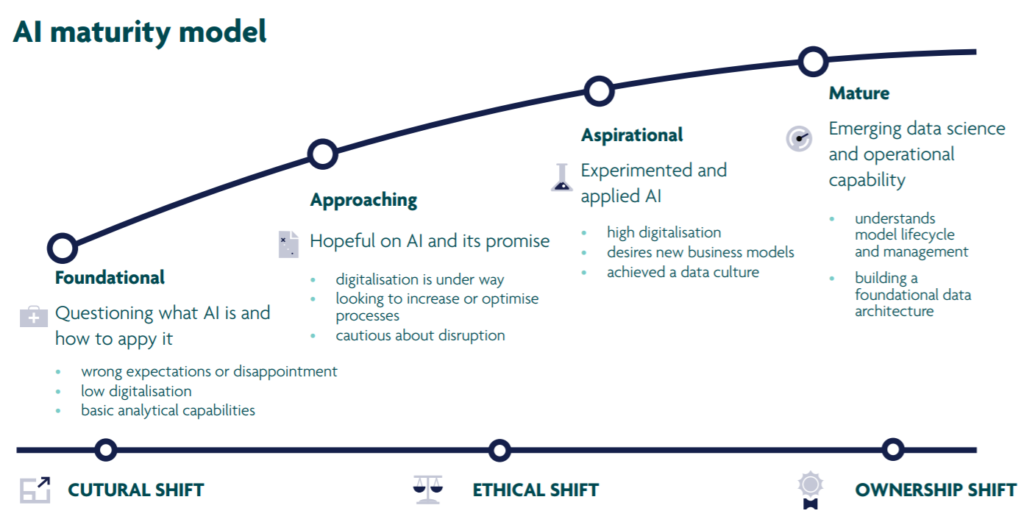

In this paper, we’ve explored the different stages of maturity in the AI journey and introduced a maturity model to support this process. As part of this journey organisations will need to consider how they grow and adapt their strategy, culture and organisation in parallel with technical capabilities. This is key for firms to holistically support the successful adoption of AI in a responsible manner, ensuring accountability for AI systems.

Scaling AI ambitions successfully past first initiatives brings new considerations. As AI projects typically require greater upfront investment than traditional solutions, and increased ongoing maintenance, understanding the medium to long-term ROI becomes an essential tool in understanding the right time and place to deploy an AI system – or not.

To avoid the first pitfall – looking at AI simply as a technology tool, and not considering the wider cultural and organisational changes necessary to become a mature AI business. To avoid the second pitfall – failing to implement and scale AI – success requires ongoing collaboration. AI skills and expertise should not just be in the domain of technology teams; instead, the opportunities, implications and responsibilities should be shared across an organisation.

Across organisational change and AI implementation, organisations should also consider how their governance arrangements enable the use of AI. The governance layer needs to be appropriate to a firm’s level of AI maturity and the level of new risk introduced but also must be built to be rapidly scalable as needs demand. The introduction of this governance is the time firms should step back and consider the broader implications of AI and its appropriate use. This paper has introduced four ethical principles of fairness, privacy and security, transparency and accountability as a starting guide for firms to consider.

Building a solid foundation now for governance for AI will stand organisations in good stead, both to manage programmes and spend effectively, and deliver high quality services to customers. Skilled and experienced AI resource is still scarce so expanding awareness of AI at both business and technical levels is vital to taking AI from experiment to broadscale production usage.

As AI is an evolving field, this paper cannot answer every question. It is clear however that by having an organisation-wide approach, and the tools to implement AI in the most appropriate areas, firms can take advantage of AI while still delivering resilient, responsible and high-quality services to their customers. It is hoped the practical tools and approaches in this paper will help firms begin this process and position them well for the future.

The full paper can be downloaded here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...