I’ve said on a number of occasions recently that banking and finance is at the heart of the climate crisis. Banks provide the financing for fossil fuel firms who are destroying the planet. The key numbers:

Coal supplies a third of all energy worldwide, with the top coal consumers and producers in 2018 being China, India, and the United States. Carbon dioxide emissions from burning coal account for 44 percent of the world total, and it's the biggest single source of the global temperature increase.

Oil accounts for nearly half the carbon emissions in the U.S. and about a third of the global total. Nonetheless, oil demand continues to rise, driven by car use and the many products—including plastics—made using petrochemicals, which are derived from oil and gas.

Gas is cleaner than coal and oil, in terms of emissions, but accounts for a fifth of the world's total Greenhouse Gas emissions (GHGs) globally. In the USA, gas has surpassed coal to become the top fuel for electricity production.

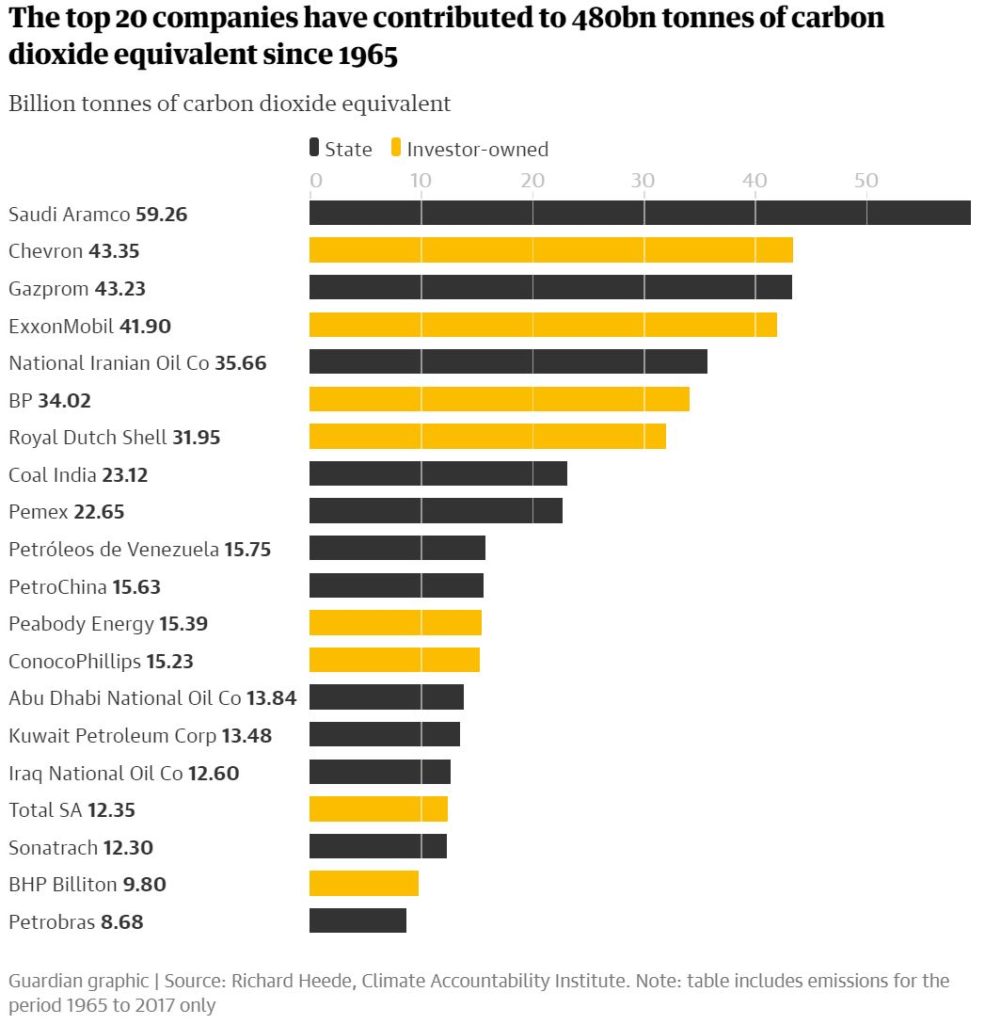

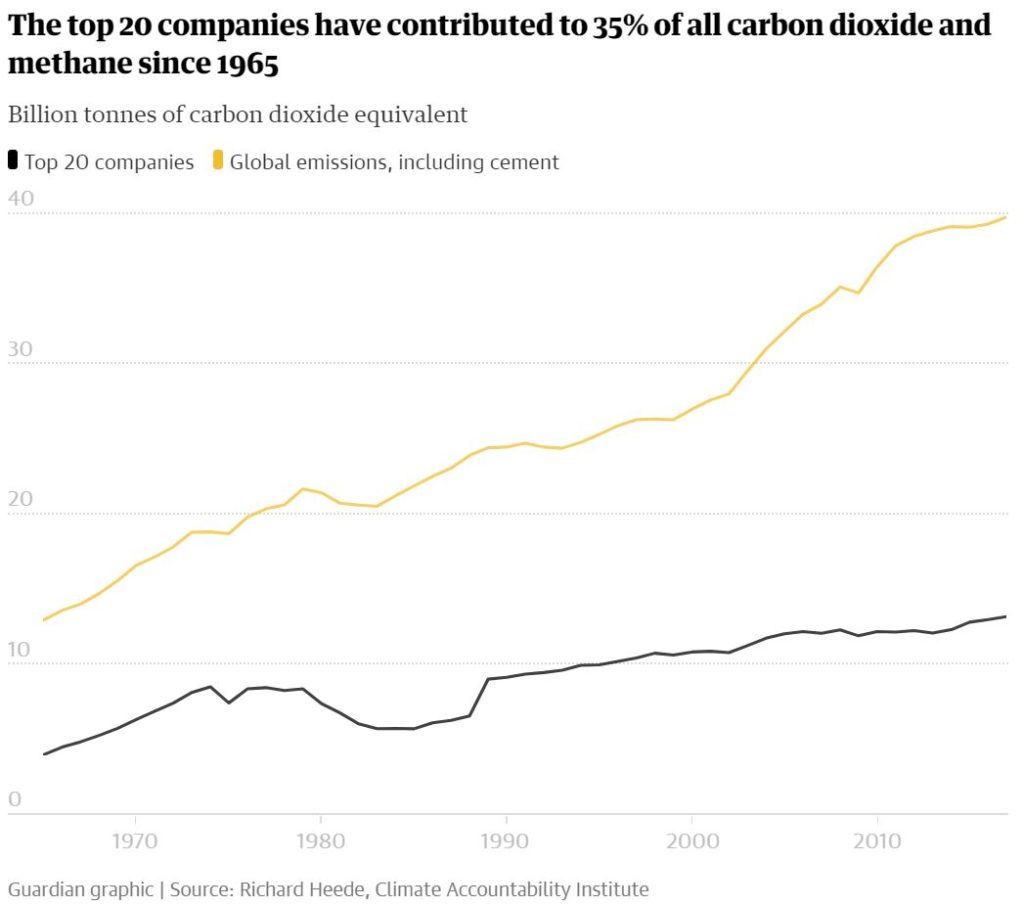

Between the major producers of coal, oil and gas, there are just 100 companies producing 71% of all GHGs since 1988. The likes of BP, Chevron, ExxonMobil and Shell. Together, there four firms created 10% of global GHGs, whilst over half can be traced to just 25 corporate and state-owned entities.

Source: The Guardian

Why can’t we just shut them down?

Because it would bring humanity to a halt. If you could not fly, drive, watch television or use the internet tomorrow … what would you do? As Ana Botin, Executive Chair of Santander Group,” stated in a recent interview with Bloomberg:

“We cannot just cut the energy off, where a lot of the economy is still powered by coal. But we did announce that we are not going to finance any new coal projects. You have to find a sensible balance between transforming and supporting customers. We have a mission to help people and customers prosper in a sustainable way.”

Fair enough, but we have to do it quick.

The Guardian notes: “If fossil fuels continue to be extracted at the same rate over the next 28 years as they were between 1988 and 2017, says the report, global average temperatures would be on course to rise by 4C by the end of the century.”

How can we do it then?

Through institutional investors.

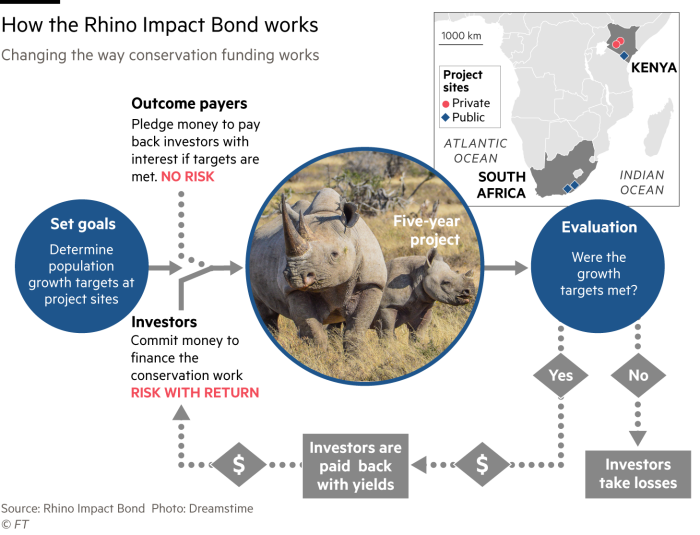

Banks, credit unions, insurance companies, pension funds, hedge funds, REITs, investment advisors, endowments and mutual funds can all influence the direction we take from here, and they are. This was demonstrated by the massive interest in conservation finance products, like London Zoo’s Rhino Impact Bond. The scheme uses a model that rewards investors if rhino populations in targeted areas increase over five years.

According to The Financial Times: “Experts in conservation and finance say the reaction shows wildlife conservation finance, for decades largely the preserve of wealthy donors and governments, has massive potential to attract institutional investors, helped by growing public awareness of the delicate state of the planet.”

They also note that the “sector is perhaps 10 years behind the renewable energy market”, and that “data and technology are playing an increasingly prominent role, helping conservationists measure wildlife more easily and finance professionals assess risk, value assets and price returns.”

A further pressure for change is coming from the investment community at large, who see the climate crisis as not so much about saving the planet as saving their investments. For example, Reuters just reported that “European investors managing assets worth more than $1.28 trillion are pressing top auditors to take urgent action on climate-related risks, warning that failure to do so could do more damage than the financial crisis.”

The investors are also writing directly to the audit committees of leading oil and gas companies to demand they take a more robust approach to climate risk. They specifically want auditors to challenge assumptions about long-term prices for oil and gas, which underpin shareholder returns, and take into account the risk of climate damage as part of those calculations.

We’ve already seen the risks of climate in action in the investment community when the Californian firm PG&E went bankrupt in January. As The Wall Street Journal put it:

PG&E Corp.’s bankruptcy could mark a business milestone: the first major corporate casualty of climate change. Few people expect it will be the last.

However, the fact is that nothing changes that much when it comes to markets focused upon shareholder return and profit, rather than societal return and risk. For example, one study from earlier this year found that the five largest stock-market-listed oil and gas companies spend nearly $200 million a year lobbying to delay, control or block policies to tackle climate change.

Shoot.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...