I saw a list on Facebook the other day about being old. It was a note that said:

“How to tell when you’re an adult:

- you gain 30lbs overnight

- you’d rather sleep in than go out

- everything hurts

- comfort comes before style

- everything feels like a chore

- you’re always annoyed”

It kind of hit home as I score on many of these points, but particularly the last one. Yep. Grumpy old man and all that.

The latest thing to annoy me is Sky Broadband, Easyjet, Airport Security, Airport Lounges (that are full and refuse entry) ... well, airport anything really. What is clear, and I've blogged about this before (see Vodafone and Dell), is that everything works well digitally when you can self-service and not deal with any humans. However, as soon as that breaks down and the humans step in, they have this clever knack of just completely messing it all up. The latest and worst example is American Express, or AMEX for short.

This great customer focused service leader of the world has no idea about customer service, when it comes to a platinum card corporate user - me - responding to their message. The message was asking me if I had used my card on Skrill that day, to make a £101 transaction. My answer was no. What then proceeded to happen is unexpected and wrong, but hey, it’s AMEX. What should have happened, as does with Metro, Monzo or Starling, is that I would then just monitor my card from the app and block it temporarily. As it’s AMEX, the fact that I rang them in response to their request and said that I didn’t use the card on Skrill, resulted in their fraud team immediately cancelling my card. They didn’t ask me if I wanted it cancelled. They just cancelled it there and then on the call, leaving me high and dry with no way to pay.

I asked them why they had done that, and they said it was because I just told them there was a suspicious transaction. I said OK, so how do I get a new card? and they said someone will call yo in the next 48 hours. Great. At that point, I was about to head off on travels to Vladivostok via London and Seoul, and said that no one could call me for a week as I would be spending most of the week at 40,000 feet. I also said that I was not happy about the card being cancelled, as it’s my primary card, and they should have asked me if that was ok. Tough, they said. Fraud is fraud.

Great.

A week later, after returning from Russia, I rang AMEX - no one called me - and asked about my card. They said it all looks clear now and could issue a new one. I asked them to send it to Poland, where I live half the time, and they promised it would be there within five working days via DHL. All good.

A few days later, I get an email and text message from the identity fraud team - not the same as the fraud team or customer service team - demanding that I ring them with a case number. So I do that. I talk with a Callum, who has little customer empathy, and he takes me through a security check and then asks: “did the transaction ask you for a code via Safekey?” I said yes, I got a text and email with a Safeky code, even then though the transaction had been approved. “Oh, that’s good, your account is still safe then”, Callum said, which surprised me. He then told me he could issue a new card. I said, but a cards on the way via DHL to Poland last week. He said no, that card is now cancelled and a different new one would be sent. I said, but I can’t get that card now as I’m on travels for the next 14 days. He said, tough.

Great. Now high and dry, with no way to pay for three weeks.

The only reason I recount this story here is that AMEX is meant to be a great customer service organisation but, in this case, it was clear to me that their fraud, identity fraud and customer service teams sit in separate call centres in different camps. Each one wants a security clearance to get through and, if you call the wrong one, then you can go round and round in circles trying to find the right one to talk to. I made one call where I started with customer service and their security clearance, only to be transferred to the fraud team and their security clearance, who told me they had to refer me to the identity team with their security clearance. Suffice to say I hung up.

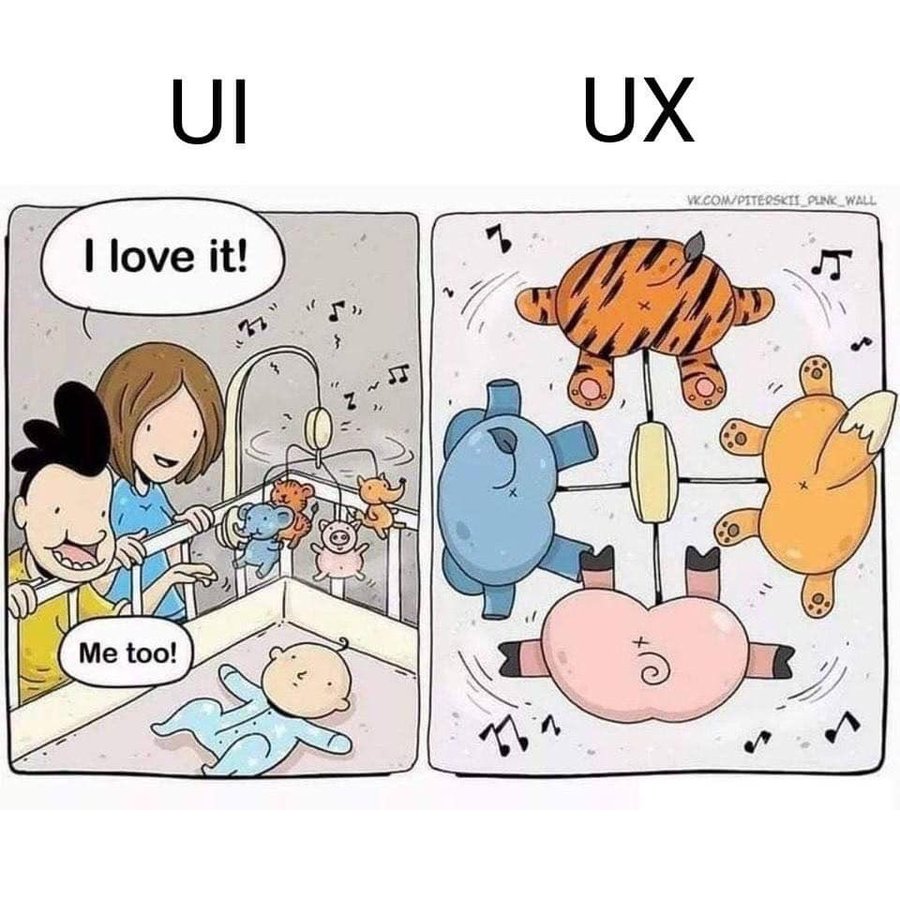

In fact, it's now been seven calls, hours of my time, and still no card. And the app has no functionality to handle this situation. It's all telephone based. In particular, what really irks, is that card companies are still working on physical tokens, 1990s service centres and scripts that make decisions on a customer’s behalf without the customer’s say-so. Kind of reminds me of this really.

Here’s to you AMEX and, fyi, you still haven't sorted out the issue, even though I raised a complaint a week ago and it's now three weeks since this process started. Even worse, you now tell me it is under executive review and they will deal with the complaint, which cannot be handled any longer by the front line team. And the executives are not contactable and have not bothered contacting me. Bottoms.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...