I was reflecting on things again. Dangerous. My reflection was on when I grew up. My mum and dad went through the second world war. They feared for their lives and for our future. There was no Europe, just a fear of Germans and Nazis, of fascism and communism, of extreme lefts and extreme rights. When they invested their hopes and fears in me, their main hope was that I grew up and got a good job. I wanted to be David Bowie. They wanted me to be the Chief Executive of a big corporation. Our aspirations did not align but, because they were my parents, I did as they asked. I looked for a good job. A job for life.

The bottom line was that the post-War generation hoped their kids would have a stable and successful life, earn well and work well. And that’s kind of what I tried to do.

It didn’t work out. I’ve had six jobs over twenty years and then independent for a long time. I’m happy being independent and would describe myself now as an entrepreneur, businessman, consultant, blogger, author, researcher, analyst … I do a lot of different things. In fact, it amuses me how many people box me into a specific area – how long have you been a journalist? – when I’m actually a mix of lots of things, roles, jobs and experiences.

Anyways, the overall theme was that my folks wanted me to get a job-for-life.

Now, there’s no such thing as a job-for-life. In banking or any career, it’s unlikely you’ll stay with the same firm for long. Even folks who work for bright young start-ups leave after a while. In fact, as I googled What does Gen Z hope for? the answer was delivered by Quartz.

Gen Z are the kids coming into the workforce today. Born on the internet, they date from the 1990s and are highly career focused. “58% say ‘bring it’ to working nights and weekends for a better salary, compared to 41% across all working generations.”

The most important thing?

Hmmm. Interesting. What about millennials?

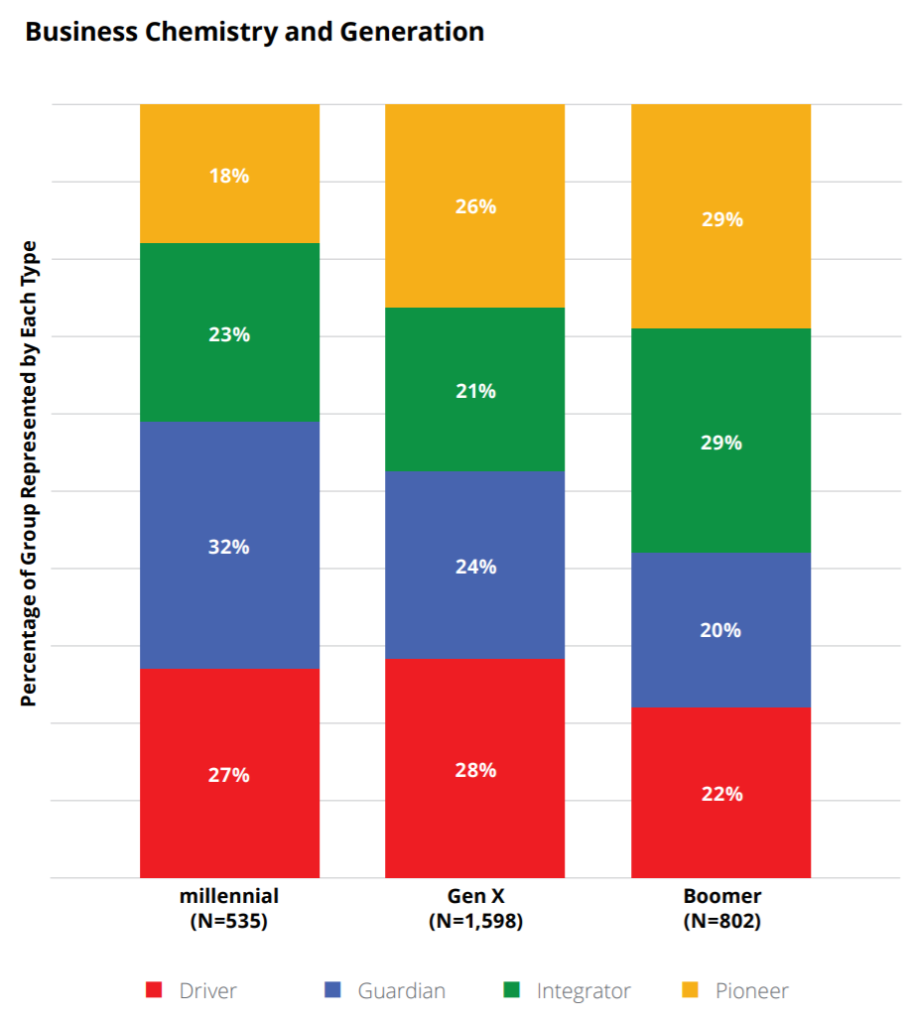

Millennials are in their 30s and 40s, born in the 1980s. An interesting analysis by Deloitte breaks these people down into four categories of work preferences: Pioneers are outgoing risk-takers, while their opposites, Guardians, are detail-oriented pragmatists. Drivers are experimental competitors, while their opposites, Integrators, are empathetic diplomats.

Whilst my generation are mainly pioneers and integrators, millennials are primarily guardians and drivers.

A very different mentality. It is one that will “appreciate what’s tried and true and be averse to change”. That’s not what I would expect, but then you cannot stereotype any generation or individual. Just that they have different ideas and perspectives. For example, Generation Z grew up in the middle of a global financial crisis. As a result, they have some trust issues. According to research from the consultancy Cassandra, cited by The Telegraph, only 34 percent of US millennials and Gen Z trust banks. That’s a challenge and a good reason why so many digital bank start-ups are launching to challenge old bank thinking. Will they change it? Will the world be different?

Well, as mentioned in previous blog posts, it’s too early to say but it is certainly true that Gen Z and their successors are looking for a different way of doing things. Global Banking & Finance summarise this well:

Unlike Millennials, generational experts define Gen Z as more conservative about money because of how their young lives have been shaped by the financial recession and austerity of the early 21st century. This is creating an interest in savings and financial management that is stronger than the previous generation – for example, 56 percent of Gen Z have spoken with their parents about savings. One 2017 study has said more than one in 10(12 percent) of Gen Z have even started saving for their retirement.

There is another, seemingly contradictory side to this generation’s interest in taking greater control over their financial affairs. While they may seem to dismiss the idea of using a traditional bank, Gen Z says it prefers to do its banking face to face; in the same Raddon/Financial Brand study, 48 percent expressed this preference. This trait stems from more than just their financial conservatism but also how Gen Z are generally regarded as considerate consumers who want to dig deep into a brand.

Hmmmm … maybe it’s important to have a physical presence after all (48% of Gen Z’s surveyed by Raddon Research say they prefer to do their banking in a branch — face to face with an employee).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...