A big area of debate in banking that has been around since the 1990s is how to make banks more accountable for sustainability. I talk about this a lot these days as 71% of all Green House Gas (GHGs) emissions emitted on planet earth since 1988 came from just 100 companies. If we could change the funding of those firms, their lines of credit and loans and their overall financing, we could change the world of climate damage faster than we think.

This has come up more and more lately, as the UN’s Principles for Responsible Banking appeared, we have had lots of dialogue about Corporate Social Responsibility (CSR) and such like, we have seen demonstrations against banks over fracking and mining, and more. Equally, climate activism has been on the rise from groups such as Extinction Rebellion and individuals like the teenager Greta Thunberg who has been notable as a force for thinking.

The problem is that there is a dark side in finance to all of this. A great example is BlackRock. BlackRock has $6 trillion in assets under management making it the largest asset management firm and one of the most powerful investors in the world. BlackRock CEO Larry Fink stated in his 2018 annual letter that companies must make positive contributions to society, and acknowledged his firm's responsibility to encourage this shift.

“Society is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.”

This is a laudable change, as investors and pension funds are the real drivers of change. If your investors say No, then it’s very hard to continue a practice that your shareholders disapprove of.

BlackRock continue this theme in many parts of their website. Here are their lines on sustainability:

“In order to deliver the best outcomes to our clients, we are also focused on the sustainability of BlackRock’s performance over the long-term. This requires taking into account environmental, social and governance issues that have real and quantifiable impacts over the long-term for our firm, our people, and the communities in which we and our clients live and work.”

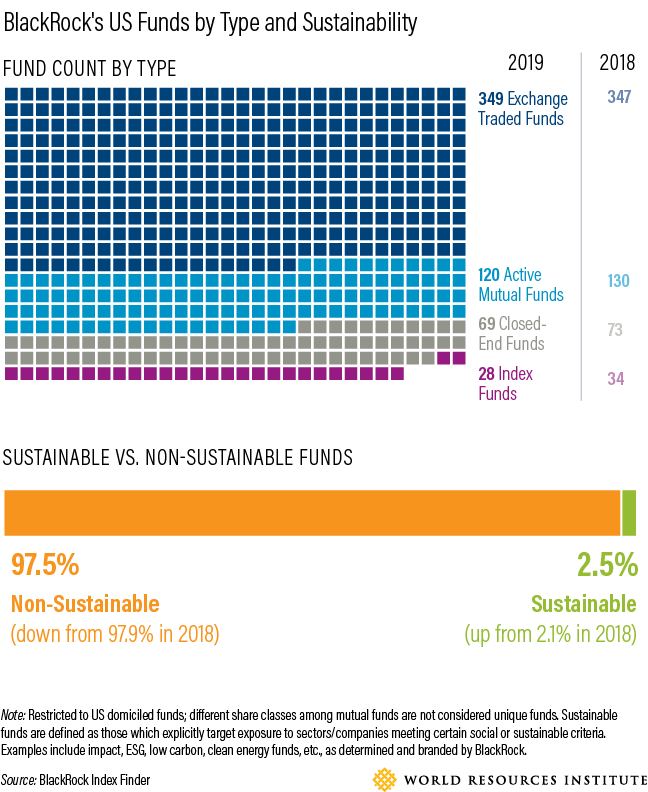

All well and good and it is not a new thing. Five years ago, The Financial Times blasted a headline that Europe was following BlackRock’s example in targeting a squeeze on funding of fossil fuel firms. However, it’s all smoke and mirrors. According to Vice and a coalition of activists known as BlackRock’s Big Problem, BlackRock is the world’s single biggest investor in companies that develop coal plants and also a large investor in companies that produce oil and gas. The group recently released research showing that funds the company markets to investors as “sustainable” are instead contributing to climate change.

Source: Greenbiz

It is similar to the story of many institutions who claim publicly to be green and are privately not. For example. Barclays are one of the founding members of the UN’s Principles for Responsible Banking whilst owning Britain’s largest fracking company, and being a lead supporter of fossil fuel firms.

This hypocrisy will need to change if the SDGs are to be reached, and climate damage reverted. However, changing this hypocrisy is darned difficult as it’s in the very nature of finance to focus upon short-term returns at the exclusion of long-term balance.

When I first got involved in this, it was back in the late 1990s when the late Belgian banker Bernard Lietaer produced a book on the future of money. The book fascinated me as it was attempting to lay a method of using money for good, based on investing for the long-term. The book is a key platform for anyone interested in learning about community currencies, sustainable finance and long-term investing for the good of society.

Bernard has since passed away, but his thoughts and energy live on. In fact, just before he died he was instrumental in one of the largest ICOs for Bancor, raising $150 million in 2017 for its sustainable crypto tokens. Bancor is still going with Co-Founder Galia Benartzi recently interviewed by CryptoNewsZ.

Community currencies are also a strong feed into Long Finance, another area I’ve been supporting through the Financial Services Club and other activities. Long Finance’s goal is “to improve society’s understanding and use of finance over the long-term. In contrast to the short-termism that defines today’s economic views, the Long Finance time-frame is roughly 100 years.”

All very good. The question is how to align the short-termism of the core banking community whose priority is shareholder return, with the long-termism of the sustainability community whose priority is good for the planet and for society.

I don’t know how that plays out, except that companies like BlackRock and the fund management and pension fund community will be critical to this. As one person stated at a recent event I chaired:

“The issue is that I run a pension fund but how can I ensure that there will be anyone left to pay a pension to?”

If we wipe out this planet investing in unsustainable companies and their activities, that is the core issue. We have to change our thinking.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...