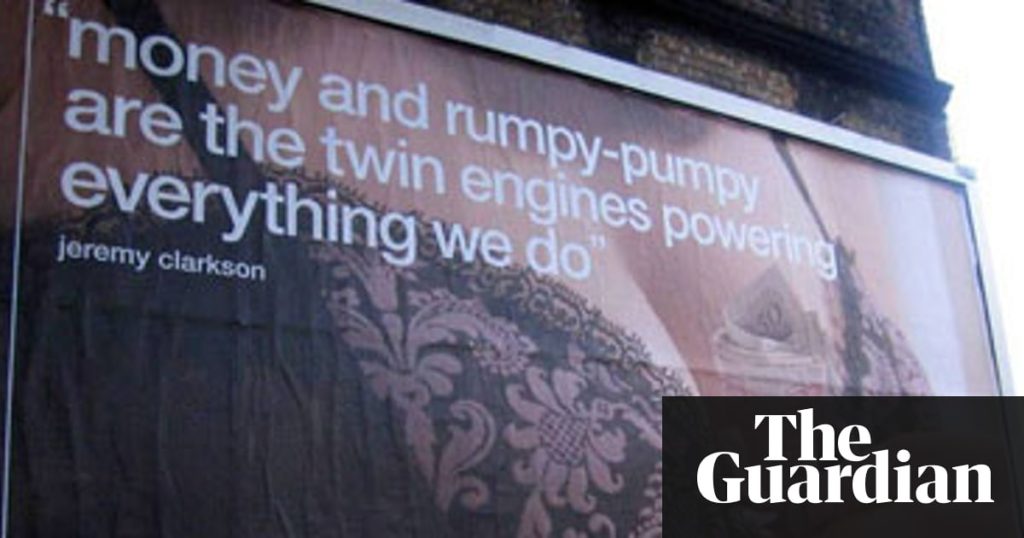

My blog often seems to return to the subject of sex, whether it be sexism or basic sex. It is for the reason that money and rumpy-pumpy are the twin engines powering everything we do, as Jeremy Clarkson so succinctly put it.

However, today I’m not writing about sex per se, but something related to it. It’s something I lingered over in the first section of Digital Human and it’s this:

Money is more to our core than any other aspect of our lives, including sex. We are more willing to talk about the issues with our sex lives than we are about issues with our financial lives. This is why the psychology of money is so wrapped up in our psyche. So many people talk about how easy it is to just download an app and look at numbers, but who are you gonna call when Google loses your money? Where’s Facebook’s telephone number? Sure, you can call Apple, but what are they gonna say when you ask for a Genius who can find your lost faster payment? These are core issues in our lives, and money is for many number one.

The prompt for writing about this today is a survey that dropped into my in-tray yesterday from deVere Group, a financial advisory firm. They surveyed 700 clients across Europe and Asia, and found that over half (56%) believed that their financial situation is a taboo subject. This dropped to one in five who were unwilling to talk about their sex lives (18%), and as for religion (12%) and politics (8%), well, you can debate that anytime.

I don’t find it surprising, although the gap between 56% who won’t talk about money compared with 82% who will talk about their sex lives is a bit of a stunner, especially as the latter is our second most taboo subject.

This is something that banks also play up to and is a reason why many people don’t switch banks. We may hate our bank, but we hate talking about our money more. I’ve also highlighted this in a few blogs about the link between financial issues and mental issues. It’s not only a taboo subject, but at the heart of our psyche and mental health.

Now, one bank recently started leveraging this issue: Lloyds in the UK. They started a marketing campaign a while ago, saying that we need to start talking about The M Word, as in M for Money.

Lloyds only surveyed the UK, but it was a more robust study of over 2,800 adults and found:

- Half (50%) of UK adults believe that talking about personal money matters is taboo;

- Two fifths (43%) of people have felt embarrassed talking about our personal finances; and

- A quarter (25%) have lied to family and friends about their personal finances.

Now, they’ve taken it a step further from being just a TV advertising campaign to being a full blown TV series, as well as investing in further research about how we think about money. It turns out for example, that being single makes you better off than being in a relationship … hmmm, no real surprises there as we are all better off if we are just lonely and bored.

Anyways, this theme of money being something we don’t talk about much is a real core reason in banking why people don’t move their money around. Banks talk about trust. It’s not trust in the bank, the people in the bank or the bank brand. It’s the trust in the belief that the bank won’t lose our money as they’re licenced. Then, it’s a further trust that it’s safer to leave our money where it is than move it somewhere else.

There’s been lots of books written on this subject, summarised nicely on a Forbes blog by Prudy Gourguechon:

There “are three key things to know about the psychology behind our personal relationships with money:

- Emotion plays a huge role.

- Anxiety and avoidance create a vicious cycle.

- Psychologically, you can’t entirely escape your family and your past.”

Yep. Money is complex and more secretively held close to our hearts than any other aspect of our lives. For this reason, when the cheerful folks state that banks will be disrupted and destroyed, I say think again. Actually, rather, just THINK.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...