A regular question that comes up is: When will the Fintech bubble burst?

My claim is that it won’t under my watch, as this is as big a restructuring of banking and finance as the internet has been for commerce and trade. The latter change is still underway after a quarter century – it doesn’t stop – and the same applies to FinTech, as can be seen by the numbers.

Last year, $111.8 billion was invested in FinTech start-ups, double the amount of the year before, according to KPMG’s numbers. Accenture has different numbers ($55.3 billion), but agree the amounts doubled in 2018.

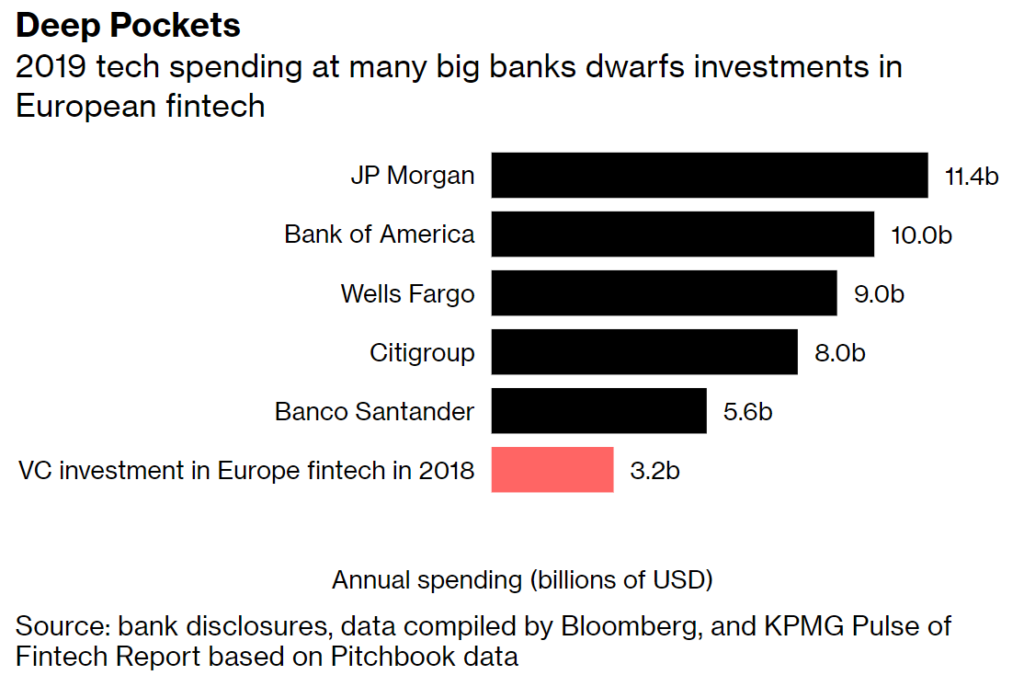

Banks are throwing billions of dollars into their own digital reformations, as well as billions into FinTech start-ups, collaboration and partnerships.

Source: Bloomberg

In particular, I thought it was interesting seeing that the leading investment firm in FinTech, Andresseen Horowitz, is doubling down on the sector. They hired Credit Karma’s Anish Acharya as their latest general partner, in an effort to beef up its investing team. Talking about the announcement with CNBC Alex Rampell, a partner at Andreessen Horowitz, said:

“Fintech is becoming a key part of the monetization strategy for more and more companies. There are more fintech companies showing up at our door — we wanted more expertise around the table there … because of mobile phones, there are a lot of opportunities for money to change as well. We think that’s going to accelerate.”

Alex said the hire of Anish was proactive and based on the firm’s view that major parts of S&P 500 are going to be “remade” by fintech — a sector that he said is “on fire” at the moment.

I agree but this leads to another question that pops up regularly: Will London lose its FinTech crown?

My view is that it will not, and that is supported by the numbers and the majority of people. According to Innovate Finance:

- Investment in UK FinTech rose by 18% to $3.3 billion in 2018

- Growth private equity investment rose 57% to $1.6 billion, while venture capital dipped slightly to $1.7 billion as the UK FinTech sector enters a new stage of its growth journey, ahead of its peers in Europe

- The UK kept its position as a world leader, ranked third globally in VC investment behind China and the US

- Global VC investment in FinTech in 2018 reached a record $36.6 billion across 2,304 deals, a 148% or 2.5x increase year over year

London continues to be the preeminent centre for FinTech in the UK, with over 80% of FinTech startups receiving venture capital headquartered in London and claiming over 90% of capital invested.

Brexit? Bojo? No-deal?

Well, that seems to be having zero impact. In a further update from Innovate Finance six months after the above stats were published:

The UK’s standout fintech sector has once again broken records, hitting a new high of $2.9bn (£2.3bn) in funding in the first six months of 2019. The amount represents the highest intake of investment in a half-year period to date, and is equal to approximately 85 per cent of the sector’s total funding in 2018.

Data from Innovate Finance revealed investment in the first half of 2019 was up 45 per cent compared to the same period last year, and nearly doubled the inflows recorded in the second half of 2018.

Fintech is the highest-performing part of the UK’s tech industry, which contributes more than £130bn to the economy every year. London startups dominated the UK’s intake in the first six months, representing 90 per cent of all investment flowing into the fintech sector.

However, I picked up an interesting read by Russell Bennett, CEO of Fraedom, in The FinTech Times last week, asking the question of whether London will keep its crown, and he offers a more balanced view.

There is no denying that fintech is on the rise the world over and while the UK and US were once seen to be paving the way, the market is growing rapidly in Asian countries in particular. According to research from PwC, based on investments and number of startups China and India are the largest fintech ecosystems and investments in Asia Pacific fintech totalled US$14.8 billion last year. However, this is still behind Europe which saw investments of $26 billion in just the first half of 2018 with the UK gaining over $16 billion of this. Therefore, it seems that even if London is no longer the fintech capital of the world, it’s certainly among them, with San Francisco appearing to be its closest rival.

True.

Either way, the outlook for the future of FinTech is bright, will continue to be bright and London's light burns the brightest.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...