I recently attended a FinTech conference where Henry Ma, Vice President & Chief Information Officer of WeBank, presented an update of how the bank is faring in China.

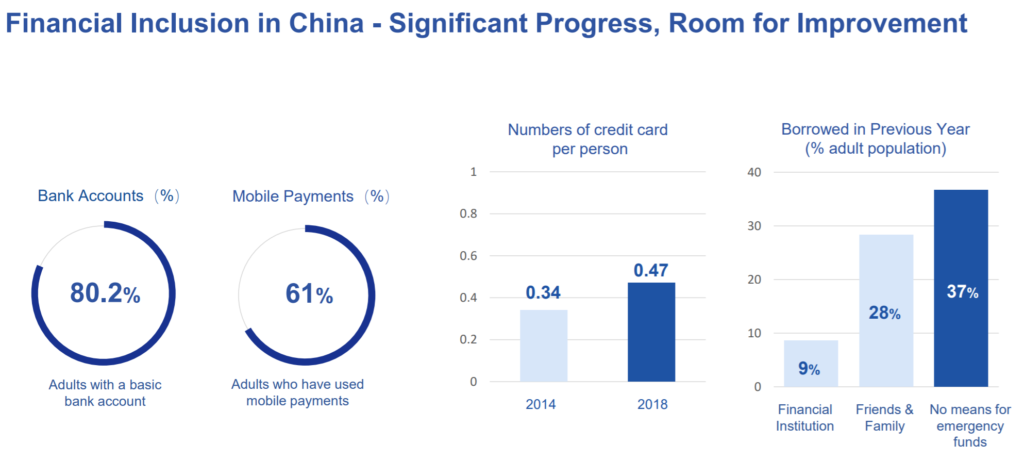

For those unaware, WeBank is the offshoot of WeChat Pay, WeChat and Tencent, and focuses upon financial inclusion in China. This may be surprising for some, as four out of five Chinese citizens already have a basic bank account, but that means that millions do not have one. In fact, most Chinese have little access to credit – there is an average of 0.47 credit cards per person – and most people have to borrow off friends and family if they need funds.

Therefore, Tencent created WeBank to address this, with a focus on blue-collar workers. It’s an IT-led, digital-first bank, with over half the employees of WeBank working in IT (that compares with two-thirds at Ant Financial (63%), a third at Goldman Sachs and a fifth at JPMorgan Chase (20%)). I particularly liked Henry’s analogy that they based the bank on ABCD:

- A for Artificial Intelligence;

- B for Blockchain;

- C for Cloud; and

- D for Data.

This is to handle high volume, low value transactions. Most of the users are dealing with small amounts – the average loan is around RMB8,100 (USD$1,150) – and this means that the platform for WeBank has to be able to handle volume at low cost too. This is where the stand-out figure appeared from Henry’s presentation:

The average cost for a WeBank customer per account per year is just RMB3.6 (USD$0.50) to administer … compared to RMB20-100 (USD$3-15) a year for a traditional bank.

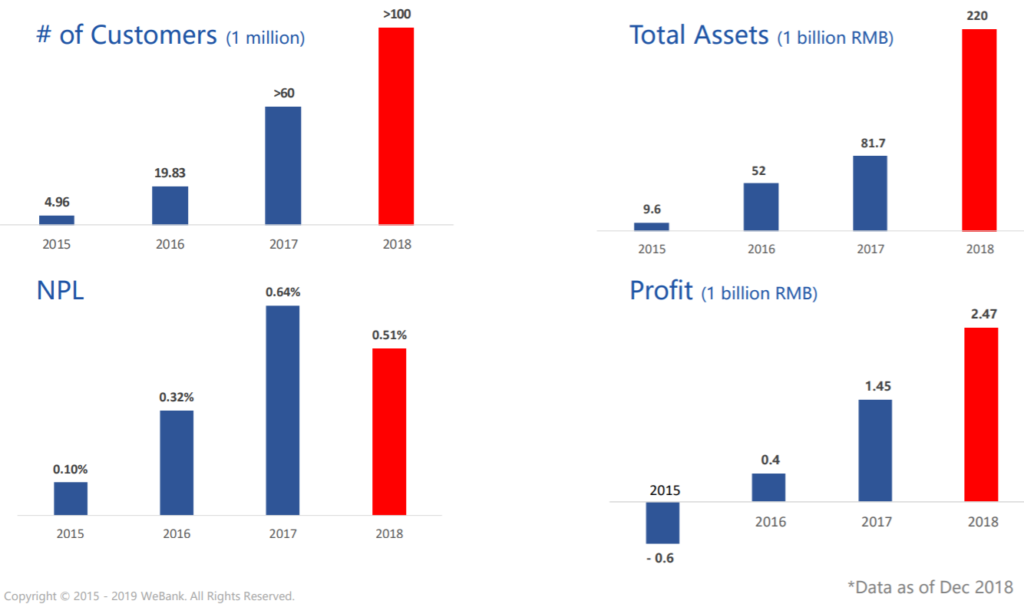

The digital-first platform that WeBank has deployed is running at 20 percent to 95 percent lower cost to run than a traditional banks IT. No wonder so many traditional banks are visiting WeBank to see how they do it. It is also no wonder that they are profitable and growing rapidly, from a base of unbanked customers.

Interestingly, WeBank’s major competitor MYBank from Ant Financial, also focuses upon financial inclusion. Whilst WeBank saw profits of near 2.5 billion RMB (USD$350 million), MYBank’s 2018 prfoit was 670 million RMB (USD$95 million) in 2018.

Also launched in 2015, MYBank is also focused upon assisting SMEs. In announcing their 2018 earnings, MYBank’s new president Jin Xiaolong (金晓龙) said that since its inception MYBank’s main focus has been to effectively serve micro and small enterprises in order to resolve their “pain points” and problems.”

“Our goal was originally to be the bank that services the largest number of micro and small enterprises with the smallest profits.”

According to Jin as of 30 April 2019, MYBank has served over 16 million SME customers, the majority of which are “street side businesses” that comprise a huge amount of China’s private economy.

“For each loan of 10,000 yuan that we give, we can bring shops earnings of 30,000 – 50,000 loans” and, “according to a survey from the National Bureau of Statistics, each small-enterprise can create employment for 7 to 8 people, while each individual industrial and commercial entity can create employment for 2.9 people.”

These banks are integral to China’s future economy. Meantime, if you wanted to see the complete presentation from Henry Ma, here it is:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...